Insolvency by the Numbers #55: NZ Insolvency Statistics June 2025

Insolvency by the Numbers #55: NZ Insolvency Statistics June 2025

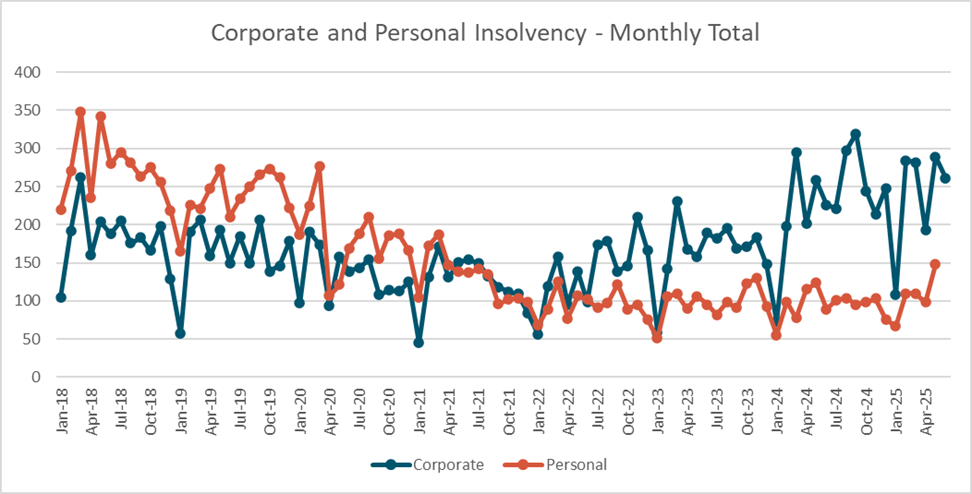

Below we outline the insolvency figures for June 2025 when compared with the last few years across personal and corporate insolvency.

