Insolvency by the Numbers #56: NZ Insolvency Statistics July 2025

Unemployment is rising

Inflation is nudging the top of the Reserve Bank’s target band

The housing market is flat

The US tariffs continue to yo-yo

The OCR didn’t drop at the last announcement

Its tough out there, and people know it

We take a look at what happened in the insolvency figures during July 2025 when compared with the last few years for personal and corporate insolvency.

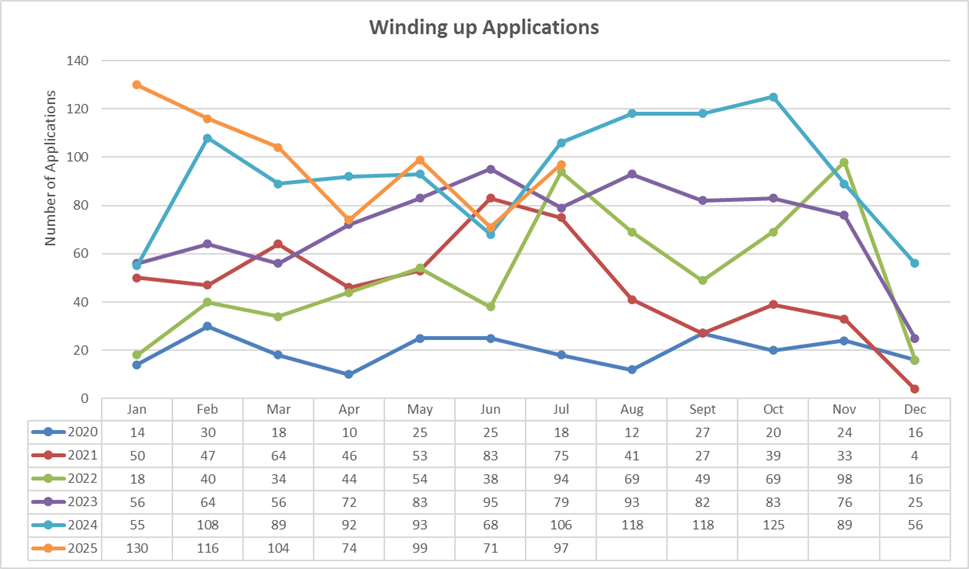

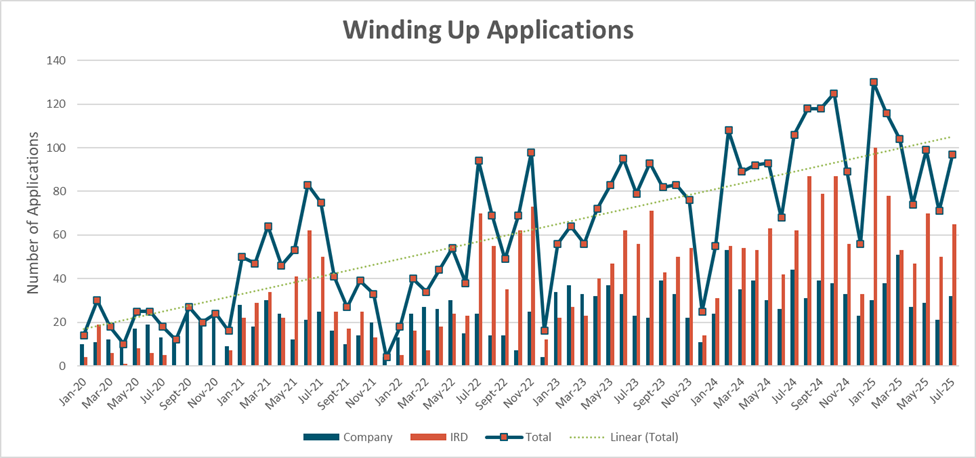

Winding Up Applications

Tipping into the back half of the year winding up applications are almost back in triple digits and expected to continue to track up further. Figures were recently released from an Official Information Act request to the IRD showing more than $1.4 billion in unpaid taxes from the 2025 tax year, $432.9m relates to employer activities and $1.047b to GST.

Based on the above IRD figures the pressure the IRD is applying to wind up delinquent debtors will likely continue for a time and well into 2026 if this level of nonpayment continues.

