Insolvency by the Numbers #59: NZ Insolvency Statistics October 2025

We take a look at what happened in the insolvency figures during October 2025 when compared with the last few years for personal and corporate insolvency.

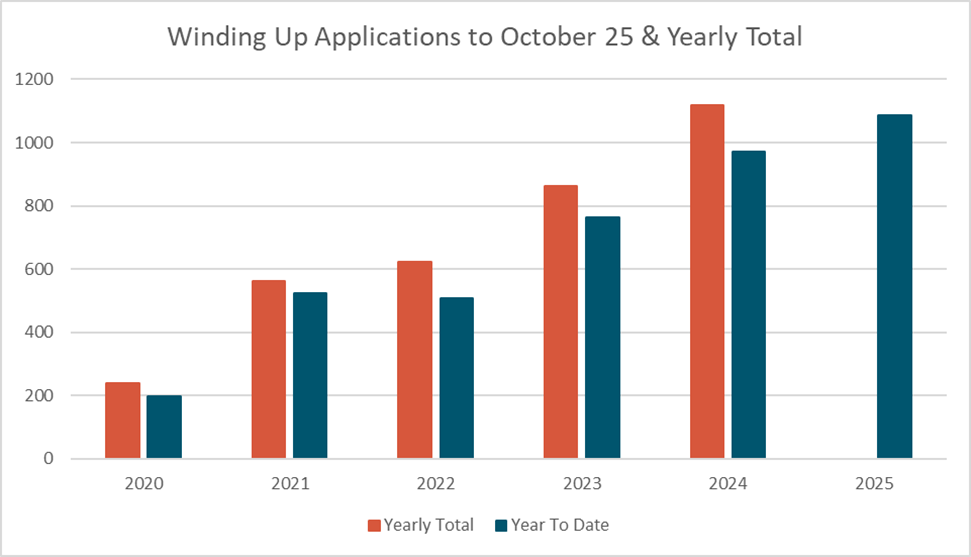

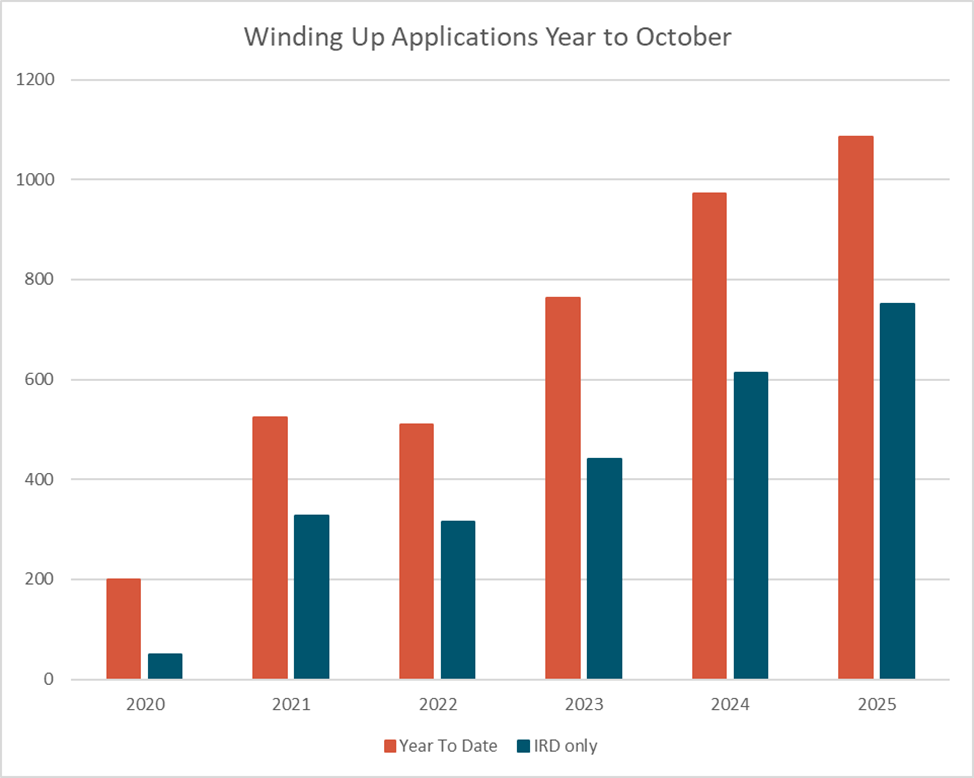

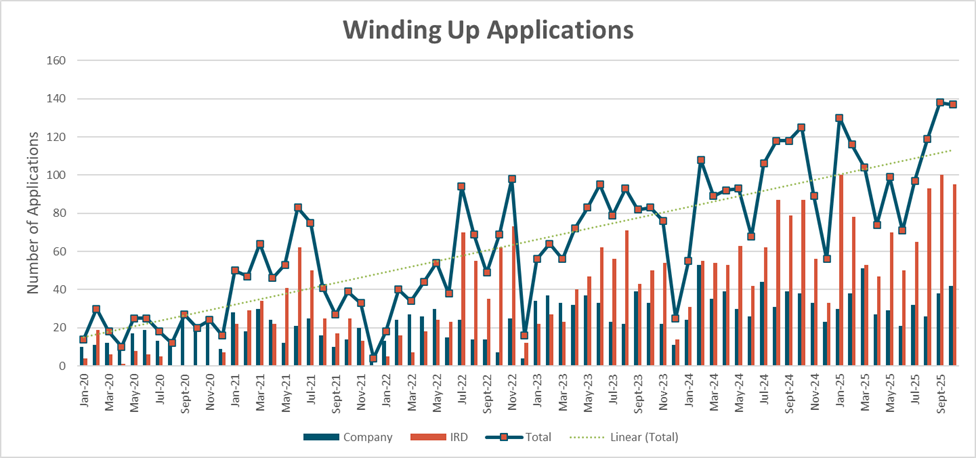

Winding Up Applications

Winding up applications for October 2025 took a slight drop of 1 application from last months highs to remain the 2nd highest they have been in the last 5 years, showing we will indeed be in for a big end to the year for creditor enforced liquidations and liquidations overall. 2025 continues to easily exceed 2024 in total numbers and looks on track to exceed 1,200 applications with 2 months left to run in the year.

The ongoing strong levels of winding up applications reinforces that the market remains under pressure despite the drop in OCR and 5% level of unemployment, creditors continue to default on payments and are facing serious collection issues.

IRD made up 95 of the 137 monthly applications, a drop of 5 from last month but still 2x+ what all other creditors are advertising for the month.

The IRD has continued their 31-month streak of having more applications than all other creditors combined. At this stage with 9 billion + in outstanding taxes to collect this is unlikely to change in the foreseeable future.

