Insolvency by the Numbers #54: NZ Insolvency Statistics May 2025

May 2025 saw another OCR drop of 0.25 basis points during the month, despite calls for a larger drop. The property market remains subdued and a buyers’ market, in addition housing stock availability continues to rise, anecdotally there appear to be a lot of recently completed townhouses sitting there unoccupied and awaiting sale. Business confidence remains low.

Below we outline the insolvency figures seen in May 2025 when compared with the last few years across personal and corporate insolvency.

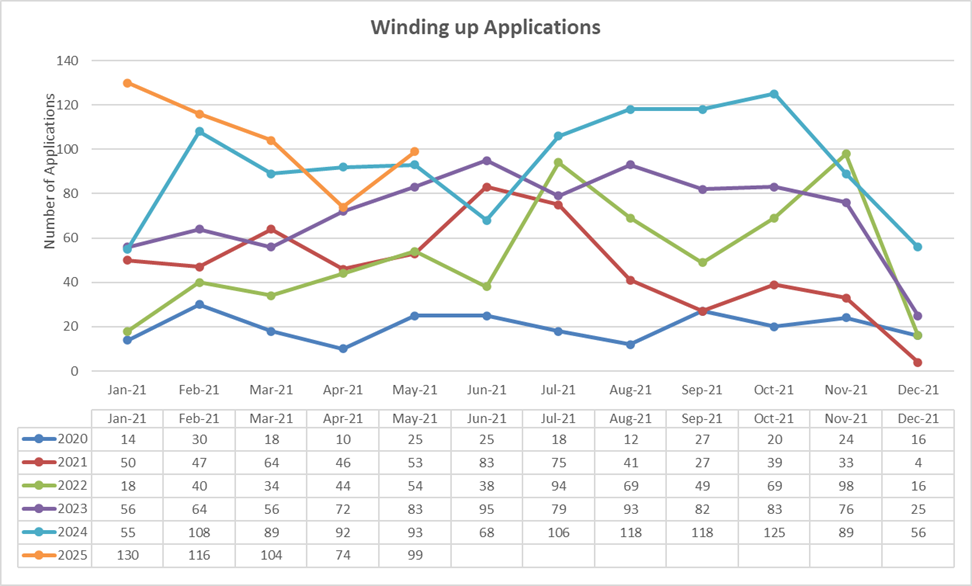

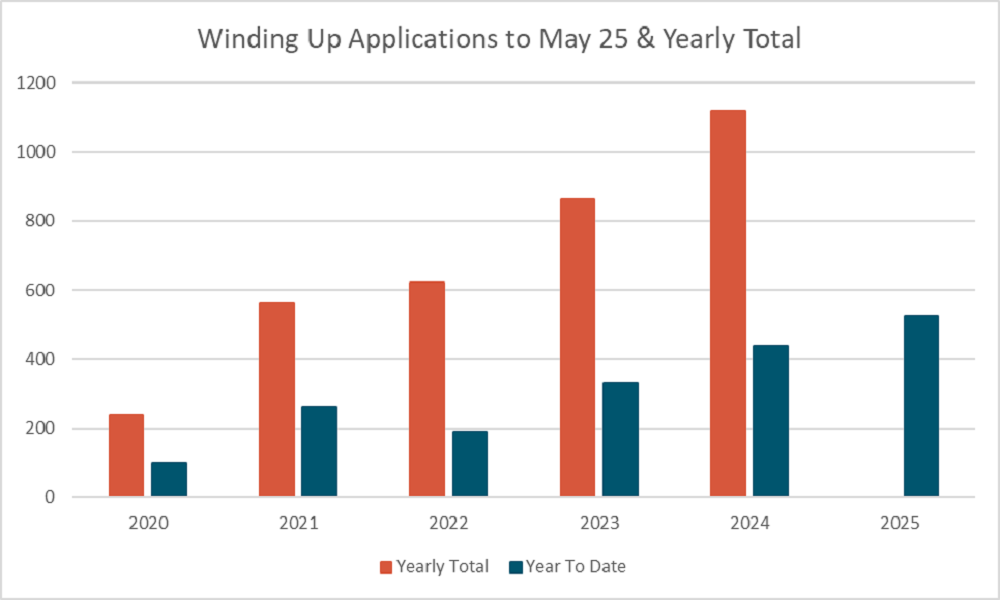

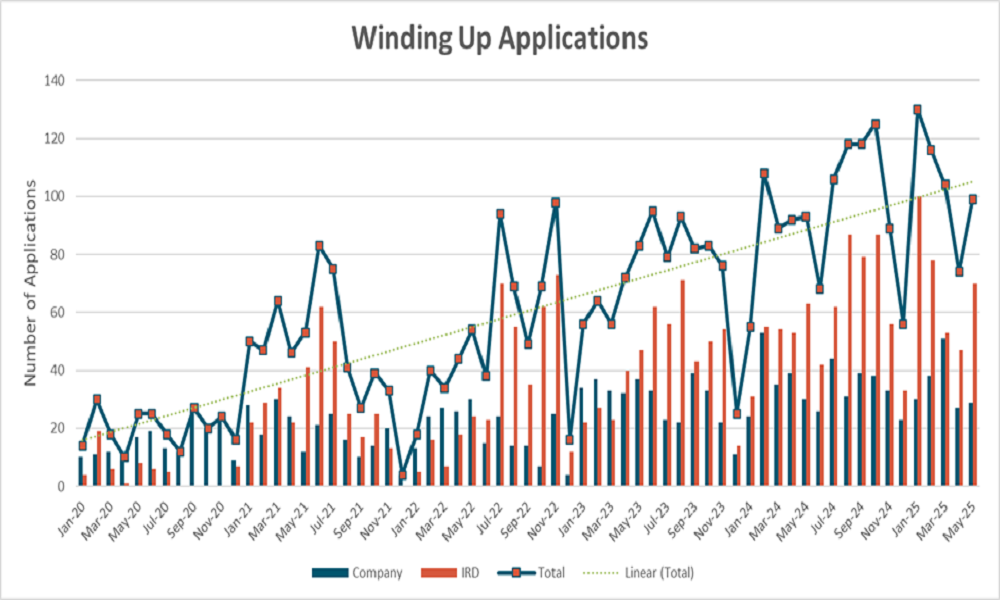

Winding Up Applications

The bounce back from last month’s public-holiday lows saw May just shy of the triple figures we had predicted.

The May winding up figures were above the level of the last 5 years, but still down from the highs experienced at the start of the year when IRD was catching up on its Christmas closure.

While not quite reaching triple figures creditors continue to apply pressure on debtors and their remains a squeeze on the economy with consumers not feeling they can return to their old spending habits. A combination of decreased discretionary spending and decreasing asset values from the highs seen a few years ago causing consumers to not feel as affluent as they once were (recall when vehicles went up in value after you purchased them and the property highs seen in 2021-2022)

Overall winding up applications for the year to date remain above prior years and look to continue increasing for the rest of the year. When compared to previous recessions this one has a winder feel across the whole economy and appears to be dragging out over a longer timeline rather than a short sharp peak.

