Unemployment is rising

Inflation is nudging the top of the Reserve Bank’s target band

The housing market is flat

The US tariffs continue to yo-yo

The OCR didn’t drop at the last announcement

Its tough out there, and people know it

We take a look at what happened in the insolvency figures during July 2025 when compared with the last few years for personal and corporate insolvency.

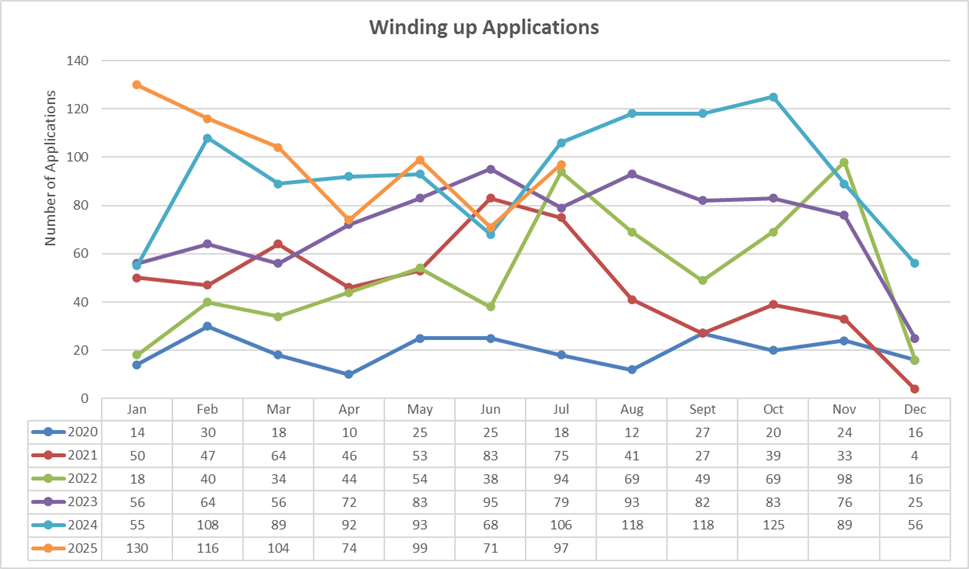

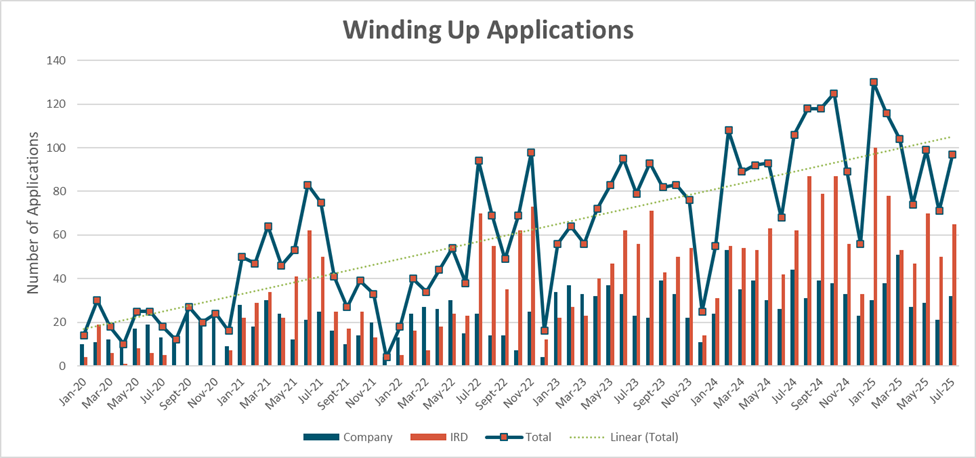

Winding Up Applications

Tipping into the back half of the year winding up applications are almost back in triple digits and expected to continue to track up further. Figures were recently released from an Official Information Act request to the IRD showing more than $1.4 billion in unpaid taxes from the 2025 tax year, $432.9m relates to employer activities and $1.047b to GST.

Based on the above IRD figures the pressure the IRD is applying to wind up delinquent debtors will likely continue for a time and well into 2026 if this level of nonpayment continues.

