We take a look at what happened with the NZ insolvency figures during September 2025 when compared with the previous years for personal and corporate insolvency.

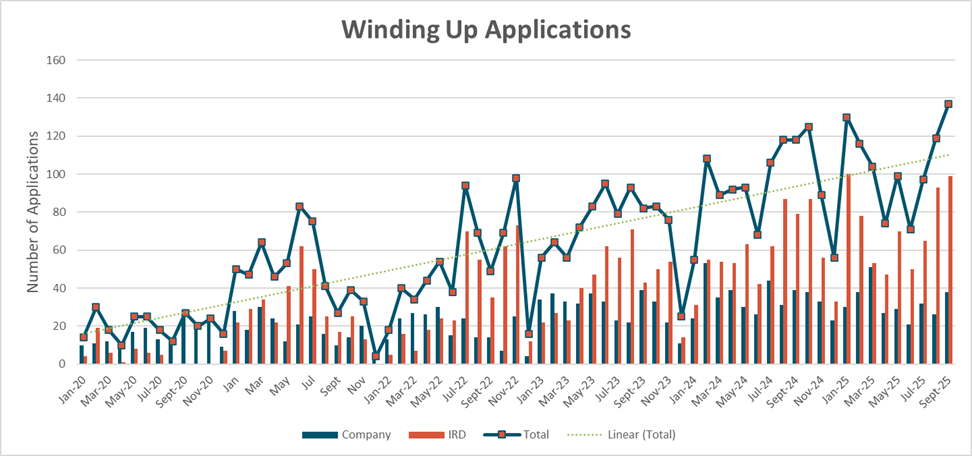

Winding Up Applications

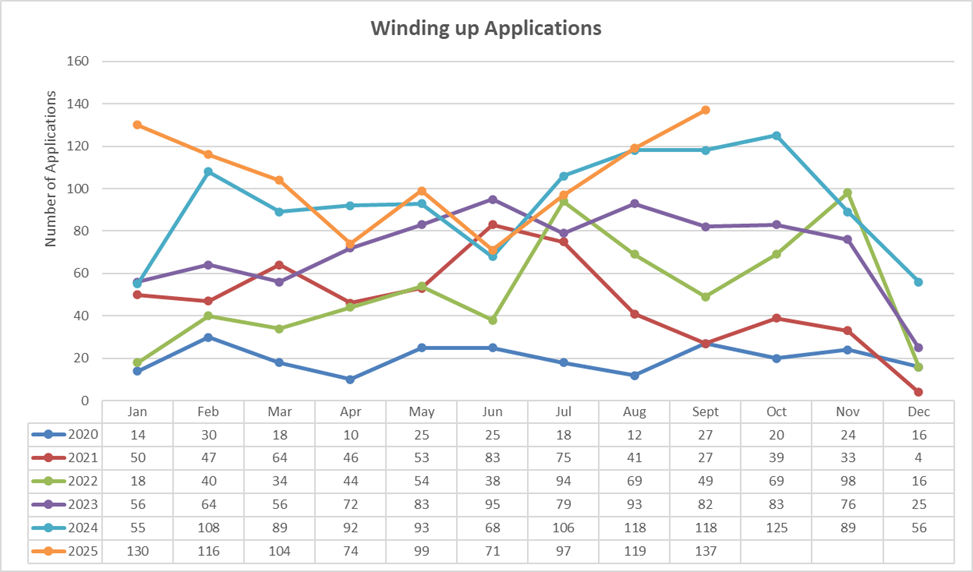

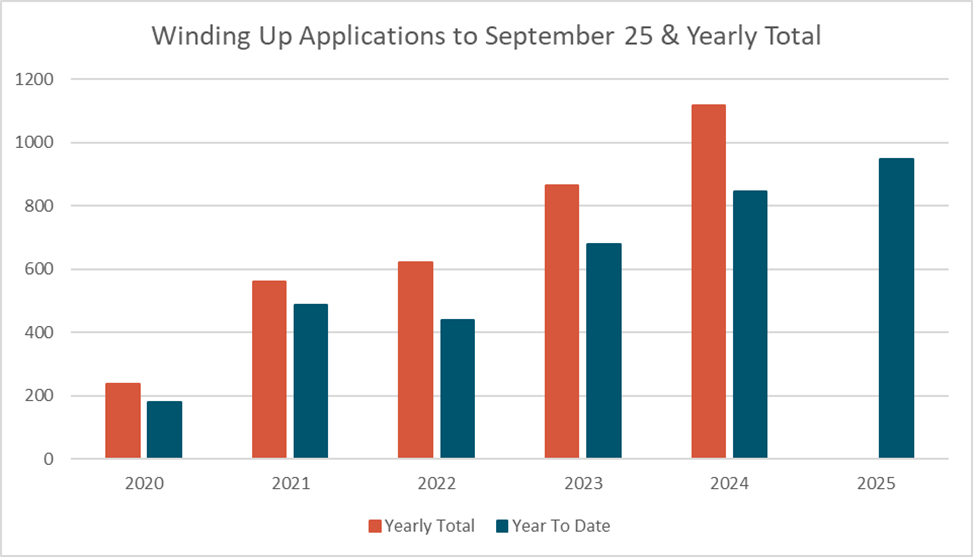

Winding up applications for September 2025 were the highest they have been in the last 5 years hinting as a big end to the year for creditor enforced liquidations and liquidations overall. 2025 continues to easily exceed 2024 in total numbers and looks on track to exceed 1,200 applications.

The continued growth in winding up applications reinforces that the market remains under pressure and creditors continue to default on payments and are facing serious collection issues. IRD maintains the pressure it has been putting on delinquent companies to catch up on their arrears.

We continue to be appointed as liquidators over companies via court appointments that are getting recalled or terminated once we get in contact with the director/shareholders. They proceed to clear all creditor claims paying out 100 cents in the dollar and the liquidators time cost and disbursements. The director/shareholders were previously unaware of the proceedings as their contact details were not current, and the registered office was not up to date. An expensive cautionary tale to keep the details on the Companies Register updated.

