What has happened with the insolvency stats during November 2025 when compared with the last few years for personal and corporate insolvency ahead of the Christmas break.

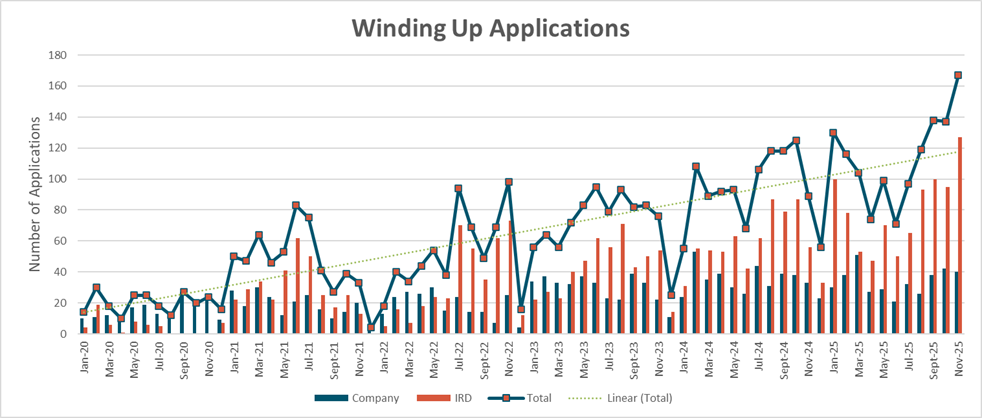

Winding Up Applications

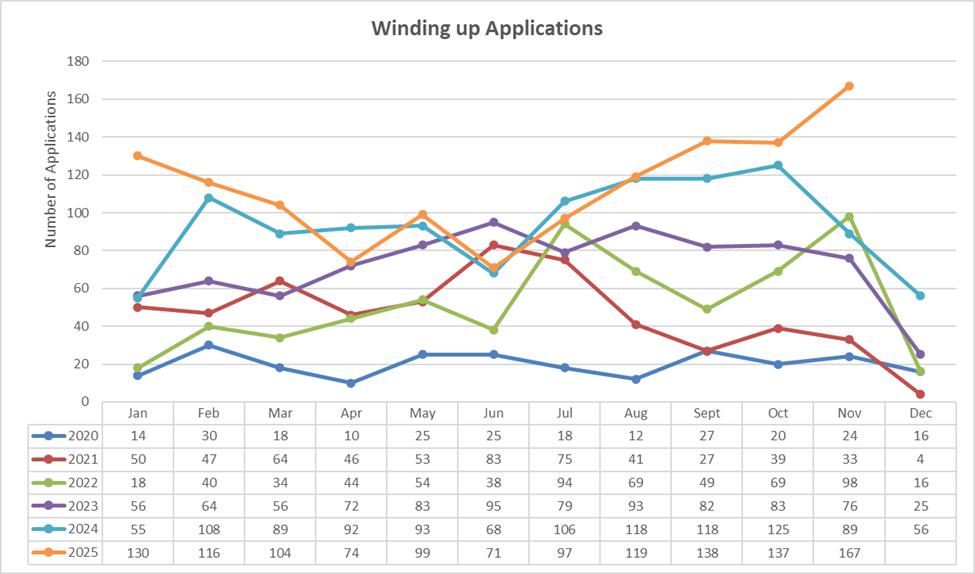

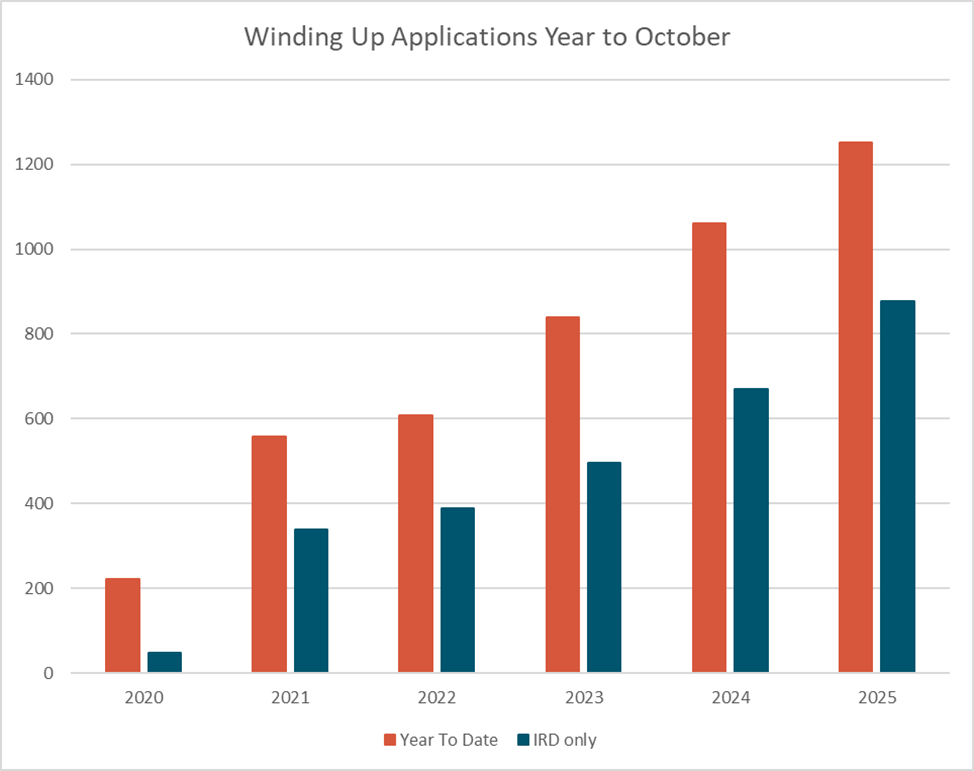

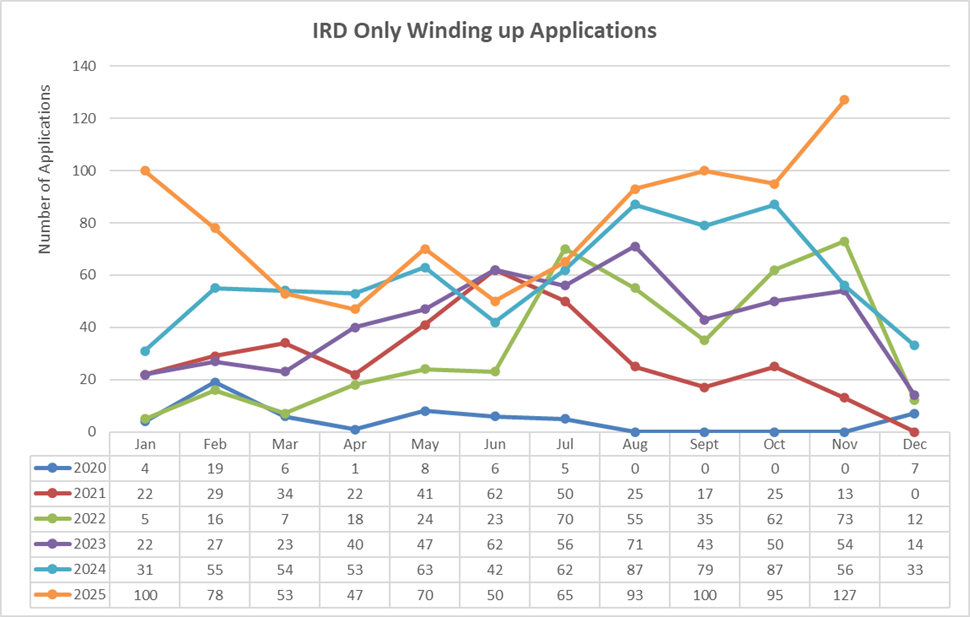

Winding up applications for November 2025 took off like a shot on the back of IRD chasing a group of 45 sushi companies with common stakeholders. Even with the 45 group winding up applications removed the monthly total would remain well above previous November highs and only slightly down on the highs seen so far throughout 2025.

The monthly total was 167 applications the highest in the last 6 years , these applications are now starting to be advertised with February court dates reinforcing the courts will be pumping into the end of the year and will start off with a busy 2026 once they reopen for liquidation appointments.

2025 continues to easily surpass 2024 in total numbers and has now exceeded 1,200 applications with December figures yet to come in.

The ongoing strong levels of winding up applications reinforces that the market remains under pressure regardless of talk of green shoots that has yet to flow through to all sectors, creditors continue to default on payments and are facing serious collection issues. IRD remains a constant for business owners chasing debts hard and taking a tougher line on payment proposals for businesses that get behind.