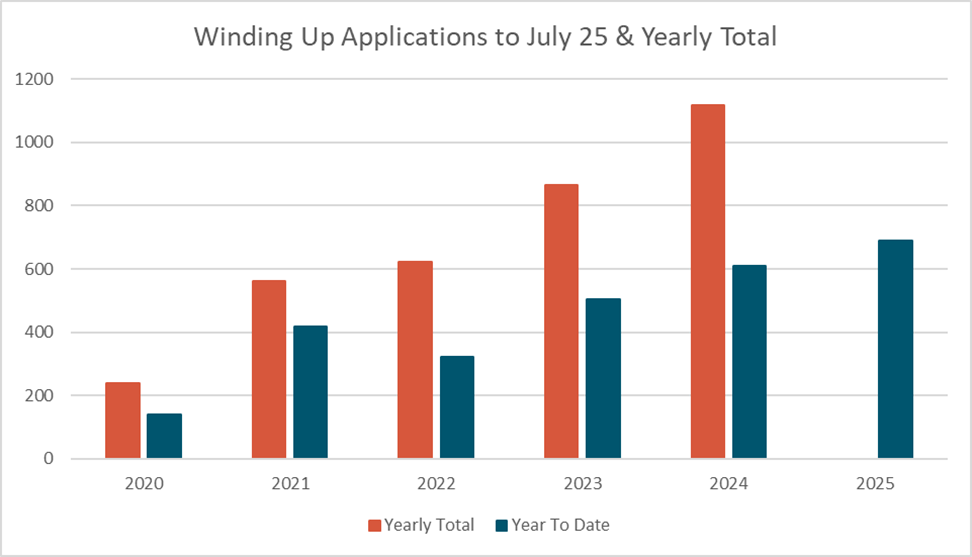

Winding up applications for the year to date continue to exceed prior years and look to continue increasing for the rest of the year. We continue to expect winding up applications for 2025 to exceed those seen in 2024.

Winding up applications for the year to date continue to exceed prior years and look to continue increasing for the rest of the year. We continue to expect winding up applications for 2025 to exceed those seen in 2024.

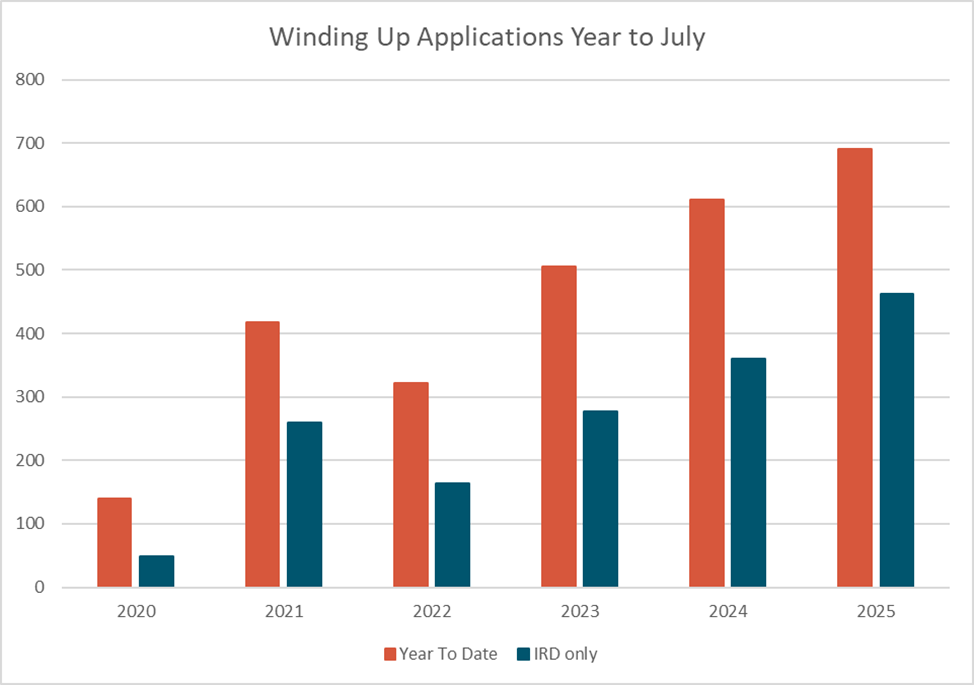

IRD made up 65 of the 97 applications for the month (67.01%), with non IRD applications still down on the figures seen in Jan, Feb and Mar.

