What Documents Are Creditors Entitled to in a Liquidation?

What Documents Are Creditors Entitled to in a Liquidation?

When a company goes into liquidation, creditors have certain legal rights to access documents for the purpose of helping stakeholders understand what’s happening, assess their chances of seeing a recovery on what they are entitled to, and to hold insolvency practitioners accountable when dealing with the assets of the company.

What documents can creditors see?

Creditors entitlements to documents in a liquidation are set out across a number of acts, these include the Companies Act, Liquidation Regulations, Insolvency Practitioners Regulations and Companies (Reporting by Insolvency Practitioners) Regulations.

Creditors are entitled to:

- Notice of appointment confirmation that the company has entered liquidation including date and time, details of who made the appointment along with contact details of the liquidator.

- Statement of affairs a snapshot of the company’s assets and liabilities.

- Liquidator’s reports:

- An initial report within 5 (shareholder) or 20 (court) working days of appointment.

- The report should contain the proposal for how the liquidation will be managed, a list of the companies known creditors and an estimated timeline for completion of the liquidation.

- Updates every 6 months.

- A final report when the liquidation is complete.

- Meeting notices and minutes if meetings of creditors are held, creditors receive agendas and outcomes.

- Detailed summary reports (realization and distributions) practitioners must disclose recoveries, fees charged, and how funds were distributed to secured, preferential, and unsecured creditors.

- Conflict of interest disclosures practitioners must file interest statements outlining any potential conflicts and how they’re being managed.

Company records

Aside from the information outlined above there are minimal sections in the various pieces of legislation that deal directly with allowing liquidators to provide creditors with copies of the company's records. It then becomes a matter for the liquidator's discretion and decision making. They will often take into consideration the reason the documents have been requested, whether providing them affect the actions available to the liquidators and potential recoveries, along with whether confidentiality is a consideration to be factored in, amongst other considerations.

Practitioners may provide informal updates to key creditors via phone or email, when they have an interest in the matter being dealt with (secured creditors with secured assets). These updates can include progress on asset sales, litigation, or expected distributions.

If the liquidator is unable or unwilling to provide the documents sought by a creditor, they have the option to apply to the court to view the documents sought provided their reasons are accepted by the court.

Final Thoughts

If you’re a creditor involved in an insolvency, understanding your entitlements both legal and practical can help you make informed decisions and protect your interests.

Employee Claims in Liquidation: How are Related Party Employee Claims Treated?

Employee Claims in Liquidation: How are Related Party Employee Claims Treated?

When a company enters liquidation, one of the liquidator’s key responsibilities is to assess and distribute the company’s remaining assets to creditors in accordance with the Companies Act 1993. Among the creditors, employees are granted preferential status for outstanding wages, holiday pay and redundancy if they are entitled to it under their employment agreement.

The situation becomes more complex when the employee is related to a director of the company.

Normal Treatment of Employee Claims in Liquidation

Under Schedule 7 of the Companies Act 1993, employees are entitled to preferential claims for:

- Wages and salaries (including commissions and piecework) earned in the four months prior to liquidation.

- Holiday pay owed at the time of liquidation.

- Redundancy compensation (if contractually owed).

- Deductions made from wages for obligations like PAYE or child support.

These preferential claims are currently capped at $31,820 gross per employee as at October 2025 (this is adjusted by statute every three years). Any amounts above this cap, or claims not covered (bonuses, notice periods, wages outside the four-month time limit), are treated as unsecured claims and rank with the other unsecured creditors.

Related Employees: How Are They Treated Differently?

Under Schedule 7 of the Companies Act 1993 section 3 (4) (b) the definition of employee is defined as:

employee means any person of any age employed by an employer to do any work for hire or reward under a contract of service; but does not include a person who is, or was at any time during the 12 months before the commencement of the liquidation, a director of the company in liquidation, or a nominee or relative of, or a trustee for, a director of the company.

Under the act when an individual is owed money by the company for outstanding wages and holiday pay, if they are a relative of the director and have worked for the company in the 12 months prior to the commencement of the liquidation their claim in the liquidation will not be entitled to the preferential status granted to other employee claims.

What is a Relative?

