Insolvency by the Numbers #55: NZ Insolvency Statistics June 2025

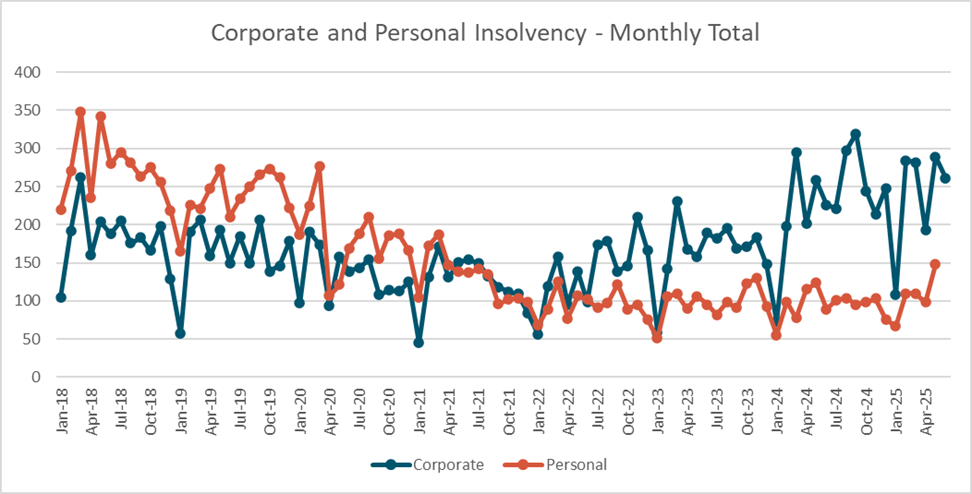

Below we outline the insolvency figures for June 2025 when compared with the last few years across personal and corporate insolvency.