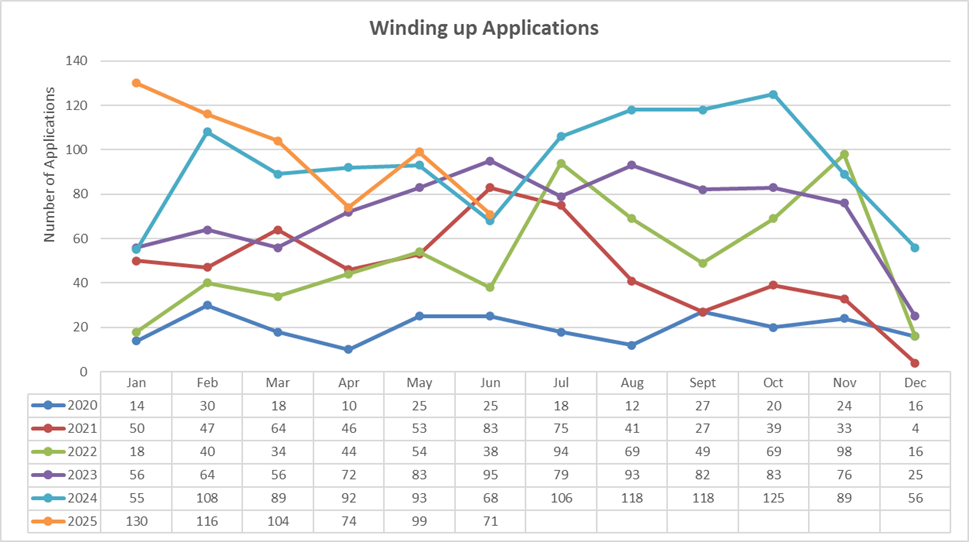

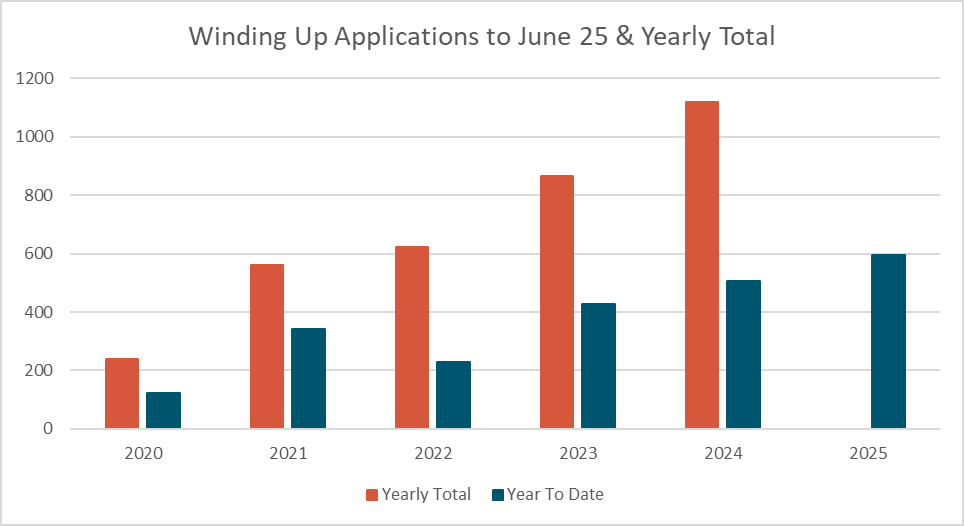

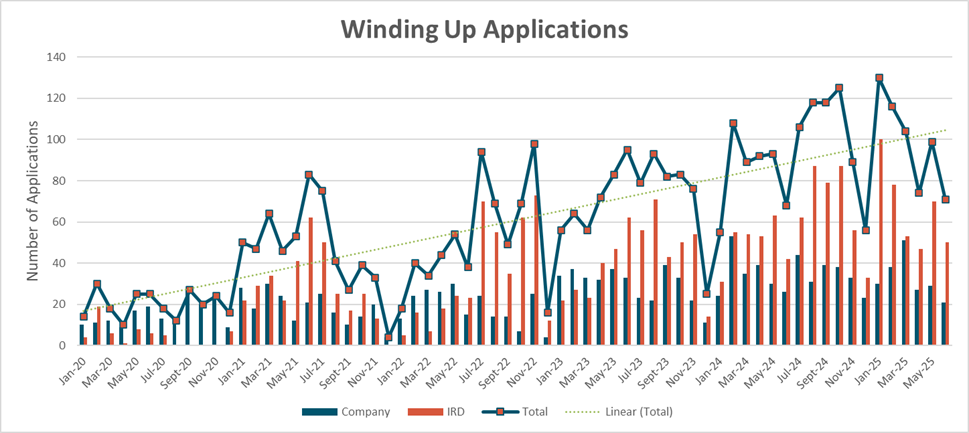

Winding Up Applications

As we mark the half way point for the year the insolvency figures follow their normal trend of a slight drop before heading upwards towards Christmas, this is in part driven by people pushing to get things done in the 2nd half of the year and a lack of public holidays delaying mattes.

While not back into the triple figures seen at the start of the year the June figures were inline with what was expected for winding up applications.

Creditors, particularly IRD, continue to apply pressure on debtors and their remains a squeeze on the economy. A combination of decreased discretionary spending and decreasing asset values from the highs seen a few years ago, anyone who has received their most recent Council valuation on their property will have noticed the drop in the RV, though I suspect we will not see a similar drop in rates.

Overall winding up applications for the year to date remain above prior years and look to continue increasing for the rest of the year. When compared to previous recessions this one has a winder feel across the whole economy and appears to be dragging out over a longer timeline rather than a short sharp peak. We continue to expect winding up application for 2025 to exceed those seen in 2024.