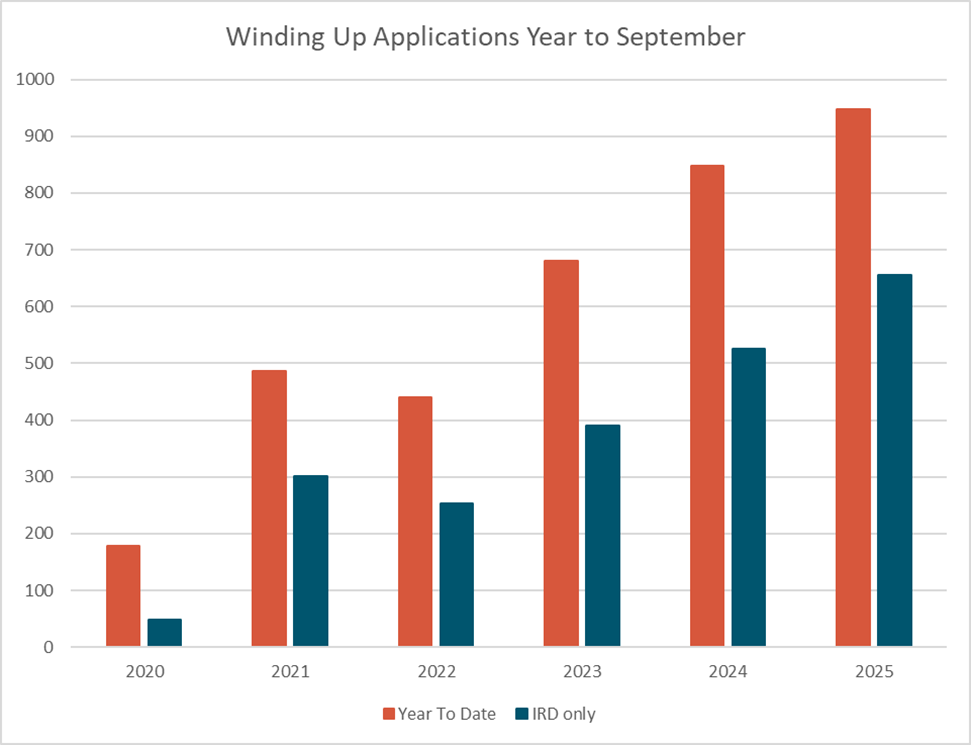

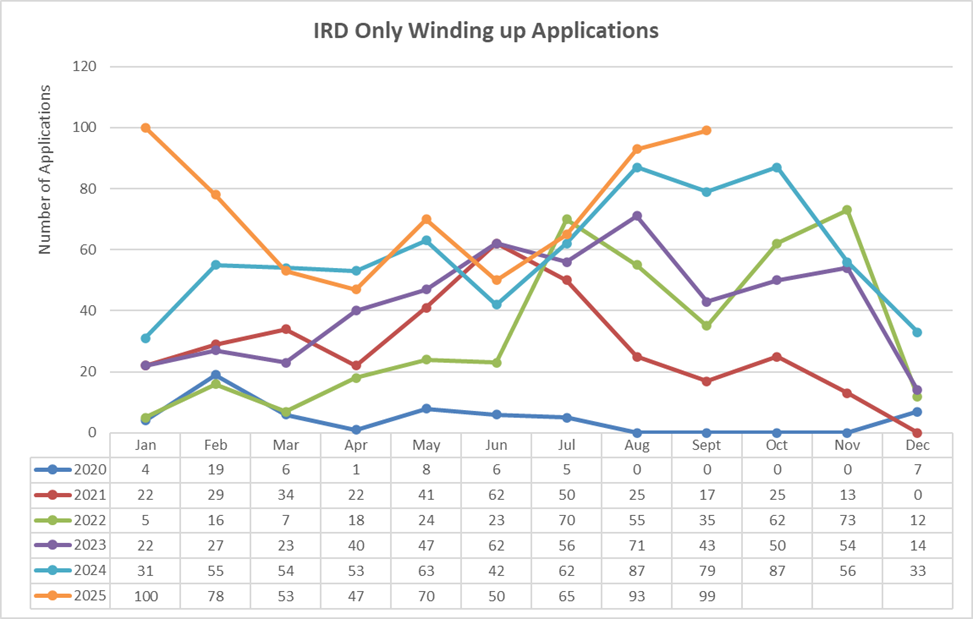

IRD made up 99 of the 137 monthly applications, only slightly down on their January high of 100 applications in a month.

The IRD has continued their 30-month streak of having more applications than all other creditors combined.

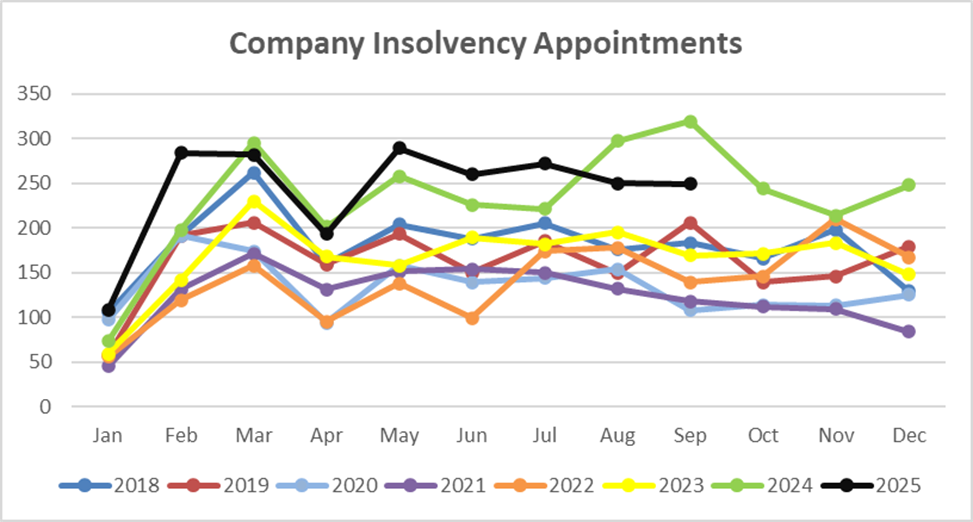

Company Insolvencies – Liquidations, Receiverships, and Voluntary Administrations

Another month where we see the appointment figures down on the 2024 numbers but they remain above all other years displayed back to 2018. With this months high in winding up applications and the IRD's continued enforcement pressures we are not expecting to see the appointment figures decrease in the short term.