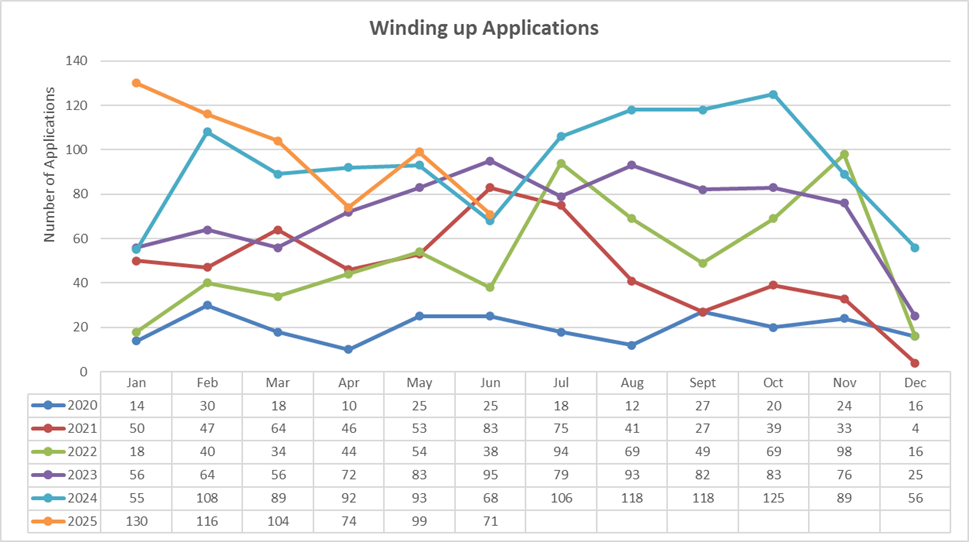

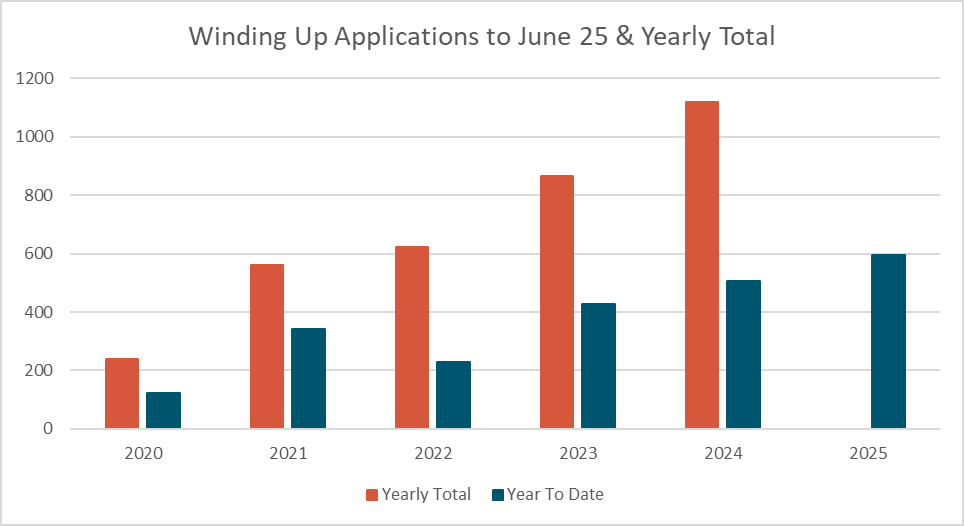

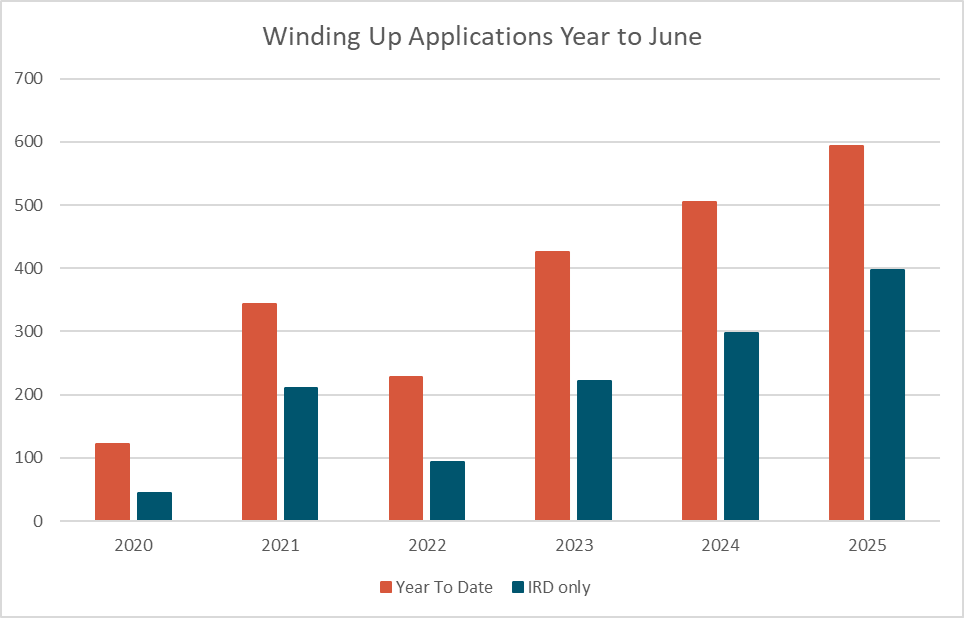

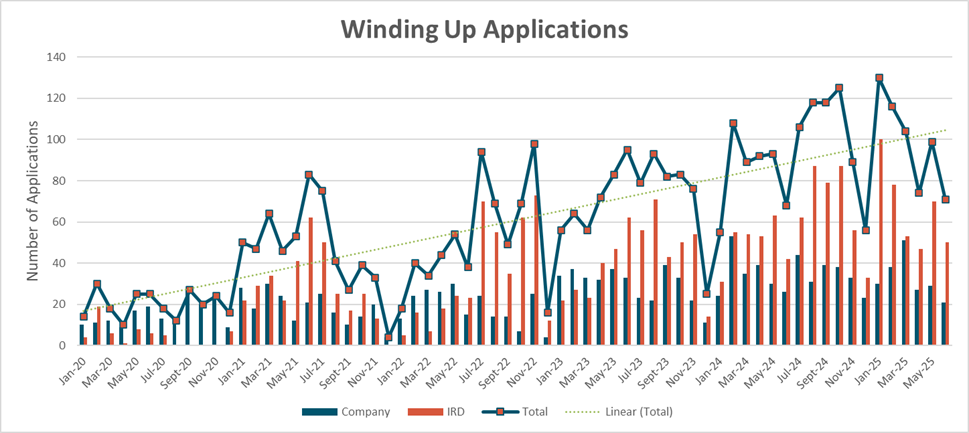

Winding Up Applications

As we mark the half way point for the year the insolvency figures follow their normal trend of a slight drop before heading upwards towards Christmas, this is in part driven by people pushing to get things done in the 2nd half of the year and a lack of public holidays delaying mattes.