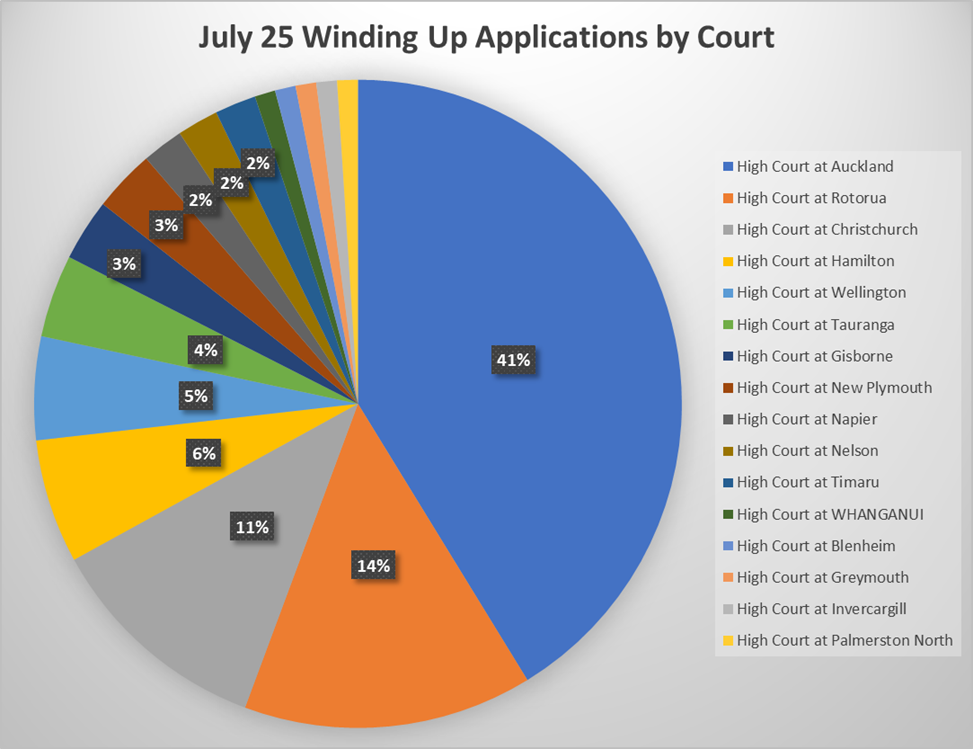

What courts saw the bulk of the winding up applications filed in July 2025? Auckland made up a large chunk but not quite as much as their 2024 average. In 2024 they floated around 54% of the applications, while July 2025 only saw them holding 41% of the applications.

What courts saw the bulk of the winding up applications filed in July 2025? Auckland made up a large chunk but not quite as much as their 2024 average. In 2024 they floated around 54% of the applications, while July 2025 only saw them holding 41% of the applications.

The reason behind this was the drive in Rotorua by IRD in filing applications, up from the 2024 average of 4% to 14% last month. Of the applications filed in Rotorua in July 2025 IRD made up 79%.

While the rest of the country remained there or there abouts when compared to their 2024 averages picking up or dropping a percentage here and there.

The IRD has continued their 28-month streak of having more applications than all other creditors combined.

The IRD has continued their 28-month streak of having more applications than all other creditors combined.