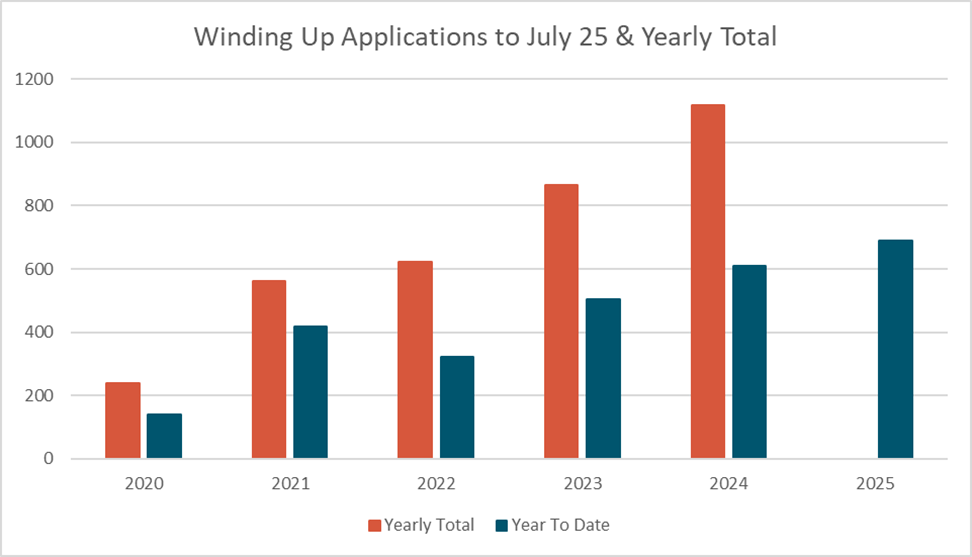

Winding up applications for the year to date continue to exceed prior years and look to continue increasing for the rest of the year. We continue to expect winding up applications for 2025 to exceed those seen in 2024.

Winding up applications for the year to date continue to exceed prior years and look to continue increasing for the rest of the year. We continue to expect winding up applications for 2025 to exceed those seen in 2024.

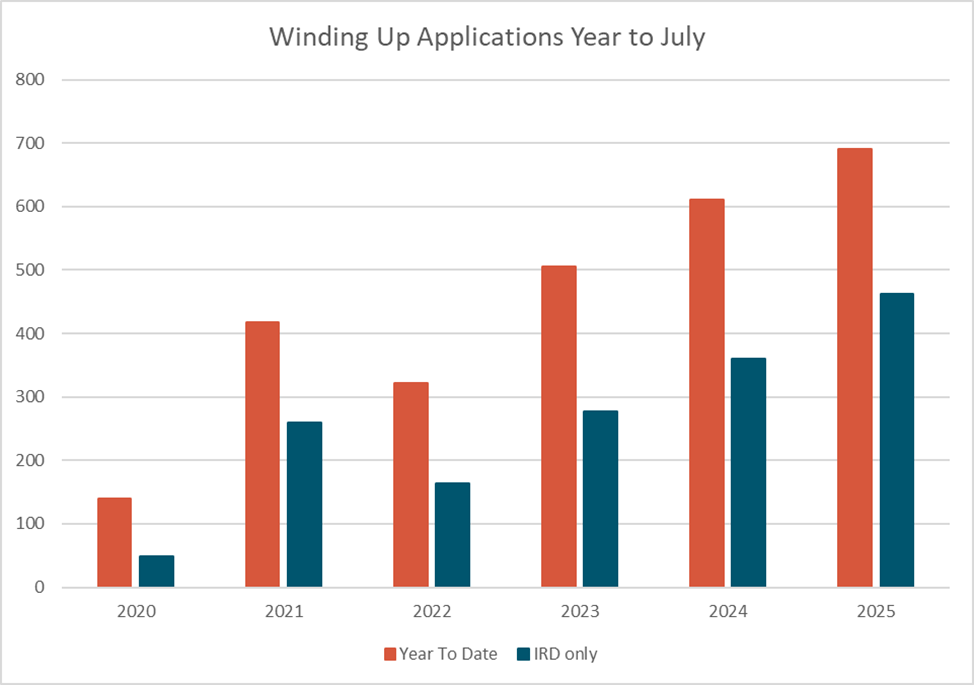

IRD made up 65 of the 97 applications for the month (67.01%), with non IRD applications still down on the figures seen in Jan, Feb and Mar.