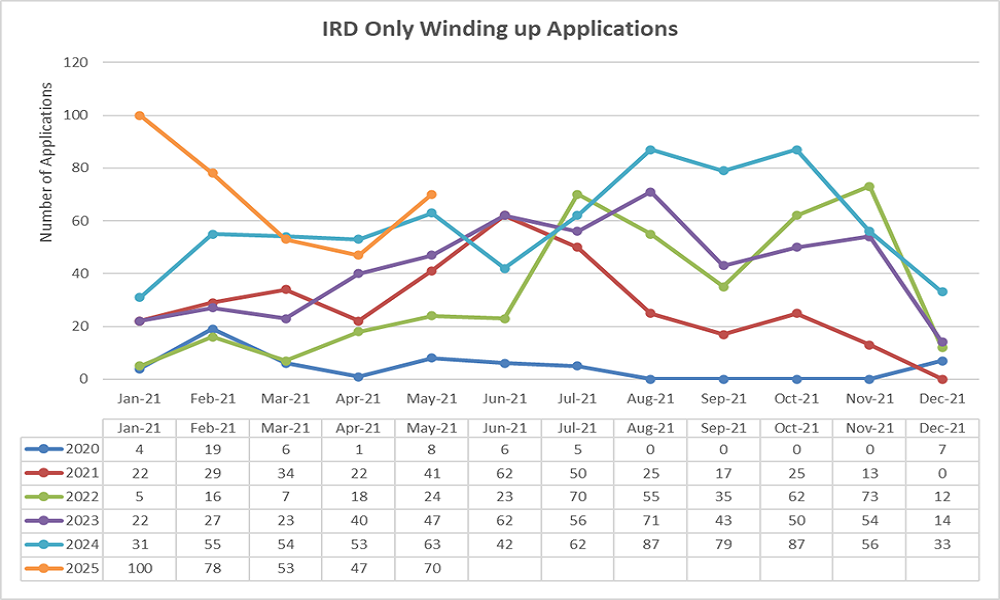

IRD made up 70 of the 99 applications for the month (70.71%), with non IRD applications still down on the figures seen in Jan, Feb and Mar. IRD continue to be well above the past 5 years average, so it is safe to assume they are continuing to apply pressure to derelict debtors, this is supported by the coms they are putting out on their increased compliance and recovery work in 2025 and the increased funding supplied by the government.

The IRD has continued their 26-month streak of having more applications than all other creditors combined.

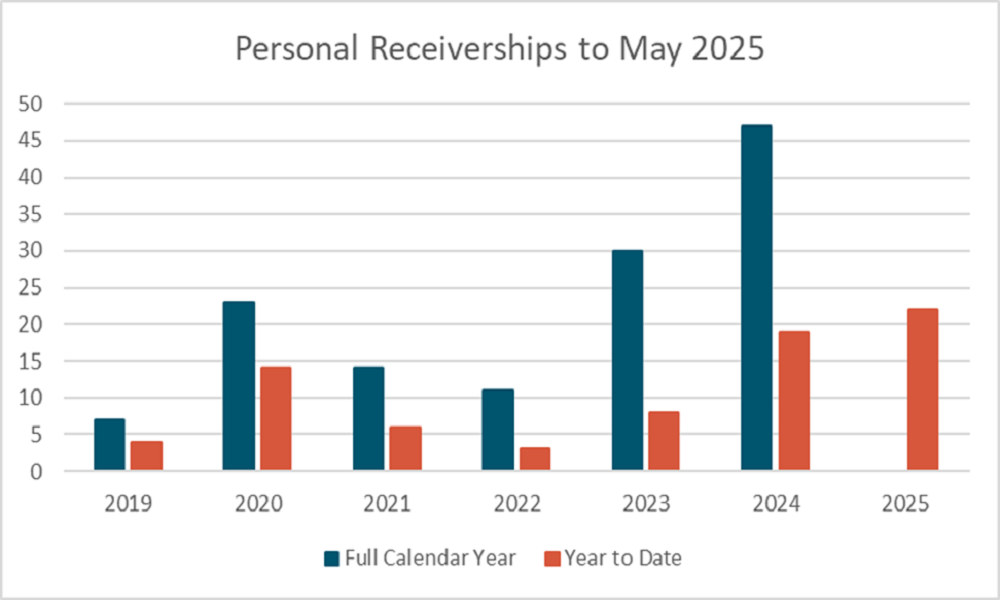

Personal Receiverships

May saw the number of personal receivership appointments continue to steadily rise ahead of the 2024 figures. As more companies continue to default on their lending personal security agreements are being called up, we believe this will continue to track upwards for the remainder of the year. There continue to be a number of tier 2 – tier 4 lenders who made some questionable lending over the least few years and are now having to take enforcement steps to try recover any value on their securities.