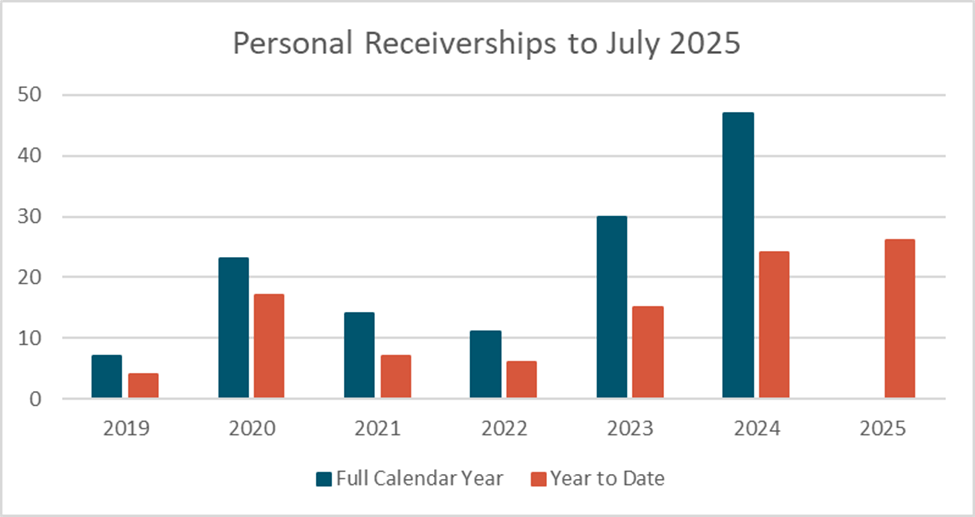

Personal Receiverships

July saw the number of personal receivership appointments rise in line with past July’s, because of this 2025 continues to be ahead of past years and remains on track to exceed 2024.

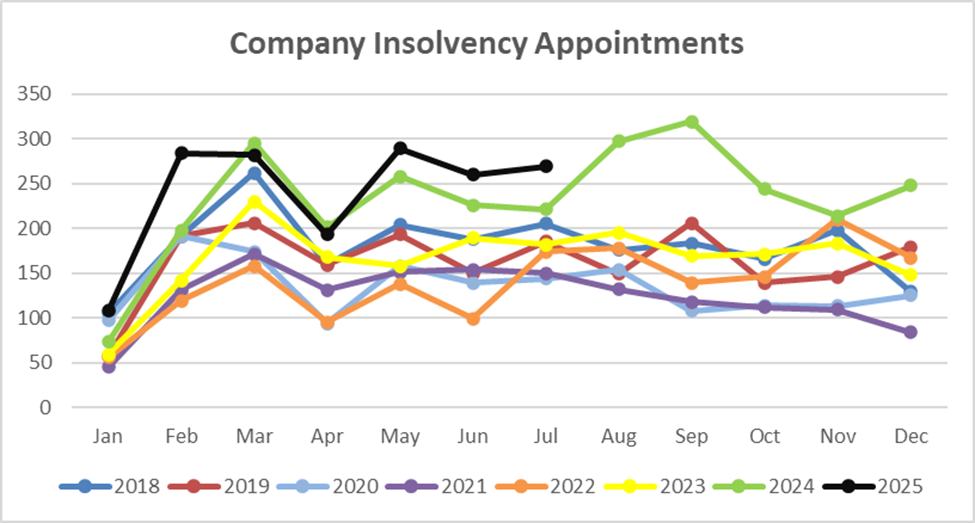

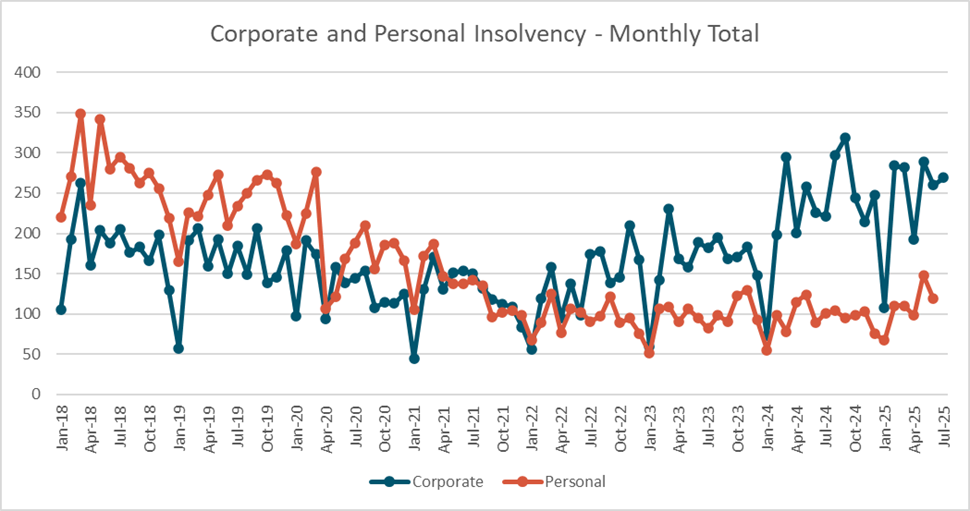

Company Insolvencies – Liquidations, Receiverships, and Voluntary Administrations