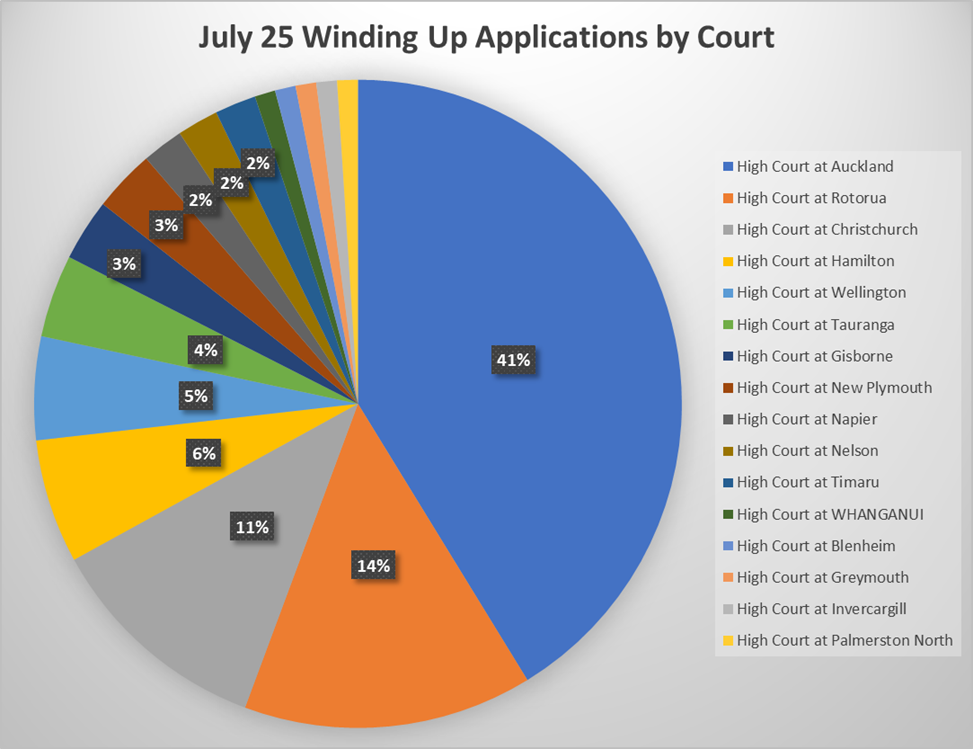

What courts saw the bulk of the winding up applications filed in July 2025? Auckland made up a large chunk but not quite as much as their 2024 average. In 2024 they floated around 54% of the applications, while July 2025 only saw them holding 41% of the applications.

What courts saw the bulk of the winding up applications filed in July 2025? Auckland made up a large chunk but not quite as much as their 2024 average. In 2024 they floated around 54% of the applications, while July 2025 only saw them holding 41% of the applications.

The reason behind this was the drive in Rotorua by IRD in filing applications, up from the 2024 average of 4% to 14% last month. Of the applications filed in Rotorua in July 2025 IRD made up 79%.

While the rest of the country remained there or there abouts when compared to their 2024 averages picking up or dropping a percentage here and there.

The IRD has continued their 28-month streak of having more applications than all other creditors combined.

The IRD has continued their 28-month streak of having more applications than all other creditors combined.

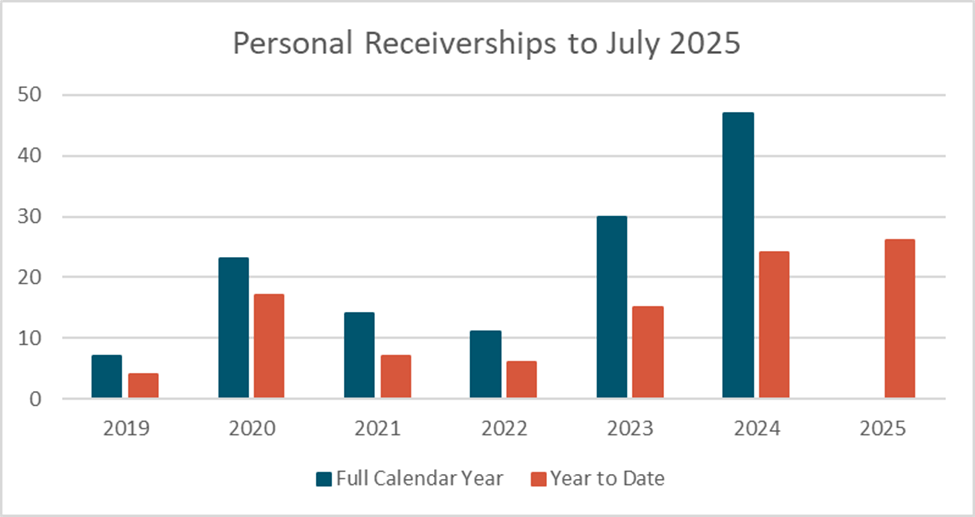

Personal Receiverships

July saw the number of personal receivership appointments rise in line with past July’s, because of this 2025 continues to be ahead of past years and remains on track to exceed 2024.