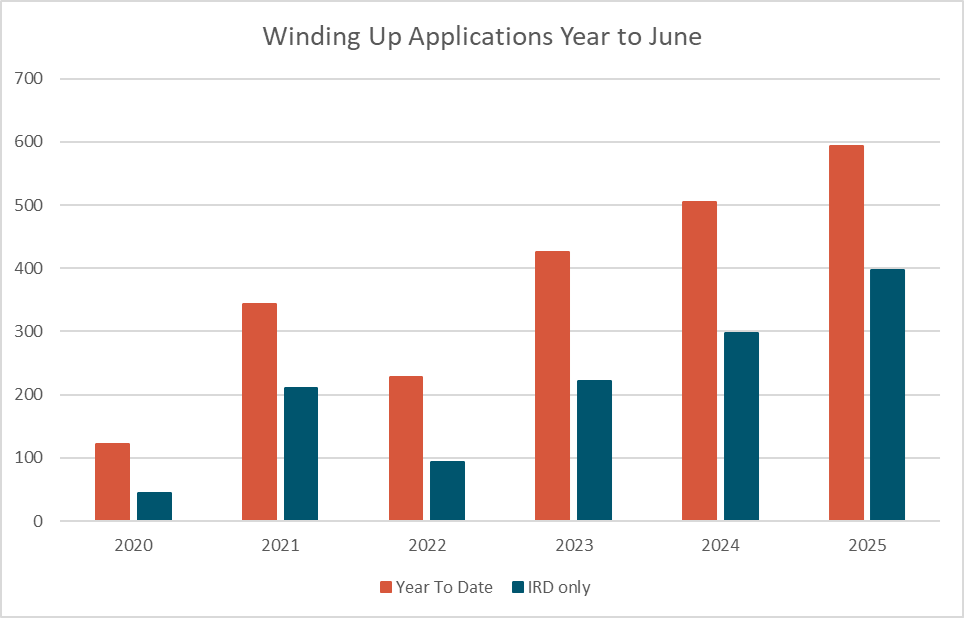

IRD made up 50 of the 71 applications for the month (70.42%), with non IRD applications still down on the figures seen in Jan, Feb and Mar.

The IRD has continued their 27-month streak of having more applications than all other creditors combined, a stat that is unlikely to change in the foreseeable future.

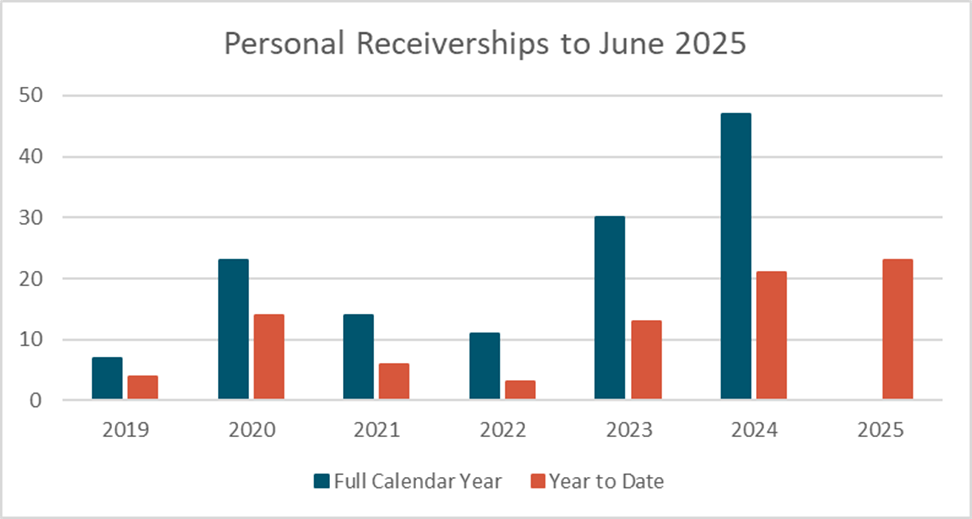

Personal Receiverships

June saw the number of personal receivership appointments only have a small rise, but it continues to be ahead of past years and remains on track to exceed 2024.