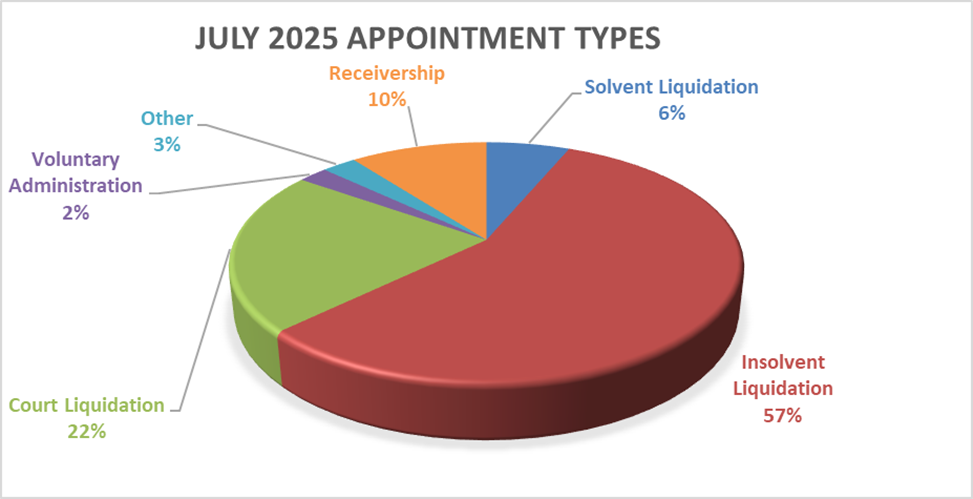

July 2025 continued the higher appointments since April 2025. The bulk of appointments came through shareholder insolvent appointments. While the trend line is following previous years it looks likely to continue to overshoot the monthly figures to date.

By industry Construction continues to make up 28% of all appointments followed by Accommodation and Food Services at 11% and Rental, Hiring and Estate also at 11% of appointments.

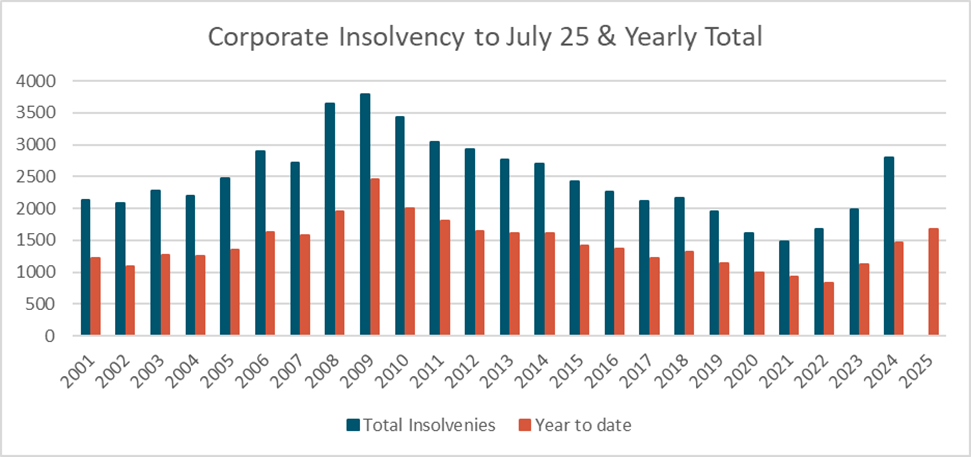

Year to date insolvency figures remain around the 2012 levels, on this basis we estimate total appointments for the year will be higher than 2024, with the possibility to exceed 3,000 appointments.

For the 7 months to date liquidation and receivership appointments remain elevated while there has been a considerable drop in voluntary administration in the year to date with only 13 appointments compared with 55 in 2024 and 29 in 2023.