IRD made up 127 of the 167 monthly applications, all other creditor applications have floated around 40 per month since September 2025. This is well above IRD’s previous highs of 100 applications.

The IRD has continued their 32-month streak of having more applications than all other creditors combined. At this stage with 9 billion + in outstanding taxes to collect this is unlikely to change in the foreseeable future. How the election next year will affect their willingness to chase debtors is yet to be seen.

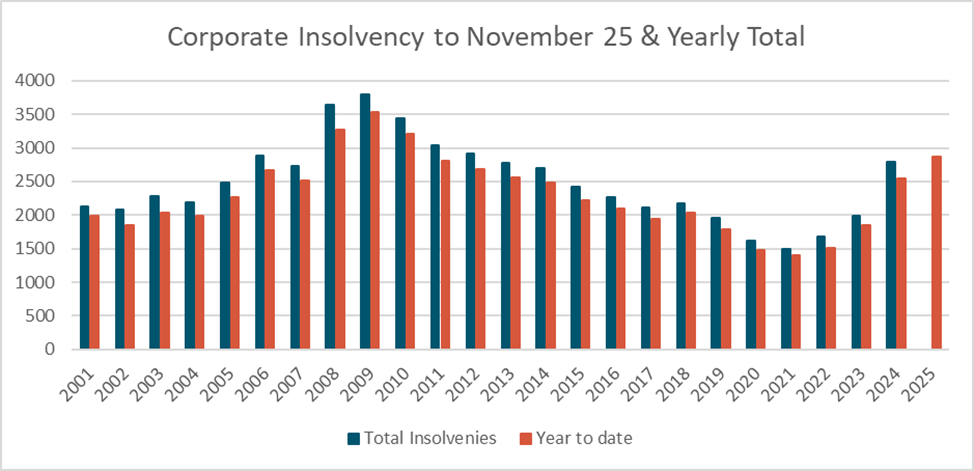

Company Insolvencies – Liquidations, Receiverships, and Voluntary Administrations

November 2025 was down on the October 2025 highs but like the winding up applications the month remains well ahead of past Novembers.

Year to date the appointment figures remain up, easily above 2024 and are now in line with the post GFC 2011 levels, at this stage it is unlikely they will reach 2010 levels and are still 700 appointments down on the same period in during the GFC in 2009. On this basis we estimate total appointments for the year have a strong likelihood of exceeding 3,000 appointments.

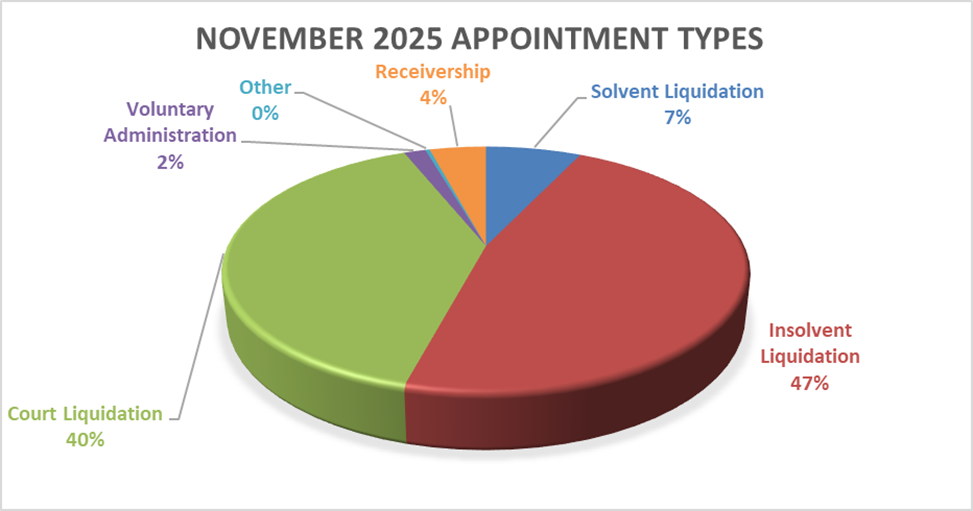

With the high levels of winding up application this month and last month the number of court appointed liquidations remains almost 3x the long-term average. Solvent liquidations continue to remain down on their average.