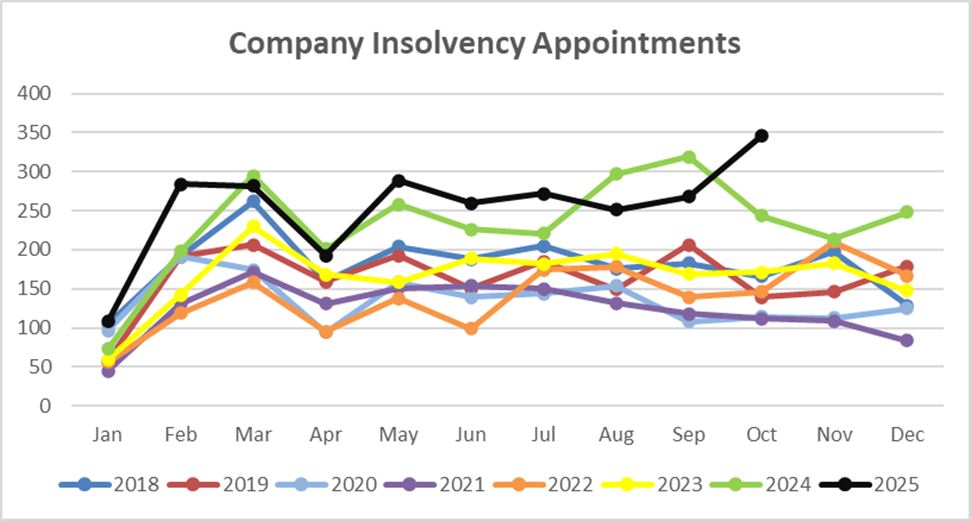

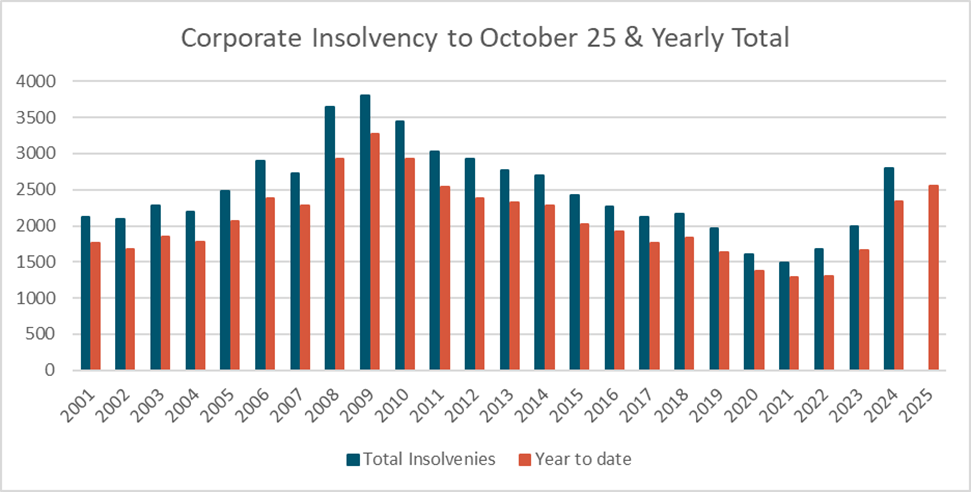

Company Insolvencies – Liquidations, Receiverships, and Voluntary Administrations

October 2025 took a jump in appointments to overtake the 2024 monthly comparison after 2 slow months in August and September.

Year to date the appointment figures remain up, easily above 2024 and are now in line with post GFC 2011 levels rather than the 2012 levels we were at last month. On this basis we estimate total appointments for the year will be higher than 2024, with the likelihood of exceeding 3,000 appointments.

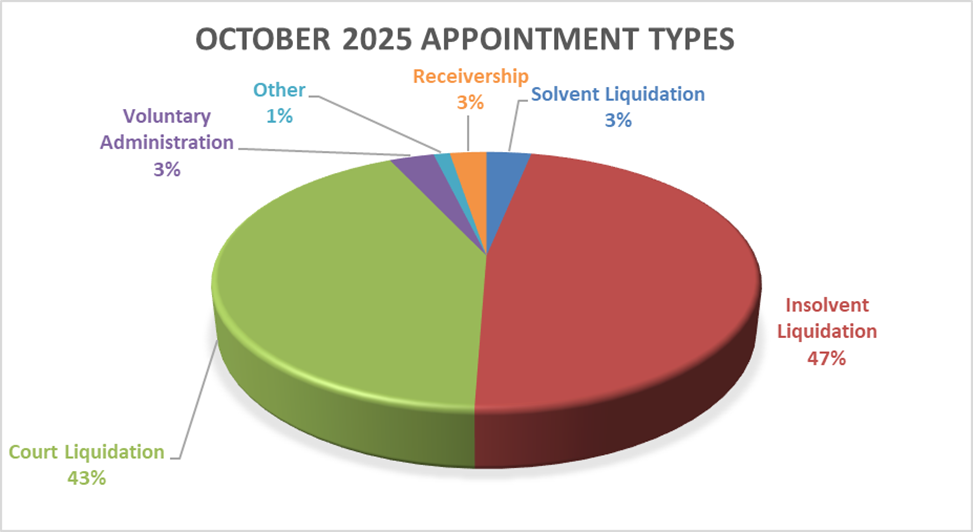