The next aspect to look at is how a relative is defined, this is dealt with under section 2 of the Companies Act 1993 it sets out a relative as (adjusted for director):

- any parent, child, brother, or sister the director; or

- any spouse, civil union partner, or de facto partner of the director; or

- any parent, child, brother, or sister of a spouse, civil union partner, or de facto partner of the director; or

- a nominee or trustee for any of those persons

Key takeaway

If you are a director employing family members it is important to understand that their claims will not have any priority in a liquidation scenario, similarly those family members need to know that they will not be able to rely on receiving those funds in preference to other unsecured creditors and will rank with other trade creditors.

For non-related employees this provides reassurance that they will likely receive a larger distribution on their claim from the available assets as related claims are excluded making the total preferential creditor claim pool smaller.

Insolvency by the Numbers #58: NZ Insolvency Statistics September 2025

We take a look at what happened with the NZ insolvency figures during September 2025 when compared with the previous years for personal and corporate insolvency.

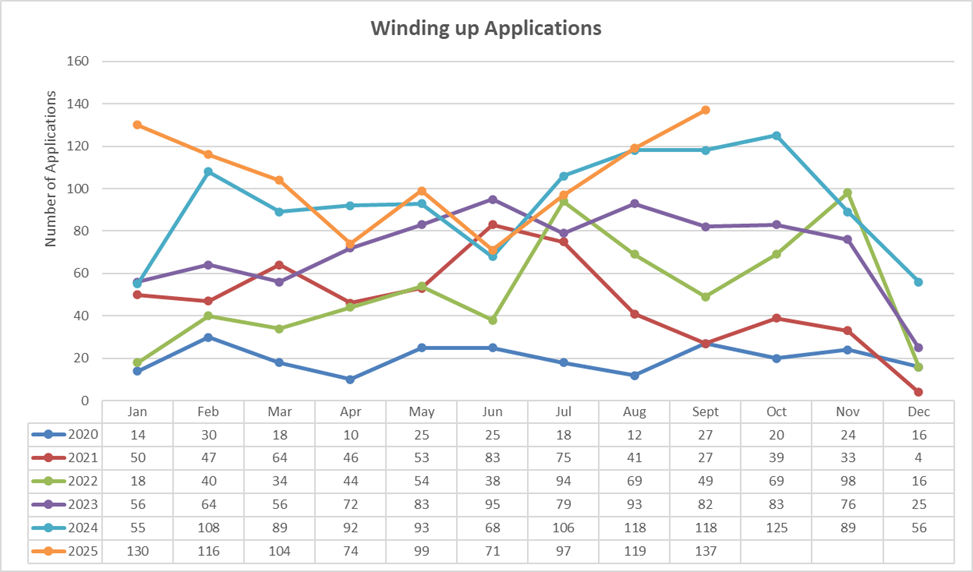

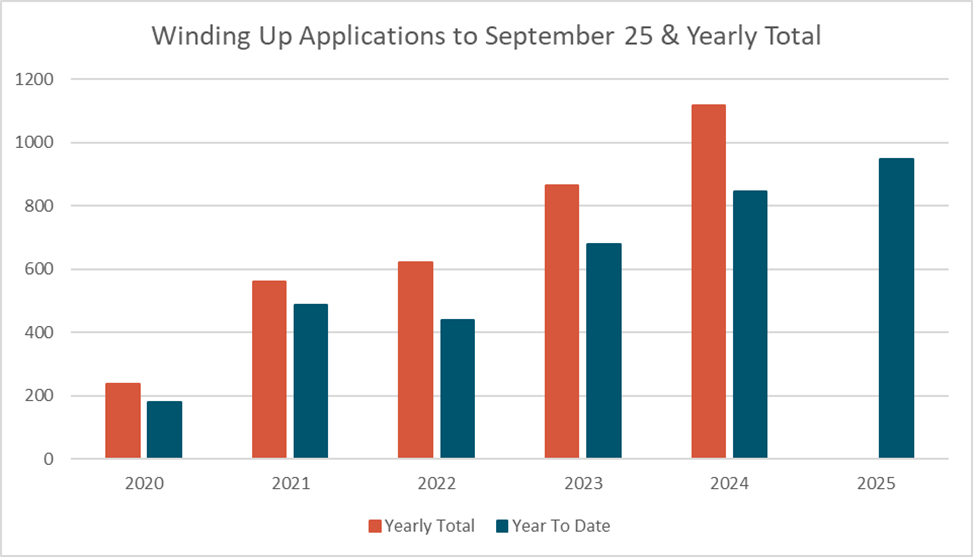

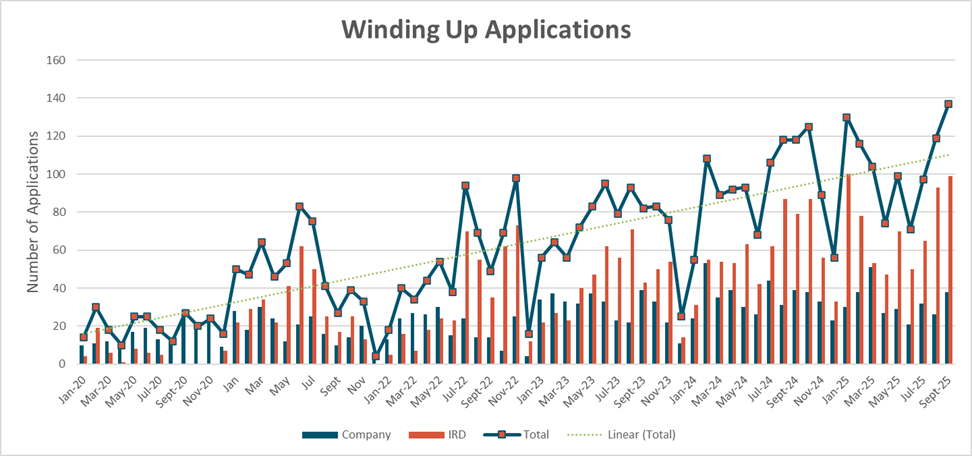

Winding Up Applications

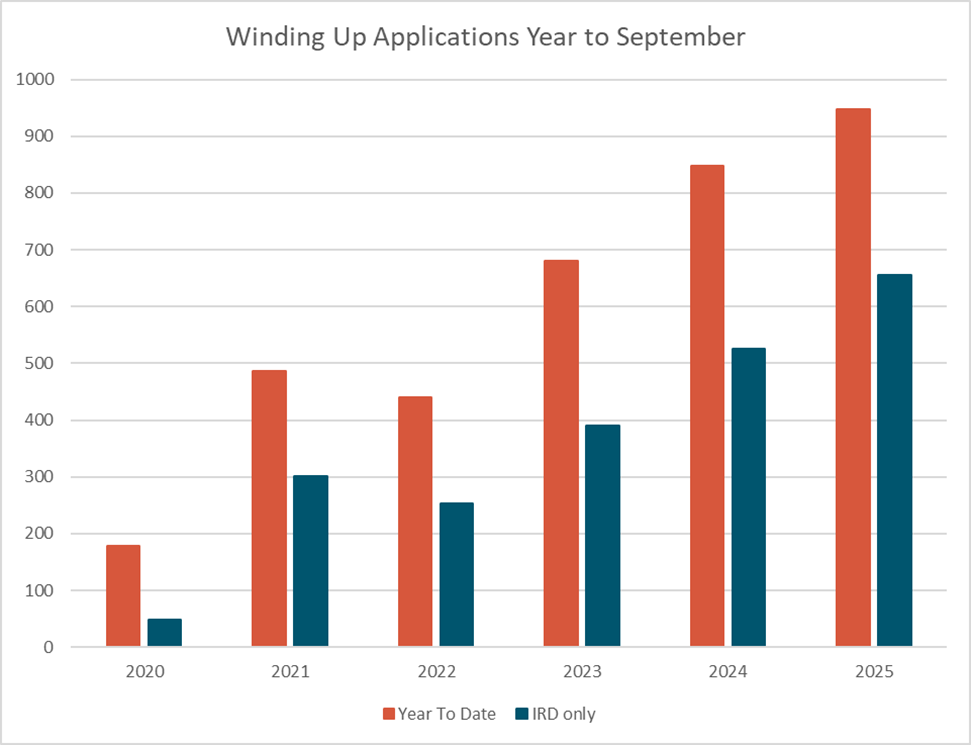

Winding up applications for September 2025 were the highest they have been in the last 5 years hinting as a big end to the year for creditor enforced liquidations and liquidations overall. 2025 continues to easily exceed 2024 in total numbers and looks on track to exceed 1,200 applications.