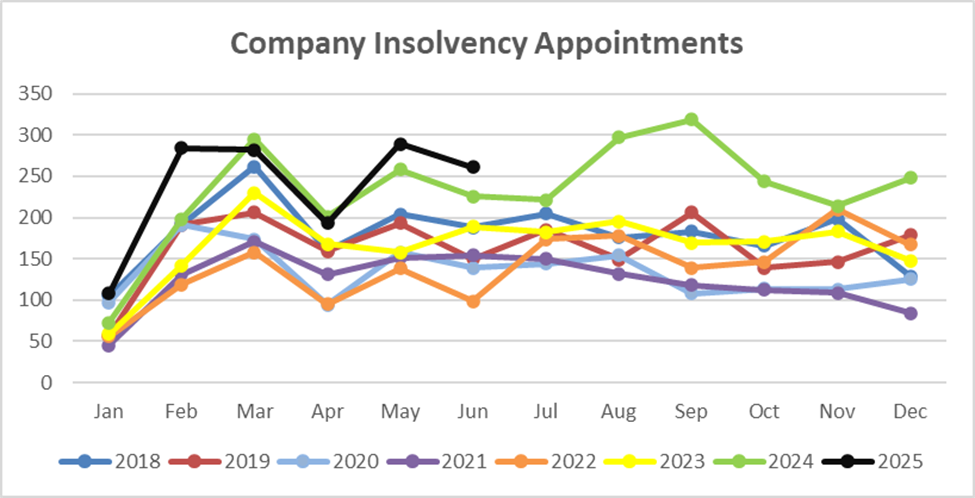

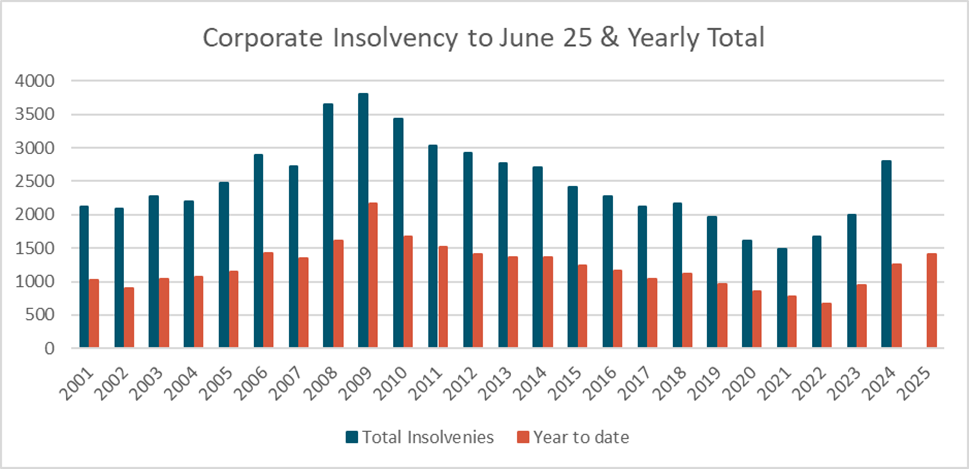

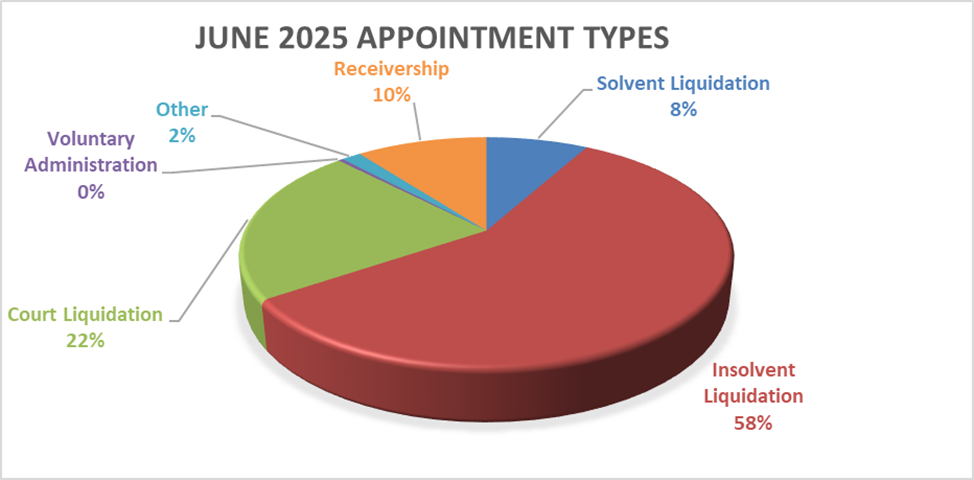

Company Insolvencies – Liquidations, Receiverships, and Voluntary Administrations

June 2025 carried on the higher appointments experienced in May 2025 and above the low appointments seen in April. This is a reflection of the tougher times being seen by businesses in the economy at the moment. The bulk of appointments came through shareholder insolvent appointments. While the trend line is following previous years it looks likely to overshoot the monthly figures to date.

Year to date insolvency figures remain just behind the 2011 levels and look similar to those seen from 2012 – 2013, on this basis we estimate total appointments for the year will be higher than 2024, with the possibility to exceed 3,000 appointments for the year.

Insolvent shareholder appointment for the month were 6% above the long term average and Receiverships were 4% above their average. The rise here was made up of a drop in voluntary administrations and solvent liquidation and court liquidations for the month. Solvent liquidations dropping off in a recession is not surprising with a tighter economy, cashing out can become more difficult.