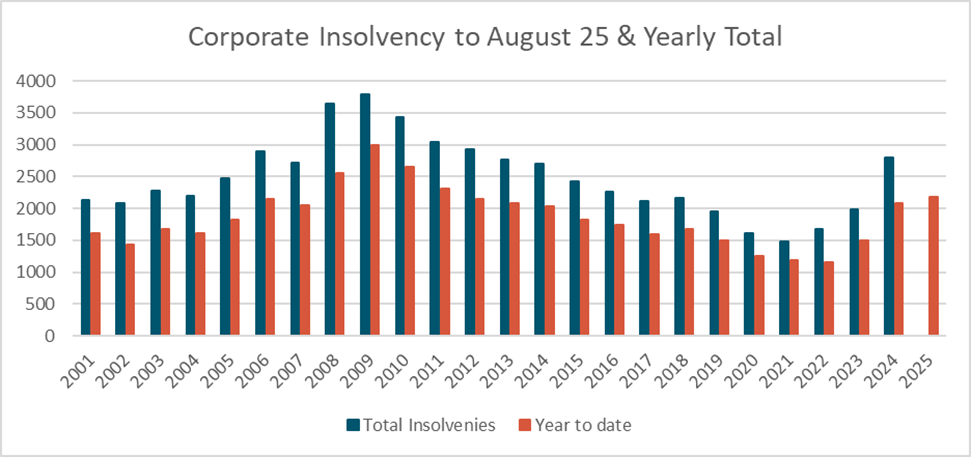

Year to date the appointment figures remain up 26% on 2024 and continue to sit around the post GFC 2012 levels, on this basis we estimate total appointments for the year will be higher than 2024, with the possibility to exceed 3,000 appointments.

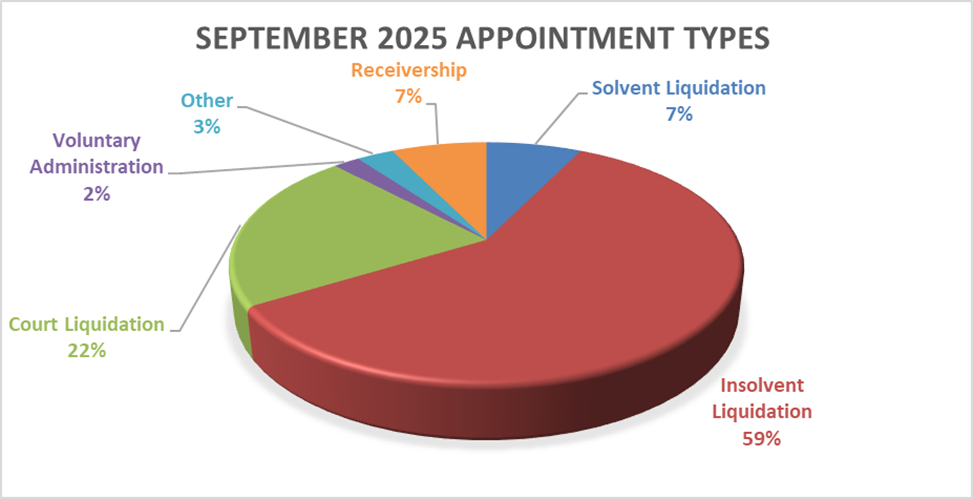

Solvent liquidation appointments remain reduced, a sign of the times no doubt, while we see elevated levels of insolvent and court liquidations. Voluntary Administrations and Receiverships continue to track their long-term averages.