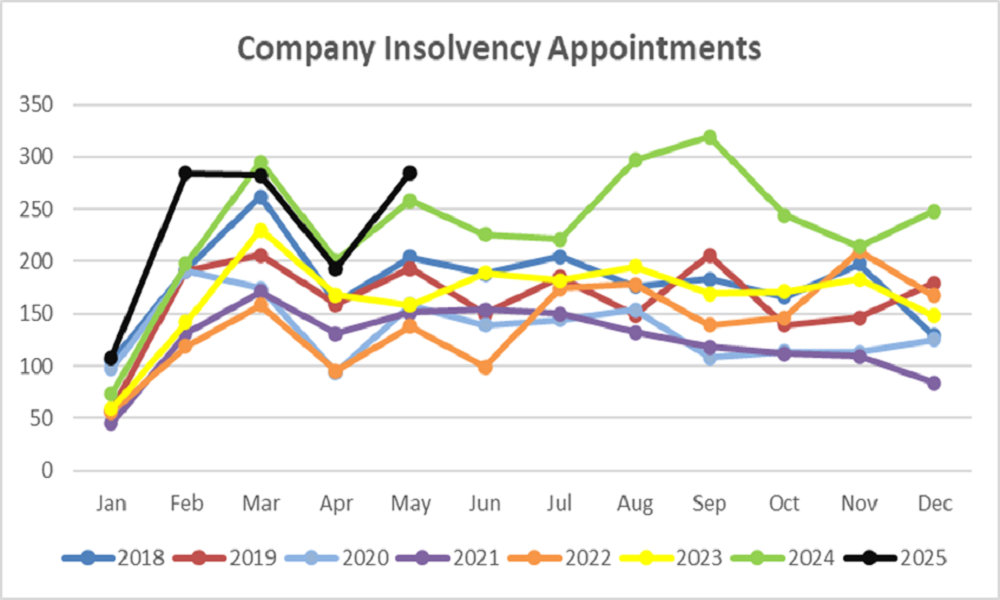

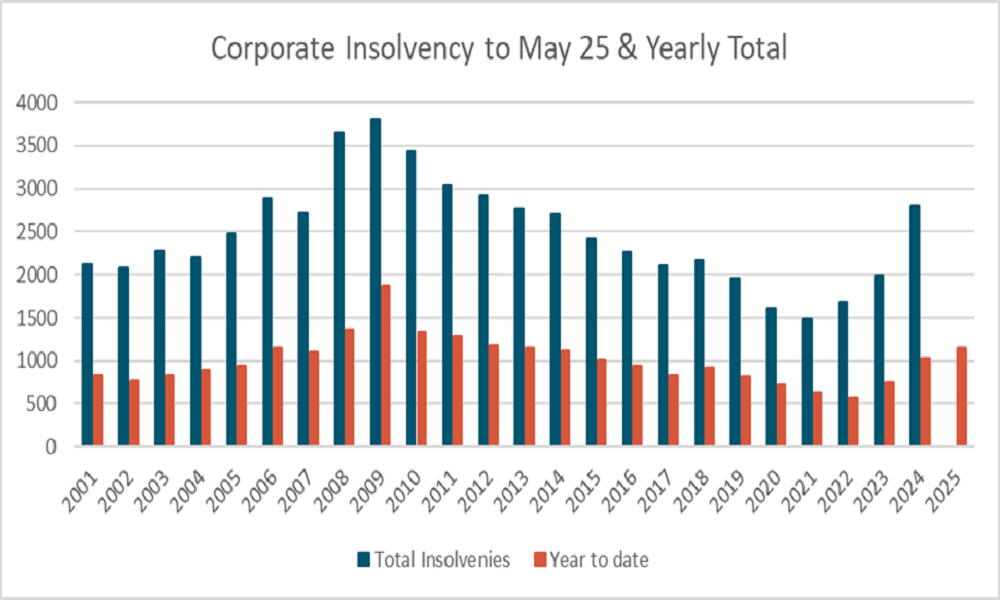

Company Insolvencies – Liquidations, Receiverships, and Voluntary Administrations

May 2025 was well above prior May’s and above the low appointments seen in April. This was a combination of the catchup in court liquidations with 112 for the month compared to April’s 28 court liquidations. The bulk of the balance of the appointments were the result of shareholder appointments. While the trend line is following previous years it looks likely to overshoot the monthly figures to date.

Year to date insolvency figures are just behind the 2011 levels and look similar to those seen from 2012 – 2013, on this basis we estimate total appointments for the year will be higher than 2024, with the possibility to exceed 3,000 appointments for the year.

The drop seen in court appointed liquidations in April has reverted to the norm and played a little catchup. However there has been a drop in other corporate appointment options and solvent liquidations. Solvent liquidations dropping off in a recession is not surprising with a tighter economy, cashing out can become more difficult. The drop in receiverships and voluntary administrations is likely just a monthly anomaly that will even out across the year.