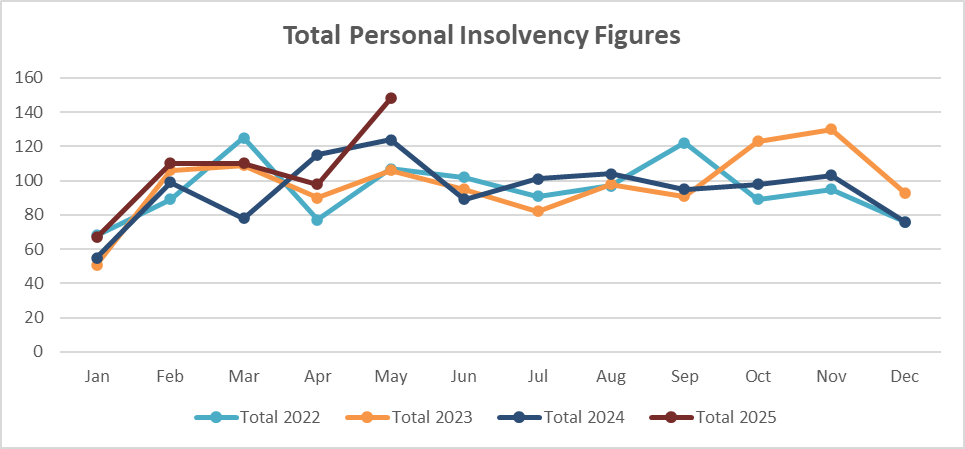

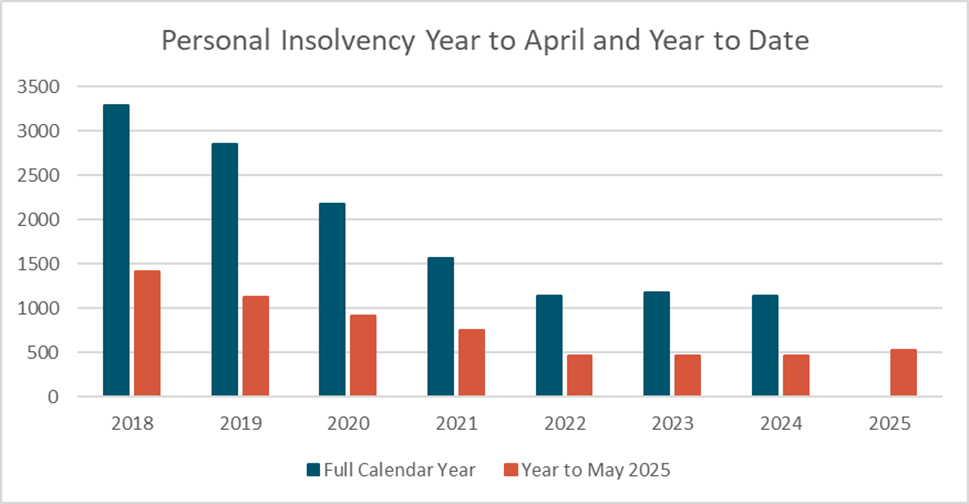

Personal Insolvencies – Bankruptcy, No Asset Procedure and Debt Repayment Orders.

May 2025 saw for the first time since 2020 a reasonable rise in personal insolvency, will this continue into next month after 3+ years of minimal movement in personal insolvency stats.

Year on year the 2025 figures still look like the last 3 years but if the lift seen in May 2025 continues we expect it will do so well into 2026.

Where to from here?

All insolvency types have continue at the raised levels seen across 2025. We continue to expect these figures to track up into the 2nd half of the year.

If you want to have a chat about any points raised or an issue you may have you can call on 0800 30 30 34 or email This email address is being protected from spambots. You need JavaScript enabled to view it..

When the IRD Comes Knocking: What Company Directors Need to Know

When the IRD Comes Knocking: What Company Directors Need to Know

No business owner wants to see a letter from the Inland Revenue Department (IRD) land on their desk especially when the business is already under financial pressure. But whether it’s a late payment notice, an audit notification, or a formal demand, how you respond can have serious implications for your company and you personally as a director.

Here’s what to know when the IRD comes knocking, and how early engagement with a licensed insolvency practitioner can help protect your business, assets, and reputation.

- Why IRD Debt Matters More Than Most

IRD isn’t just another creditor. It has stronger enforcement powers than most including the ability to:

Garnish funds directly from your bank accounts or debtors

Charge penalties and compounding interest

Issue statutory demands

Pursue directors personally in certain situations (e.g. for PAYE or GST trust money)

Apply to liquidate your company

When tax arrears are involved, directors must act quickly and responsibly to avoid compounding the problem or exposing themselves to personal liability or risking breaches of their directors’ duties.