With the high levels of winding up application seen last month the number of court appointed liquidations was almost 3x the long-term average, while solvent liquidations had dropped off once again reinforcing cash flow shortages in the economy.

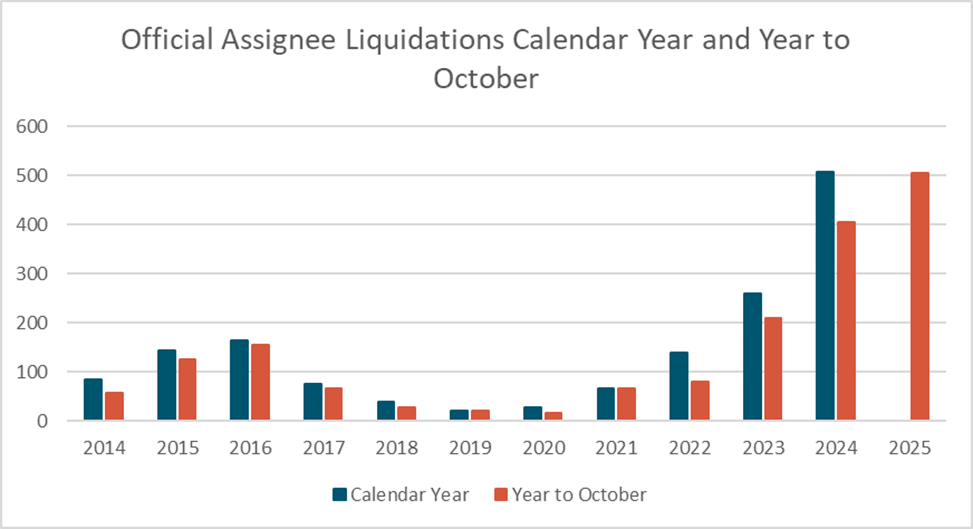

Leading on from the above comments on winding up applications I have included a graph of liquidations taken by the Official Assignee since 2014. It shows the huge uplift in liquidation work they are experiencing over the last few years largely driven by IRD winding up applications. In October 2025 the Official Assignee took 103 of the 147 court appointed liquidations. As a comparison the bulk of insolvency firms in 2024 did not take over 100 appointments in the entire year.