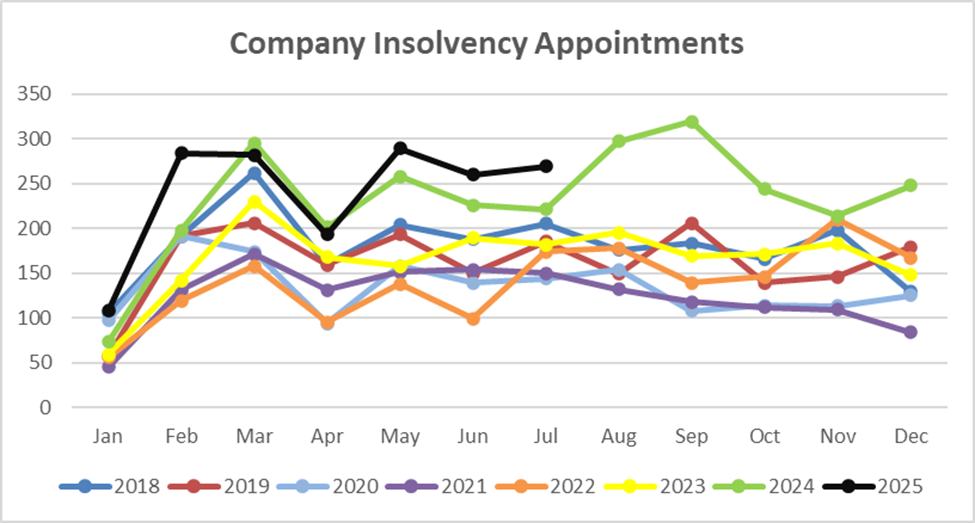

Company Insolvencies – Liquidations, Receiverships, and Voluntary Administrations

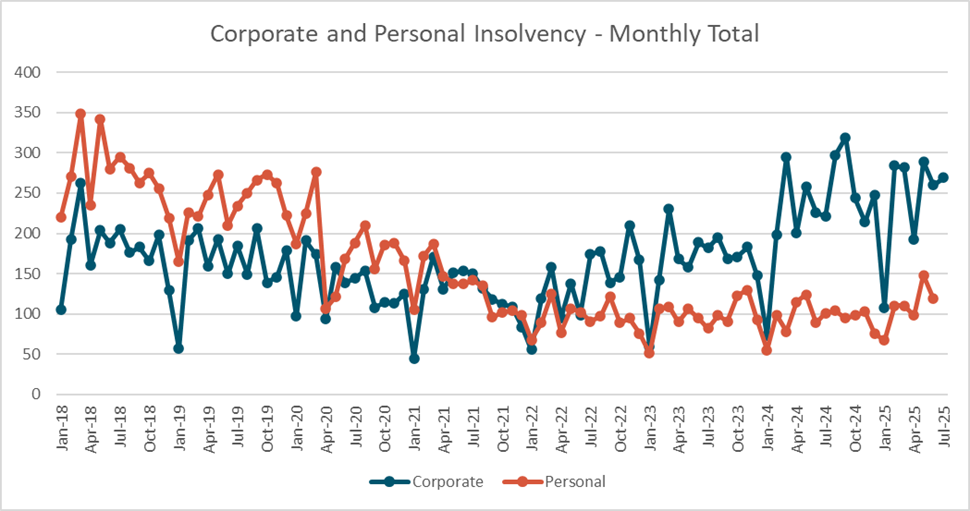

July 2025 continued the higher appointments since April 2025. The bulk of appointments came through shareholder insolvent appointments. While the trend line is following previous years it looks likely to continue to overshoot the monthly figures to date.

By industry Construction continues to make up 28% of all appointments followed by Accommodation and Food Services at 11% and Rental, Hiring and Estate also at 11% of appointments.