The continued growth in winding up applications reinforces that the market remains under pressure and creditors continue to default on payments and are facing serious collection issues. IRD maintains the pressure it has been putting on delinquent companies to catch up on their arrears.

We continue to be appointed as liquidators over companies via court appointments that are getting recalled or terminated once we get in contact with the director/shareholders. They proceed to clear all creditor claims paying out 100 cents in the dollar and the liquidators time cost and disbursements. The director/shareholders were previously unaware of the proceedings as their contact details were not current, and the registered office was not up to date. An expensive cautionary tale to keep the details on the Companies Register updated.

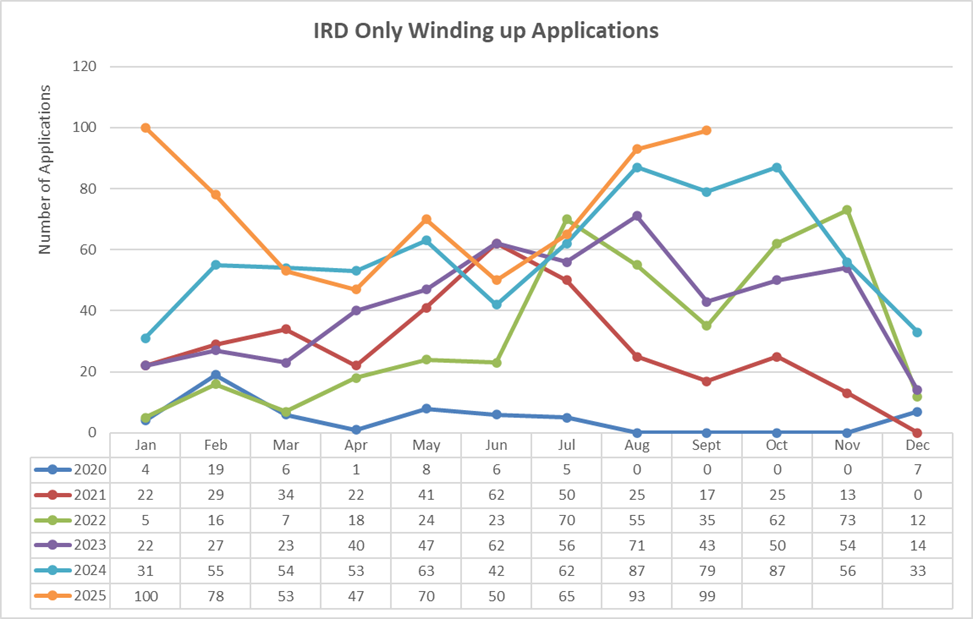

IRD made up 99 of the 137 monthly applications, only slightly down on their January high of 100 applications in a month.

The IRD has continued their 30-month streak of having more applications than all other creditors combined.