Personal Insolvencies – Bankruptcy, No Asset Procedure and Debt Repayment Orders.

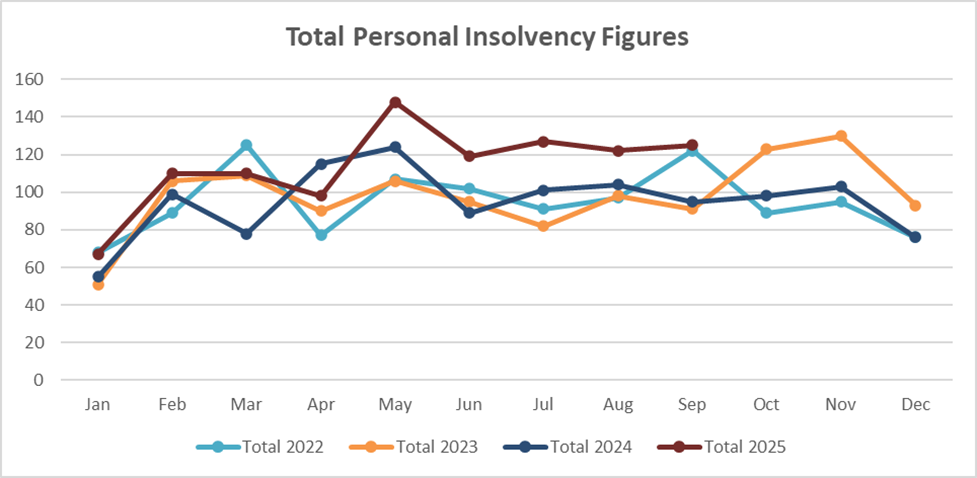

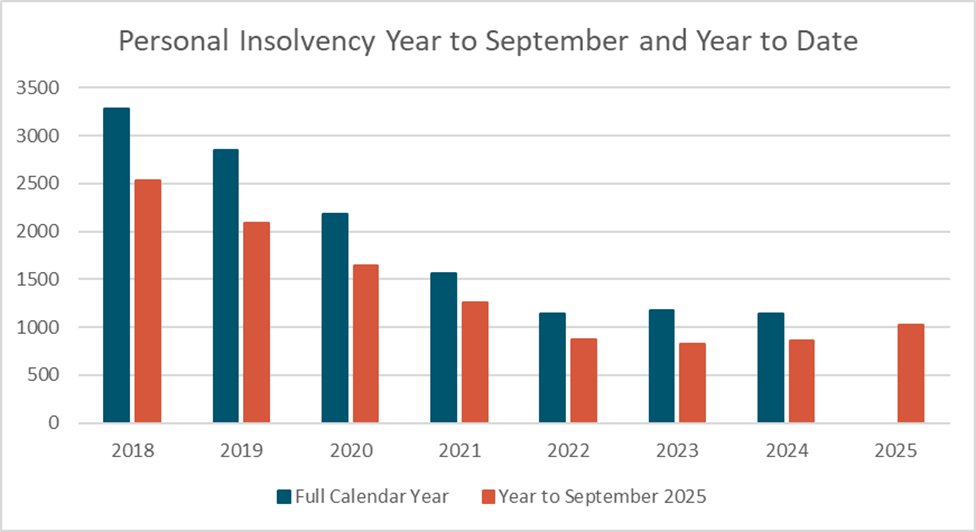

Personal insolvency figures have stabilised at slightly elevated levels and seen no further growth since the jump reported in May. At this point we continue to expect more of the same for the rest of the year with a further uplift predicted in 2026

Year on year the 2025 figures are now above the last 3 years, while on the increase they remain behind the 2021 figures. This period remains one of the lowest bases for personal insolvency figures.

Where to from here?

All insolvency types have continued at the increased levels seen across 2025. We continue to expect these figures to track up through the end of the year and into 2026.

If you want to have a chat about any points raised or an issue you may have you can call on 0800 30 30 34 or email This email address is being protected from spambots. You need JavaScript enabled to view it..