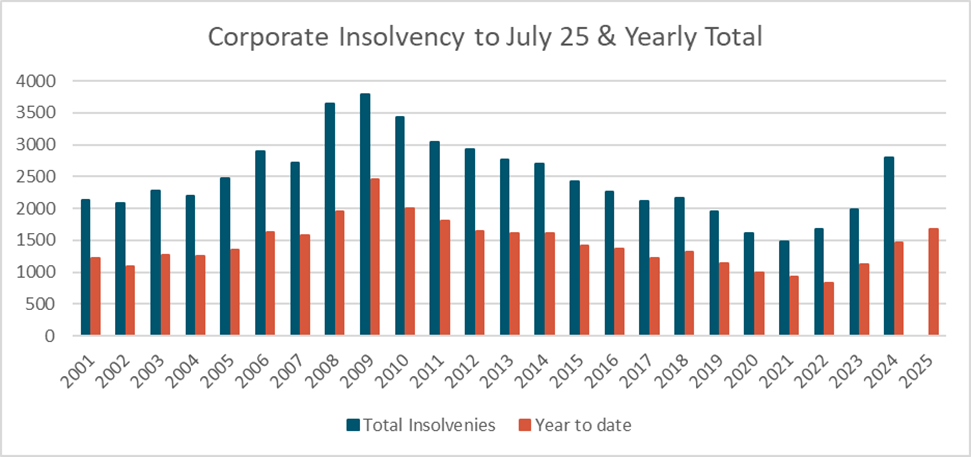

Year to date insolvency figures remain around the 2012 levels, on this basis we estimate total appointments for the year will be higher than 2024, with the possibility to exceed 3,000 appointments.

For the 7 months to date liquidation and receivership appointments remain elevated while there has been a considerable drop in voluntary administration in the year to date with only 13 appointments compared with 55 in 2024 and 29 in 2023.

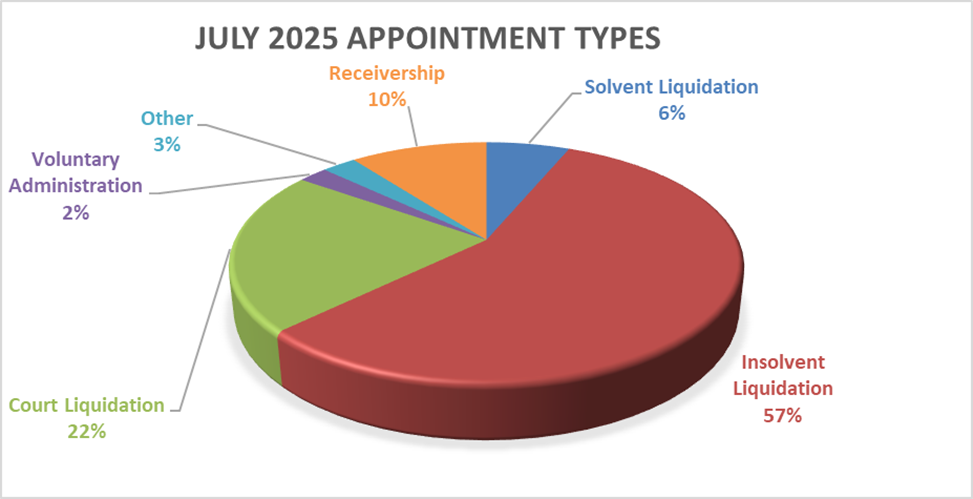

Insolvent shareholder appointment for the month was 5% above the long-term average and Receiverships were 4% above their average. The rise here was made up of a drop solvent liquidation by 6% and court liquidations by 4% compared to their long-term average for the month. Solvent liquidations dropping off in a recession is not surprising with a tighter economy, cashing out can become more difficult.

Personal Insolvencies – Bankruptcy, No Asset Procedure and Debt Repayment Orders.