Personal Insolvencies – Bankruptcy, No Asset Procedure and Debt Repayment Orders.

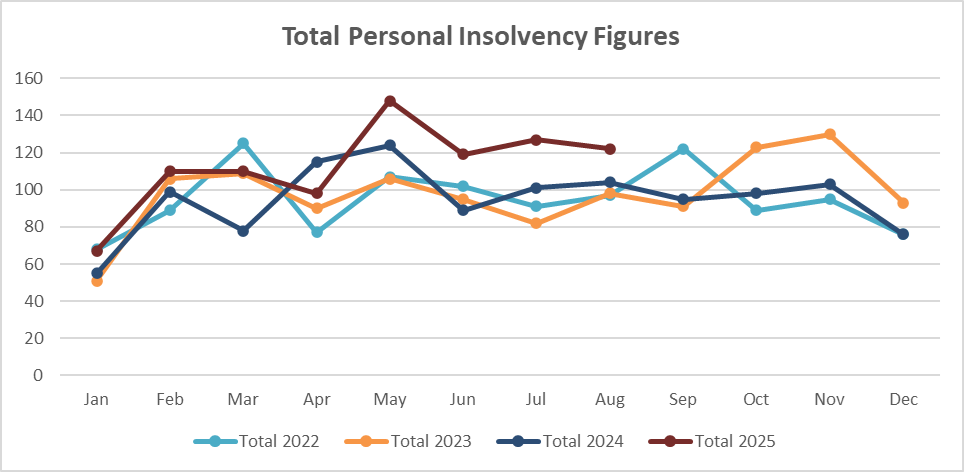

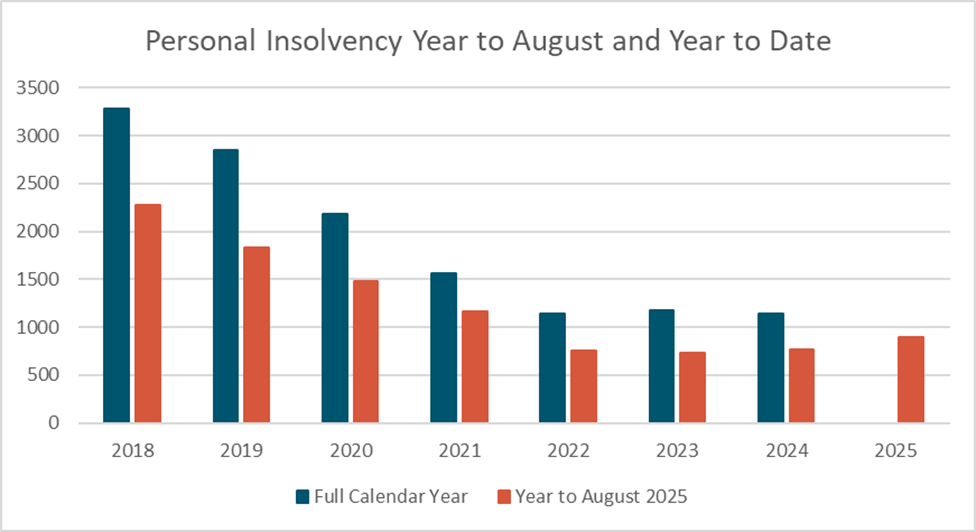

That makes four months in a row with slightly elevated personal insolvency levels, they certainly are not however screaming upwards off the charts. At this point we are likely looking at more of the same for the rest of the year with a further uplift predicted in 2026.

Year on year the 2025 figures are now noticeably above the last 3 years, while on the increase they remain behind the 2021 figures. This period remains one of the lowest bases for personal insolvency figures.

Where to from here?

All insolvency types have continued at the increased levels seen across 2025. We continue to expect these figures to track up through the end of the year and into 2026. Survive to 2025 continues to be Survive 2025.

If you want to have a chat about any points raised or an issue you may have you can call on 0800 30 30 34 or email This email address is being protected from spambots. You need JavaScript enabled to view it..