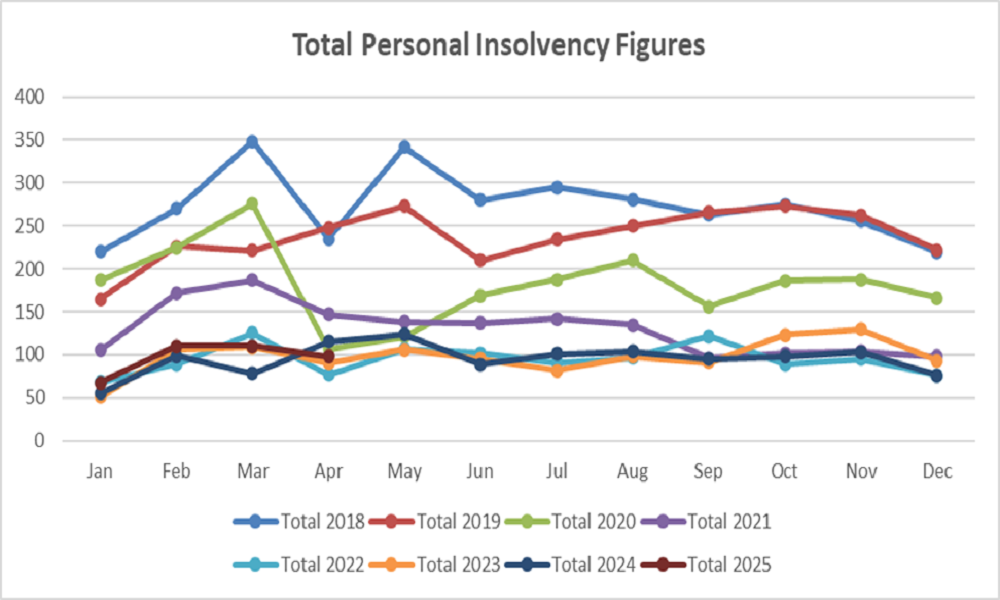

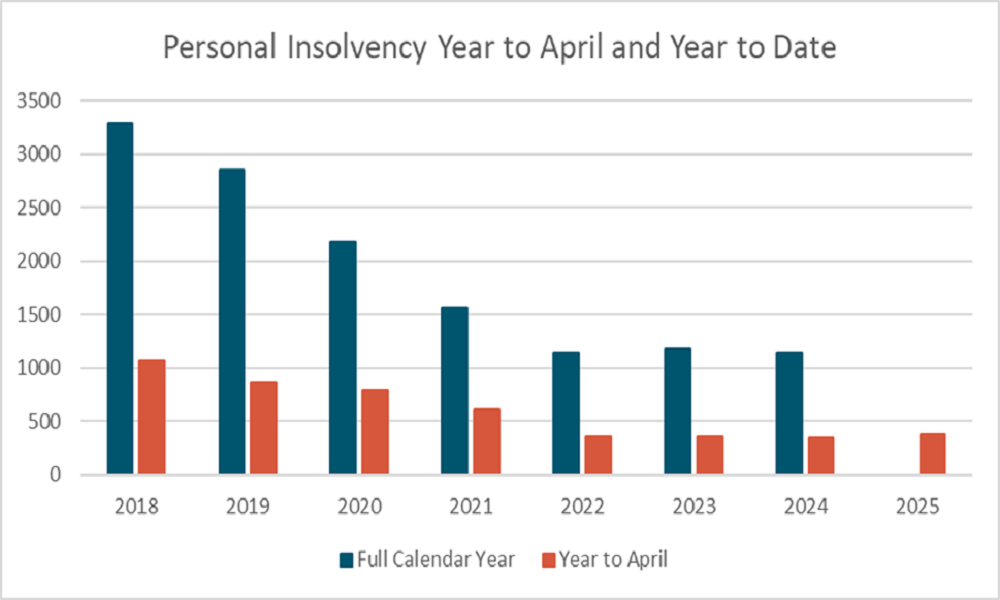

Personal Insolvencies – Bankruptcy, No Asset Procedure and Debt Repayment Orders.

Personal insolvency appointment figures have not yet moved. Minimal change to Bankruptcy, No Asset Procedure and Debt Repayment Order figures. This may pick up towards the 2nd half of the year as corporate appointments continue to lift and flow through.

Where to from here?

All insolvency types have seen a jump up in May. We expect these figures to track up into the 2nd half of the year as they historically have.

If you want to have a chat about any points raised or an issue you may have you can call on 0800 30 30 34 or email This email address is being protected from spambots. You need JavaScript enabled to view it..