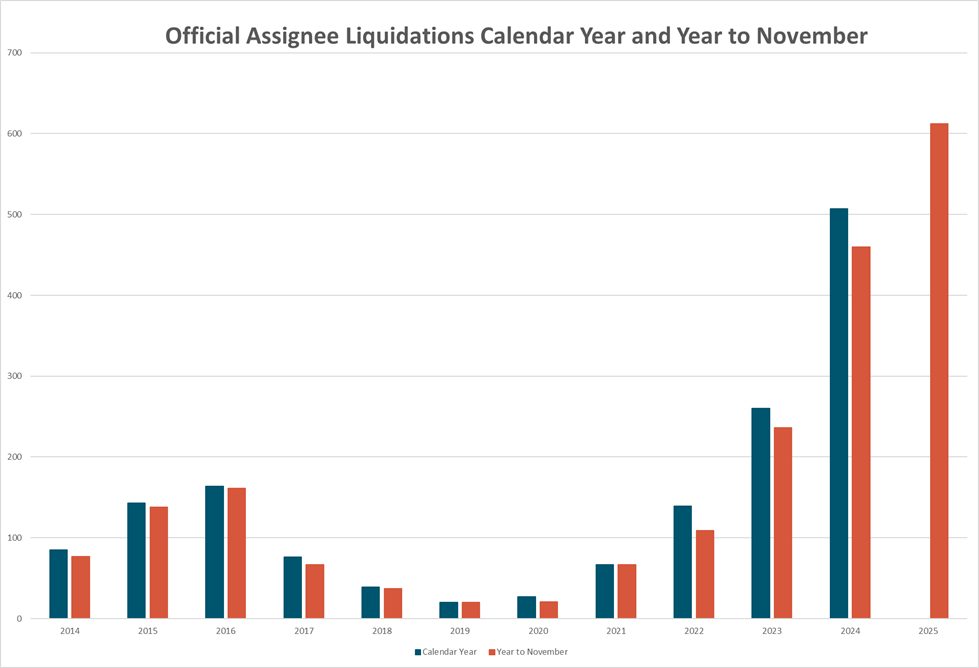

Like last month we have continued with the graph of liquidations taken by the Official Assignee since 2014. It shows the huge uplift in liquidation work they are experiencing over the last few years largely driven by IRD winding up applications. In November 2025 the Official Assignee took 104 of the 124 court appointed liquidations. This makes two months in a row where the Official Assignee has taken over 100 appointments, they could reasonably be one government department that could justify taking on more staff to deal with the workload they are facing.

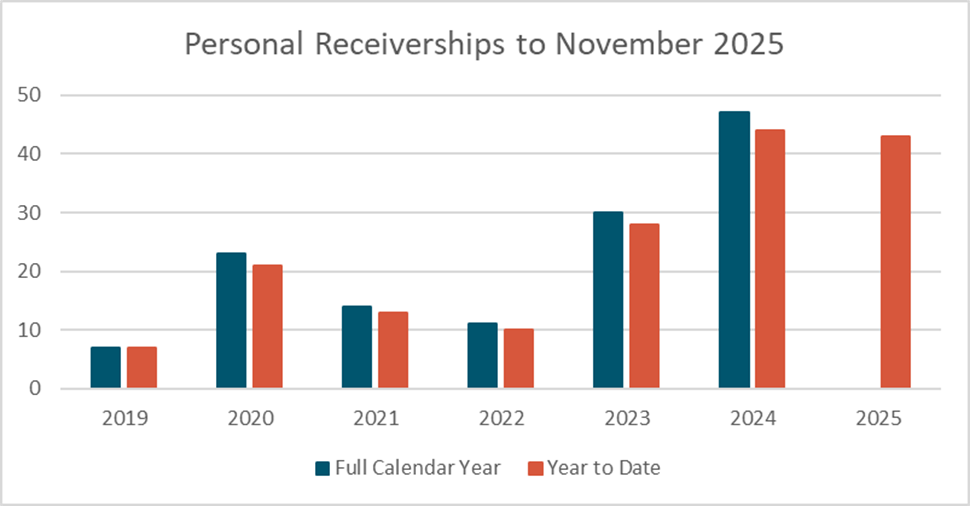

Personal Receiverships

Personal receiverships took a bit of a break in October with minimal appointments before picking back up in November, regardless they have not come back to the momentum seen at the start of the year and look likely to finish slightly down on 2024 or there abouts. A reversal from my earlier prediction of a new high for the year.