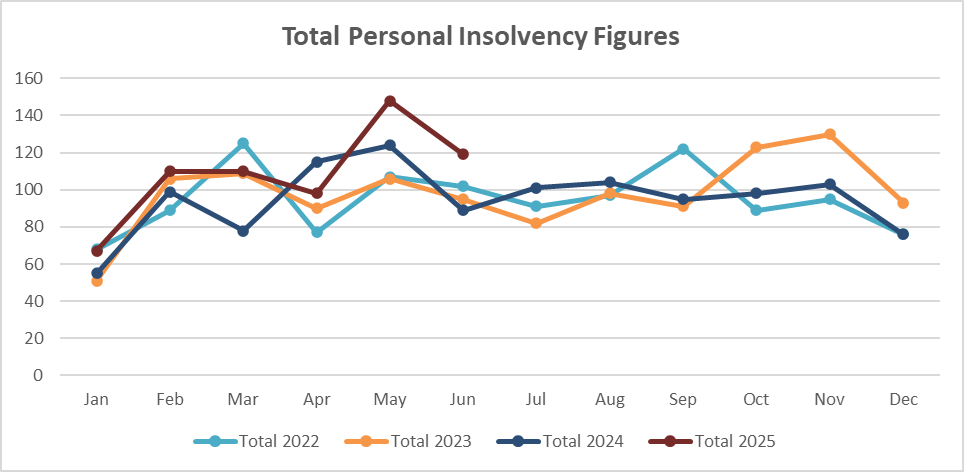

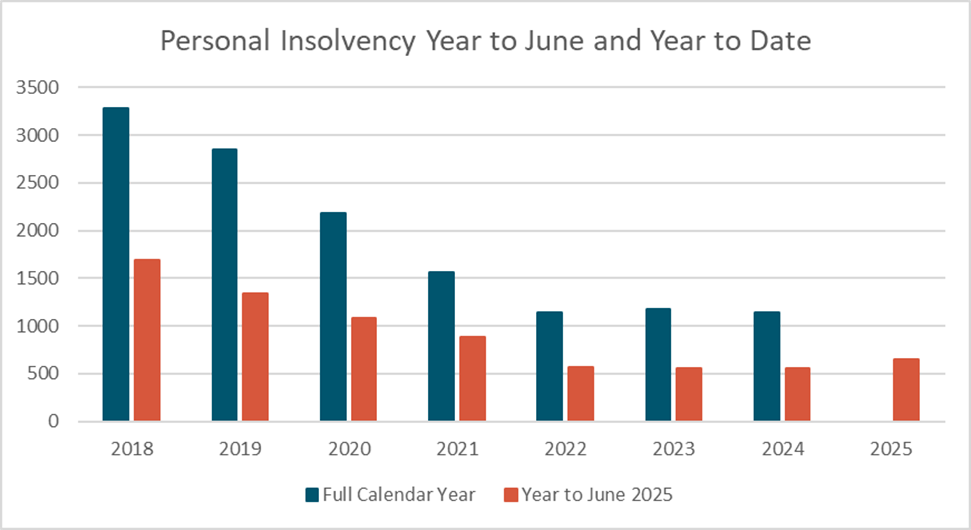

June 2025 didn’t quite manage to hold the lift seen in April, but it was above the past 3 years June figures.

Year on year the 2025 figures are marginally above the last 3 years, while on the increase they remain behind the 2021 figures. This period remains one of the lowest bases for personal insolvency figures.

Where to from here?

All insolvency types have continued at the increased levels seen across 2025. We continue to expect these figures to track up into the 2nd half of the year and through into 2026. Survive to 2025 has now become Get through 2025.

If you want to have a chat about any points raised or an issue you may have you can call on 0800 30 30 34 or email This email address is being protected from spambots. You need JavaScript enabled to view it..

Public Notices: Why the NZ Gazette Should Be Your First Stop

Where do you look for public notices? If your answer is the NZ Herald, The Post or another regional paper, you’re not alone but you might miss the bigger picture.

We publish public notices every week for new insolvency appointments. It’s not optional, it’s a legal requirement under the Companies Act 1993 and other relevant legislation depending on the type of appointment. These notices serve an important purpose: they inform creditors, shareholders, and other stakeholders about key developments like:

- New insolvency appointments

- Opportunities to file claims in insolvency engagements, corporate and personal

- Meetings of creditors

- Watershed meetings

- Creditors taking enforcement action against companies and individuals

- Notices to end appointments

These notices are a critical part of the insolvency process. They ensure transparency, give affected parties a chance to respond, and help maintain the integrity of the process. But here’s the catch: if the notice doesn’t reach the right people, it’s not doing its job.

We had a situation that highlighted the importance of where these notices are published. We advertised an appointment in the New Zealand Gazette a few days before it appeared in the NZ Herald. The Gazette notice went live, and… silence. But once the regional ad ran, creditors started reaching out requesting claim forms and providing evidence to assist the liquidators.