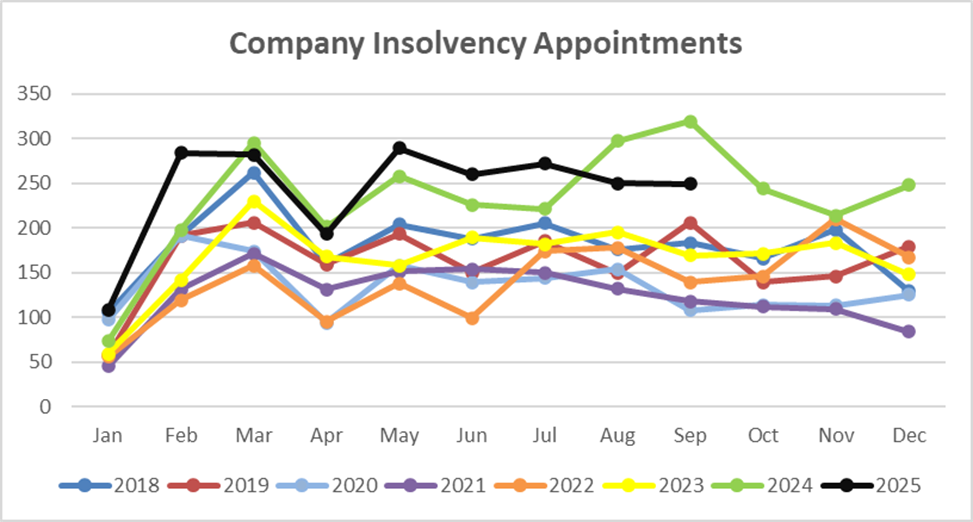

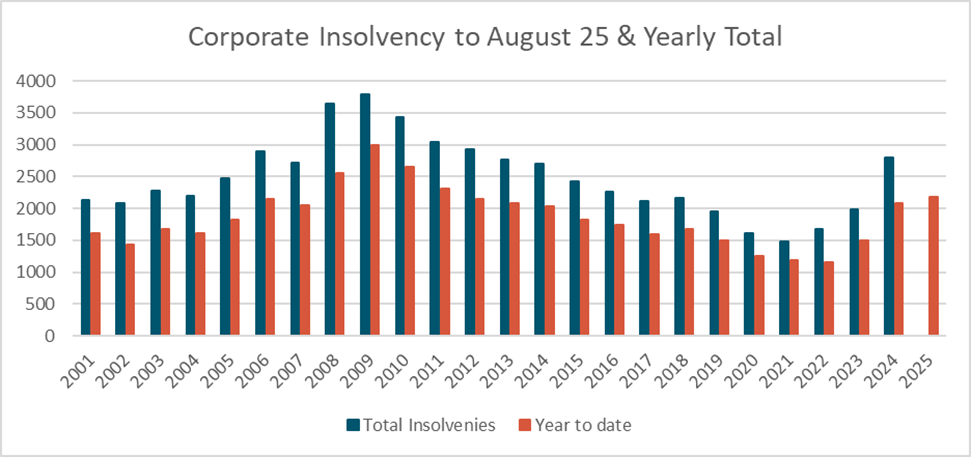

Company Insolvencies – Liquidations, Receiverships, and Voluntary Administrations

Another month where we see the appointment figures down on the 2024 numbers but they remain above all other years displayed back to 2018. With this months high in winding up applications and the IRD's continued enforcement pressures we are not expecting to see the appointment figures decrease in the short term.

Year to date the appointment figures remain up 26% on 2024 and continue to sit around the post GFC 2012 levels, on this basis we estimate total appointments for the year will be higher than 2024, with the possibility to exceed 3,000 appointments.

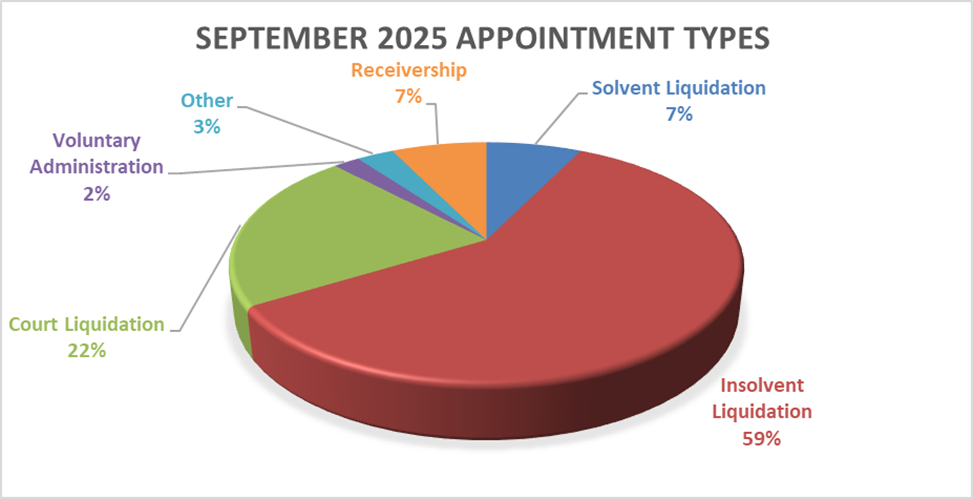

Solvent liquidation appointments remain reduced, a sign of the times no doubt, while we see elevated levels of insolvent and court liquidations. Voluntary Administrations and Receiverships continue to track their long-term averages.