While not back into the triple figures seen at the start of the year the June figures were inline with what was expected for winding up applications.

Creditors, particularly IRD, continue to apply pressure on debtors and their remains a squeeze on the economy. A combination of decreased discretionary spending and decreasing asset values from the highs seen a few years ago, anyone who has received their most recent Council valuation on their property will have noticed the drop in the RV, though I suspect we will not see a similar drop in rates.

Overall winding up applications for the year to date remain above prior years and look to continue increasing for the rest of the year. When compared to previous recessions this one has a winder feel across the whole economy and appears to be dragging out over a longer timeline rather than a short sharp peak. We continue to expect winding up application for 2025 to exceed those seen in 2024.

IRD made up 50 of the 71 applications for the month (70.42%), with non IRD applications still down on the figures seen in Jan, Feb and Mar.

The IRD has continued their 27-month streak of having more applications than all other creditors combined, a stat that is unlikely to change in the foreseeable future.

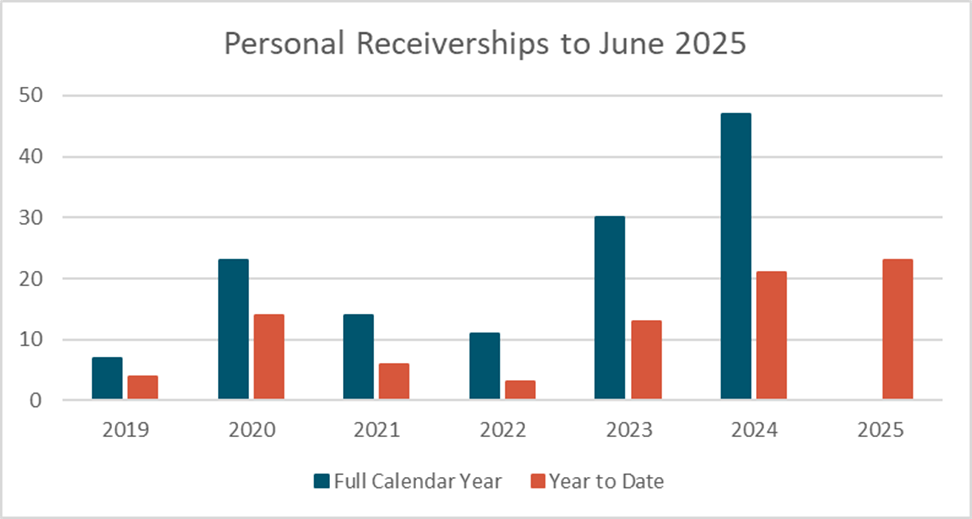

Personal Receiverships

June saw the number of personal receivership appointments only have a small rise, but it continues to be ahead of past years and remains on track to exceed 2024.