Personal Insolvencies – Bankruptcy, No Asset Procedure and Debt Repayment Orders.

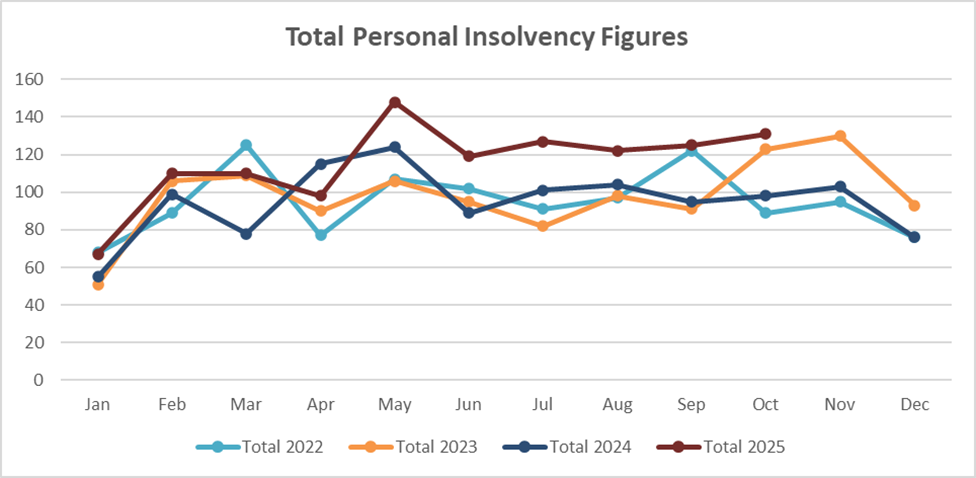

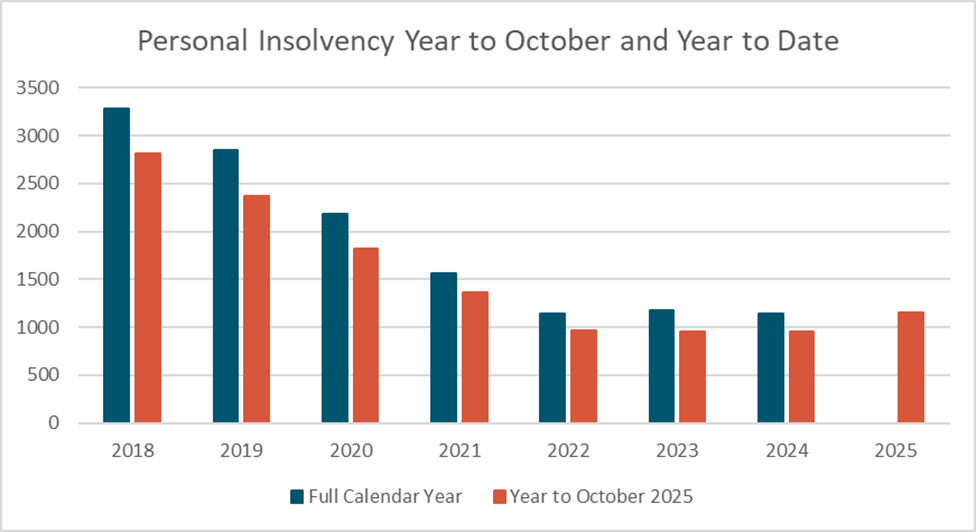

Personal insolvency figures have remained stable at slightly elevated levels and seen no further growth since the jump we noted in May. At this point we continue to expect more of the same for the rest of the year with a further uplift predicted in 2026 if the IRD pursuit of corporate tax debt flows through to personal tax debt.

Year on year the 2025 figures are now above the last 3 years, while on the increase they remain behind the 2021 figures. This period remains one of the lowest bases for personal insolvency figures.

Where to from here?

All insolvency types have continued at the increased levels seen across 2025. We continue to expect these figures to track up through to the end of the year and into 2026. Whether 2026 increases on 2025 is still to be determined, 2026 is an election year where we have in the past anecdotally noted a pullback in IRD pressure.

If you want to have a chat about any points raised or an issue you may have you can call on 0800 30 30 34 or email This email address is being protected from spambots. You need JavaScript enabled to view it..