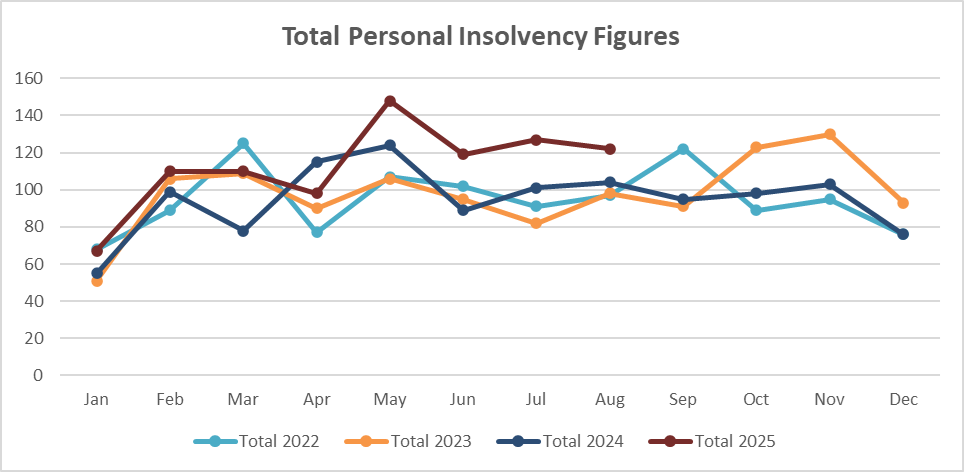

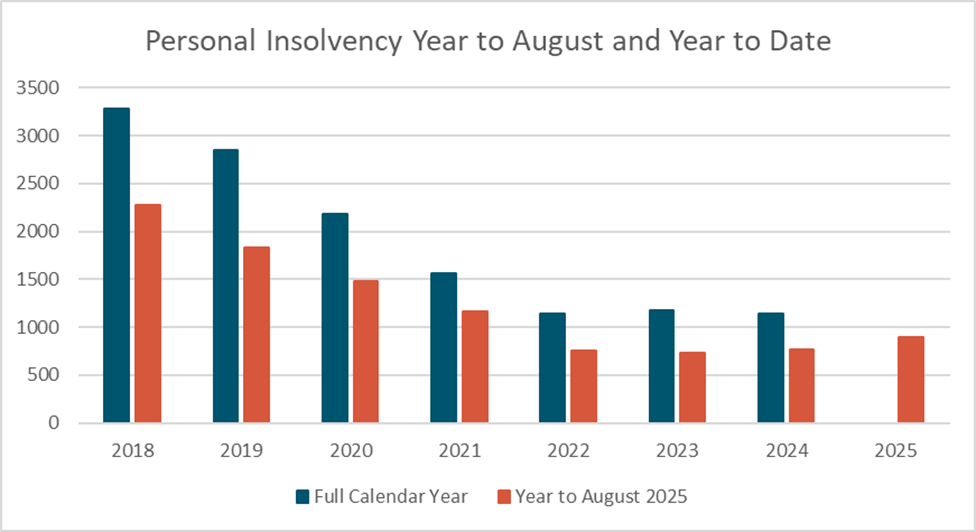

Personal Insolvencies – Bankruptcy, No Asset Procedure and Debt Repayment Orders.

That makes four months in a row with slightly elevated personal insolvency levels, they certainly are not however screaming upwards off the charts. At this point we are likely looking at more of the same for the rest of the year with a further uplift predicted in 2026.

Year on year the 2025 figures are now noticeably above the last 3 years, while on the increase they remain behind the 2021 figures. This period remains one of the lowest bases for personal insolvency figures.

Where to from here?

All insolvency types have continued at the increased levels seen across 2025. We continue to expect these figures to track up through the end of the year and into 2026. Survive to 2025 continues to be Survive 2025.

If you want to have a chat about any points raised or an issue you may have you can call on 0800 30 30 34 or email This email address is being protected from spambots. You need JavaScript enabled to view it..