It got me thinking why the delay.

The Reach Problem

The NZ Herald is a regional paper. It’s great for Auckland, but what about creditors in Christchurch, Wellington, or Invercargill? Businesses aren’t confined to one city. Suppliers and customers operate nationwide. If you’re only checking your local paper, you’re potentially missing notices that affect you.

Understanding the Difference

Let’s break it down:

New Zealand Gazette

- Nationwide coverage: It’s the central source for all public notices in New Zealand.

- Official status: It’s the government’s formal record.

- Searchable archive: Notices are easy to find and reference.

- Timely publication: Listings often go live faster than print media.

Regional Newspapers (e.g., NZ Herald, The Post, etc.)

- Local reach: Great for targeting a specific geographic audience.

- Print and digital formats: Useful for readers who prefer traditional media.

- Limited scope: Notices are usually region-specific and may not be seen by stakeholders outside the area.

Why It Matters for Stakeholders?

Insolvency Practitioners are required to give notice. But more than that, we want affected parties to be informed. If a creditor doesn’t see a notice, they might miss their chance to file a claim or attend a meeting. They may continue to trade with a customer and allow their account to be used when it should have been closed. That’s not just inconvenient, it can be costly. And for Insolvent Practitioners, it can mean delays, disputes, or even legal challenges.

Best Practice: Use Both Platforms.

As at the date of writing this article July 2025 the Companies Act 1993 says that Public Notices should be advertised in both the Gazette and a newspaper circulating in the area in which is situated (section 3). There has been discussion of Companies Act reform that will change the advertising requirements, with the decline in newspaper distribution the move online newspapers, the requirement for notification through newspapers will be removed. The same information will remain online through The Gazette.

Beyond Insolvency: Public Notices in General

While this article focuses on insolvency, the same principles apply to other types of public notices changes to company structures, statutory declarations, land transfers, and more. The Gazette is the central hub for all of these, and it’s free to access.

How to protect your business from a customer’s IRD debt.

Suppliers face a real challenge when trying to assess a potential customers’ IRD debt before they set up an account and provide them with credit. IRD debt levels are not publicly available information, so what can you do to protect yourself?

Why IRD Debt Is Hard to Detect?

IRD debt is considered confidential and is not listed on public registers like the Companies Office unless the IRD has issued a statutory demand and formal recovery actions like liquidation proceedings have commenced. Because of this an IRD debt may not necessarily appear on a traditional credit check. This lack of transparency means suppliers must rely on indirect methods to assess risk.

Warning Signs a Company May Have IRD Debt

- Poor Communication or Avoidance – Businesses that avoid discussing financials or are vague about payment terms may be hiding issues

- Frequent Changes in Directors or Shareholders – This can indicate instability or attempts to avoid liability.

- Negative Media or Industry Reputation – News reports or word-of-mouth about financial trouble or IRD scrutiny

- IRD Audit Activity – IRD has increased audits in industries with high cash transactions (e.g., hospitality, construction, retail), they are openly disclosing which sectors they are focusing on. If your customer is operating in that sector, it is probably worth taking the time to complete additional due diligence.

How Suppliers Can Protect Themselves?

Request financial information, ask for recent financial statements, GST returns, and confirmation of tax compliance. This can include a copy of their MYIR printout to see what is owed. If it is all showing zeroes, then go one step further and make sure they have no outstanding filings. While not foolproof, reluctance to provide these can be a red flag.

Use credit checks and trade references, services like Equifax or Centrix may show defaults or judgments, though IRD debt won’t appear unless formal action has been taken.

Include protective clauses in contracts, make sure you are requesting Personal Guarantees from directors, taking security over the assets you are supplying (and registering it on the PPSR), lastly included in your terms of trade should be the ability to request financials periodically once the account is set up.

Monitor the companies register, watch for changes in solvency status, liquidation notices, or director resignations. Alerts can be set up in your watchlist to advise you of any changes.

Ultimately the decision to supply lies in your hands and if they are not prepared to provide you with the requested documents or not everything appears to be checking out, this raises a red flag and you have a decision to make. You can ignore the warning signs and take the risk, you can provide a reduced level of credit on the account, you can put them on a cash account, or you can opt to not deal with them at all (while this can be a difficult decision it will often be the correct one if its being considered).