- Common IRD Triggers You Shouldn’t Ignore

Even if your business has been managing up until now, the following are signs that trouble may be brewing:

Missed GST, PAYE, or income tax payments

Reliance on tax arrears to manage cashflow, IRD is not a bank

Lack of timely IRD compliance (returns filed late or not at all)

Receiving a Notice of Assessment, Default Notice, or Statutory Demand

Ignoring these signs won’t make them go away in fact, it can escalate matters quickly.

- Director Risk: Personal Exposure Is Real

Directors are legally responsible for ensuring their company meets its tax obligations. This includes trust money such as PAYE collected on behalf of the IRD. If your company is insolvent and continues to incur tax debt, you could be at risk of:

Breach of Directors Duties claims under the Companies Act

Director penalties for PAYE or GST

This is why seeking advice early and documenting your actions is vital for protecting yourself.

- Your Options: Don’t Wait for Enforcement

IRD is generally open to working with businesses that engage early and transparently. Possible solutions include:

Payment arrangements or instalment plans

Restructuring advice, including business turnaround or voluntary administration

Formal compromise under the Companies Act, where appropriate

A licensed insolvency practitioner can help you negotiate with IRD, assess your company's solvency, and develop a strategy that balances compliance with business survival.

- What Not to Do

When IRD pressure builds, some directors take actions that later lead to legal and financial consequences. Avoid:

Transferring assets to related parties or new entities for minimal or no consideration

Taking drawings or loans while tax debt goes unpaid

Prioritising some creditors over others without advice

Trading while insolvent without a clear recovery plan

Ignoring communication from the IRD

All of these may lead to greater scrutiny and personal exposure if the company fails.