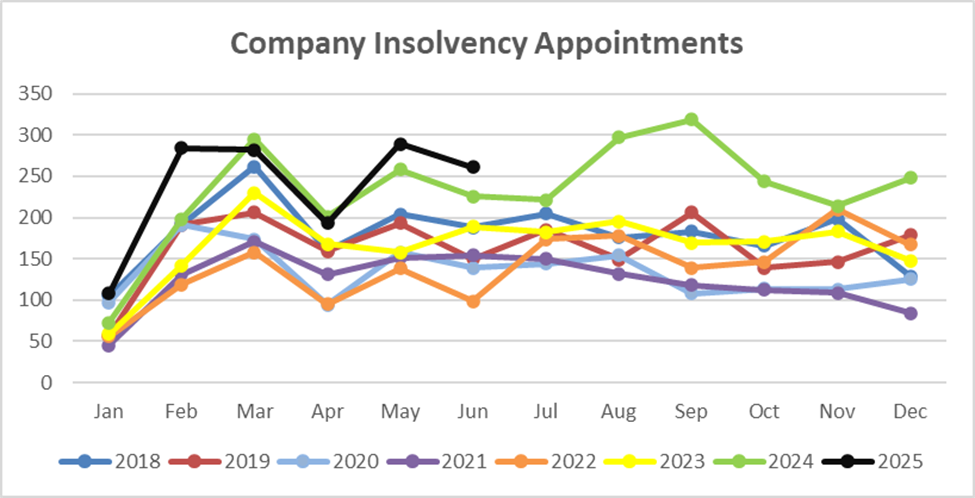

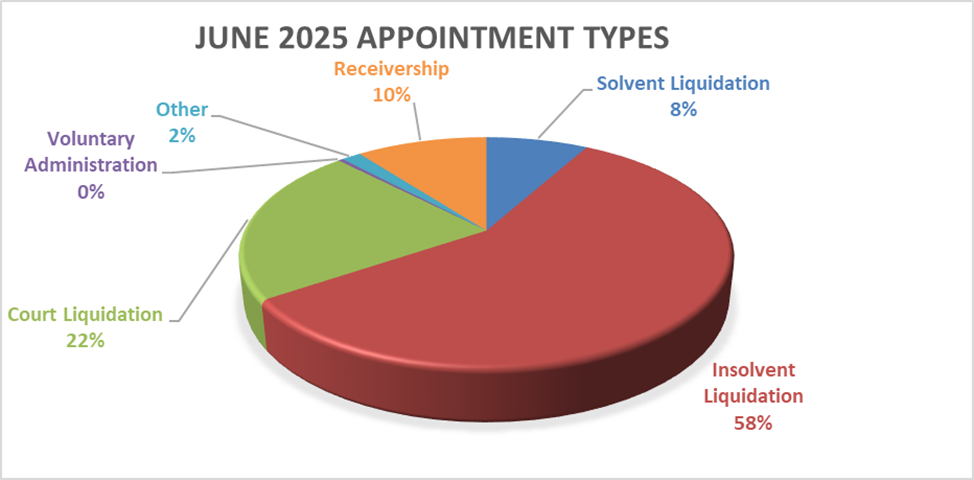

Company Insolvencies – Liquidations, Receiverships, and Voluntary Administrations

June 2025 carried on the higher appointments experienced in May 2025 and above the low appointments seen in April. This is a reflection of the tougher times being seen by businesses in the economy at the moment. The bulk of appointments came through shareholder insolvent appointments. While the trend line is following previous years it looks likely to overshoot the monthly figures to date.

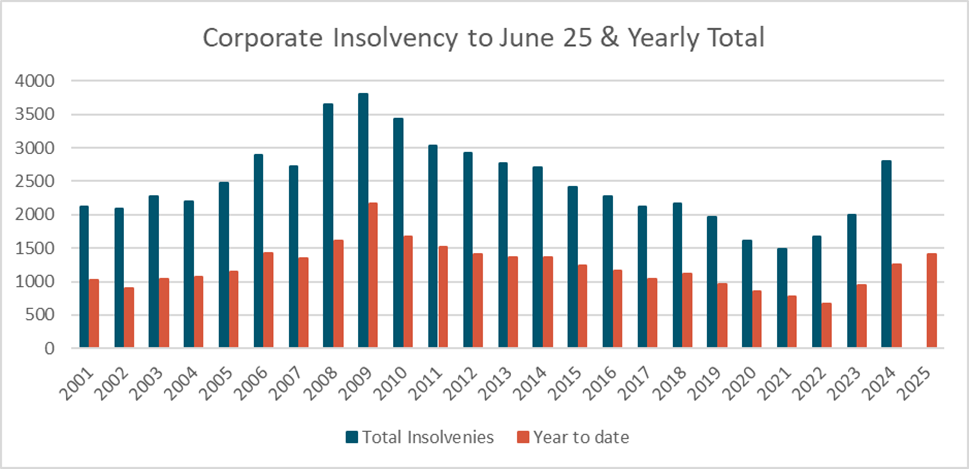

Year to date insolvency figures remain just behind the 2011 levels and look similar to those seen from 2012 – 2013, on this basis we estimate total appointments for the year will be higher than 2024, with the possibility to exceed 3,000 appointments for the year.

