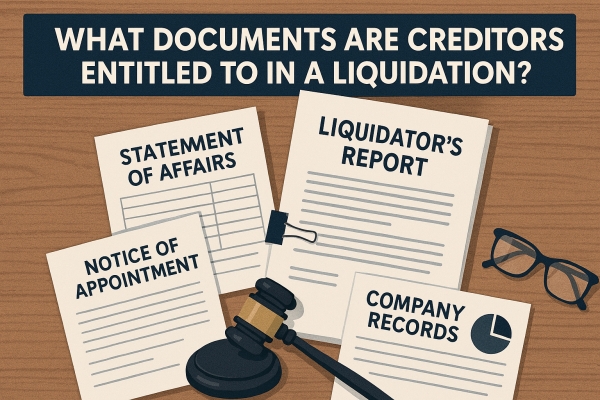

What Documents Are Creditors Entitled to in a Liquidation?

When a company goes into liquidation, creditors have certain legal rights to access documents for the purpose of helping stakeholders understand what’s happening, assess their chances of seeing a recovery on what they are entitled to, and to hold insolvency practitioners accountable when dealing with the assets of the company.

What documents can creditors see?

Creditors entitlements to documents in a liquidation are set out across a number of acts, these include the Companies Act, Liquidation Regulations, Insolvency Practitioners Regulations and Companies (Reporting by Insolvency Practitioners) Regulations.

Creditors are entitled to:

- Notice of appointment confirmation that the company has entered liquidation including date and time, details of who made the appointment along with contact details of the liquidator.

- Statement of affairs a snapshot of the company’s assets and liabilities.

- Liquidator’s reports:

- An initial report within 5 (shareholder) or 20 (court) working days of appointment.

- The report should contain the proposal for how the liquidation will be managed, a list of the companies known creditors and an estimated timeline for completion of the liquidation.

- Updates every 6 months.

- A final report when the liquidation is complete.

- Meeting notices and minutes if meetings of creditors are held, creditors receive agendas and outcomes.

- Detailed summary reports (realization and distributions) practitioners must disclose recoveries, fees charged, and how funds were distributed to secured, preferential, and unsecured creditors.

- Conflict of interest disclosures practitioners must file interest statements outlining any potential conflicts and how they’re being managed.

Company records

Aside from the information outlined above there are minimal sections in the various pieces of legislation that deal directly with allowing liquidators to provide creditors with copies of the company's records. It then becomes a matter for the liquidator's discretion and decision making. They will often take into consideration the reason the documents have been requested, whether providing them affect the actions available to the liquidators and potential recoveries, along with whether confidentiality is a consideration to be factored in, amongst other considerations.

Practitioners may provide informal updates to key creditors via phone or email, when they have an interest in the matter being dealt with (secured creditors with secured assets). These updates can include progress on asset sales, litigation, or expected distributions.

If the liquidator is unable or unwilling to provide the documents sought by a creditor, they have the option to apply to the court to view the documents sought provided their reasons are accepted by the court.

Final Thoughts

If you’re a creditor involved in an insolvency, understanding your entitlements both legal and practical can help you make informed decisions and protect your interests.