- Talk to a Licensed Insolvency Practitioner First

Whether your business is facing an IRD demand, audit, or long-overdue obligations, talking to a licensed insolvency practitioner gives you options. We can:

Clarify your legal position and risks

Engage with IRD on your behalf

Help you assess your company’s viability

Develop a restructuring or exit plan

Protect your personal and business assets where possible

Don’t Wait for the Knock

The earlier you seek advice, the more choices you’ll have and the less likely the situation is to spiral out of control. If your business has fallen behind on its taxes or you’re worried about IRD enforcement, we’re here to help.

KiwiSaver and Bankruptcy: A Recovery Option for Creditors Pre-Bankruptcy.

KiwiSaver and Bankruptcy: A Recovery Option for Creditors Pre-Bankruptcy.

New Zealand's KiwiSaver scheme, introduced in 2007, has become a cornerstone of the country's retirement savings framework. However, when financial difficulties arise and bankruptcy looms, both debtors and creditors face complex questions about how KiwiSaver funds are treated in insolvency proceedings. This article explores the intersection of KiwiSaver and bankruptcy law, with particular focus on recovery options available to creditors before formal bankruptcy proceedings commence.

If an individual is adjudicated bankrupt in New Zealand, their assets vest in the Official Assignee (OA) for the benefit of creditors. One of the exceptions to this rule is the individual’s KiwiSaver. Despite being considered an asset under the Insolvency Act, the OA cannot access these funds while they remain in the KiwiSaver fund. If withdrawn during the term of your bankruptcy they could become available to creditors.

The reason behind the exception is that the KiwiSaver Act was put in place to promote long-term retirement savings and remove some of the burden from the government of supporting individuals in their retirement, it was not intended to serve as a pool of funds for creditors.

The Pre-Bankruptcy Recovery Option

This bankruptcy exception creates a window for creditors before bankruptcy. If a debtor is facing mounting pressure and is not yet bankrupt, creditors may encourage the individual to apply for an early withdrawal from their KiwiSaver. If successful and the withdrawal application is approved by the KiwiSaver provider, the withdrawn funds become accessible cash and can be used to repay debts. This would then provide the creditors with access to an asset that would not traditionally be available to them in bankruptcy.

This approach does play round the intention of the Act to a degree but remains a legal option. It does raise a risk for those creditors who act early. While they may recover funds, other creditors may receive nothing upon bankruptcy. In this case those creditors who receive funds run the risk that the funds received may be clawed back by the OA to be re-distributed in accordance with the Insolvency Act.

For those concerned that an individual may choose to sell up their assets and dump the funds into their KiwiSaver pre bankruptcy, effectively trying to protect their assets and exclude them from their bankruptcy, the OA does have a number of powers to investigate these transactions and look to recover them for the benefit of creditors if they have occurred within certain timeframes and at a point when the individual was already insolvent.

What This Means for Stakeholders

- For Creditors: Timing is everything. Acting before bankruptcy may yield a better recovery in full, or in part if the funds are clawed back. It may be beneficial to ensure all creditors are paid evenly so the funds are not clawed back, and a chunk gets used for the OA’s time and legal cost.

- For Debtors: Understanding their rights and the long-term consequences of early KiwiSaver withdrawal is crucial. They need to be aware that in a bankruptcy these funds would not be accessible. But if they can be used to avoid bankruptcy entirely and settle all outstanding creditors’ claims that may be acceptable as a good trade off to the individual. Ultimately, they need to be aware of their options to make an informed decision.

The increasing value of KiwiSaver balances across the New Zealand population means these issues will become more significant over time.

This article provides general information only and should not be considered legal or financial advice. Professional advice should be sought for specific situations involving KiwiSaver and potential bankruptcy proceedings.