Insolvent shareholder appointment for the month were 6% above the long term average and Receiverships were 4% above their average. The rise here was made up of a drop in voluntary administrations and solvent liquidation and court liquidations for the month. Solvent liquidations dropping off in a recession is not surprising with a tighter economy, cashing out can become more difficult.

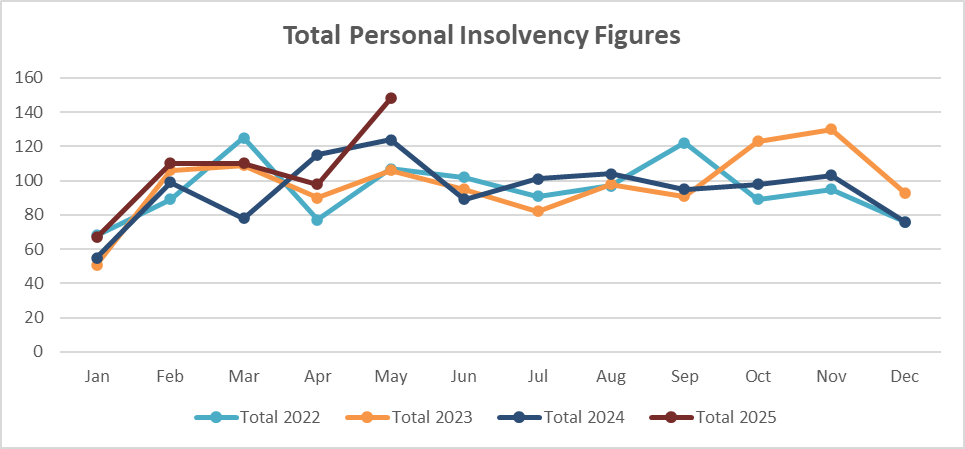

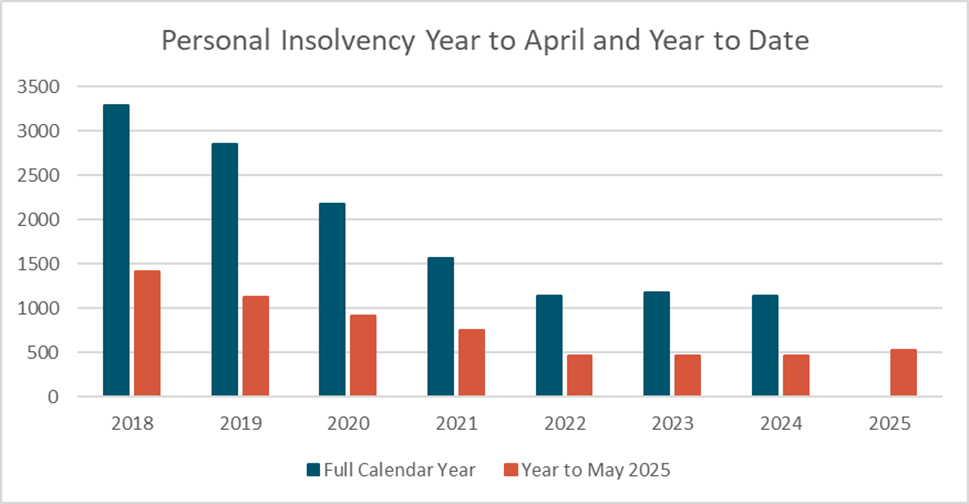

Personal Insolvencies – Bankruptcy, No Asset Procedure and Debt Repayment Orders.

May 2025 saw for the first time since 2020 a reasonable rise in personal insolvency, will this continue into next month after 3+ years of minimal movement in personal insolvency stats.

Year on year the 2025 figures still look like the last 3 years but if the lift seen in May 2025 continues we expect it will do so well into 2026.

Where to from here?

All insolvency types have continue at the raised levels seen across 2025. We continue to expect these figures to track up into the 2nd half of the year.

If you want to have a chat about any points raised or an issue you may have you can call on 0800 30 30 34 or email This email address is being protected from spambots. You need JavaScript enabled to view it..