Insolvent shareholder appointment for the month was 5% above the long-term average and Receiverships were 4% above their average. The rise here was made up of a drop solvent liquidation by 6% and court liquidations by 4% compared to their long-term average for the month. Solvent liquidations dropping off in a recession is not surprising with a tighter economy, cashing out can become more difficult.

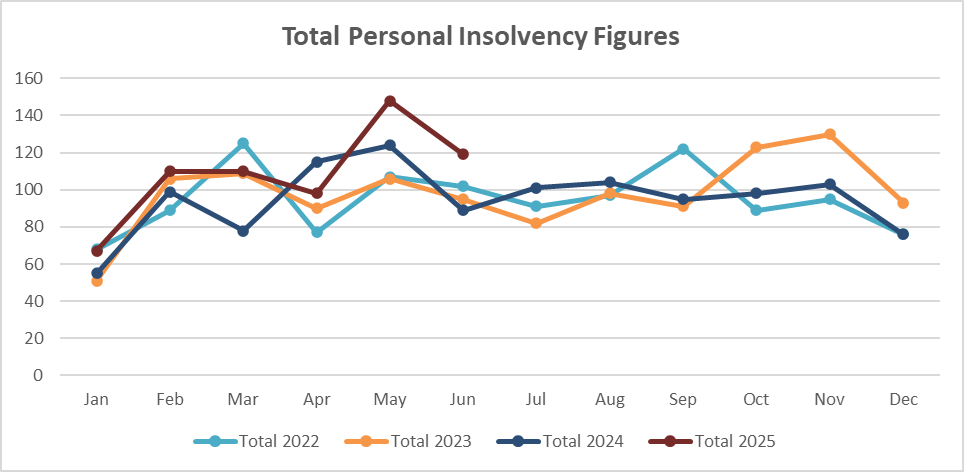

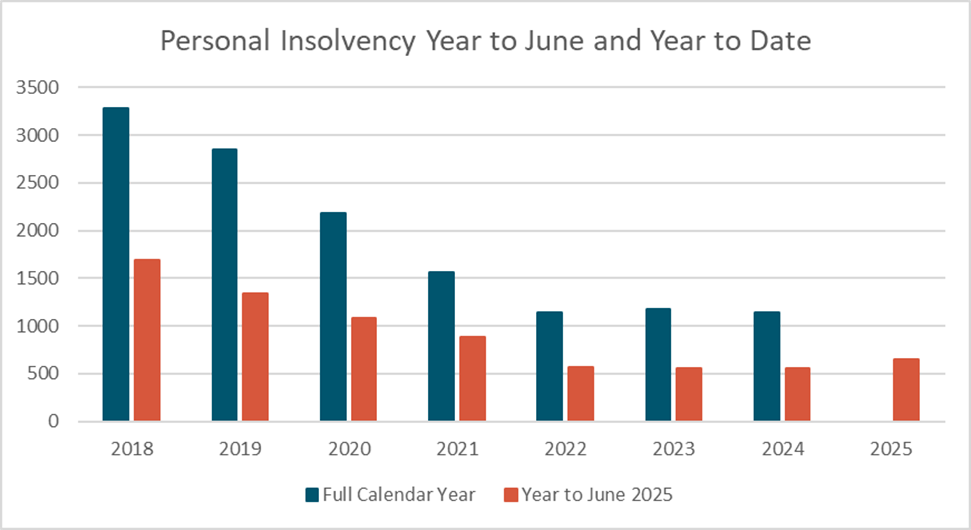

Personal Insolvencies – Bankruptcy, No Asset Procedure and Debt Repayment Orders.

June 2025 didn’t quite manage to hold the lift seen in April, but it was above the past 3 years June figures.

Year on year the 2025 figures are marginally above the last 3 years, while on the increase they remain behind the 2021 figures. This period remains one of the lowest bases for personal insolvency figures.

Where to from here?

All insolvency types have continued at the increased levels seen across 2025. We continue to expect these figures to track up into the 2nd half of the year and through into 2026. Survive to 2025 has now become Get through 2025.

If you want to have a chat about any points raised or an issue you may have you can call on 0800 30 30 34 or email This email address is being protected from spambots. You need JavaScript enabled to view it..