Insolvency by the Numbers #54: NZ Insolvency Statistics May 2025

Insolvency by the Numbers #54: NZ Insolvency Statistics May 2025

May 2025 saw another OCR drop of 0.25 basis points during the month, despite calls for a larger drop. The property market remains subdued and a buyers’ market, in addition housing stock availability continues to rise, anecdotally there appear to be a lot of recently completed townhouses sitting there unoccupied and awaiting sale. Business confidence remains low.

Below we outline the insolvency figures seen in May 2025 when compared with the last few years across personal and corporate insolvency.

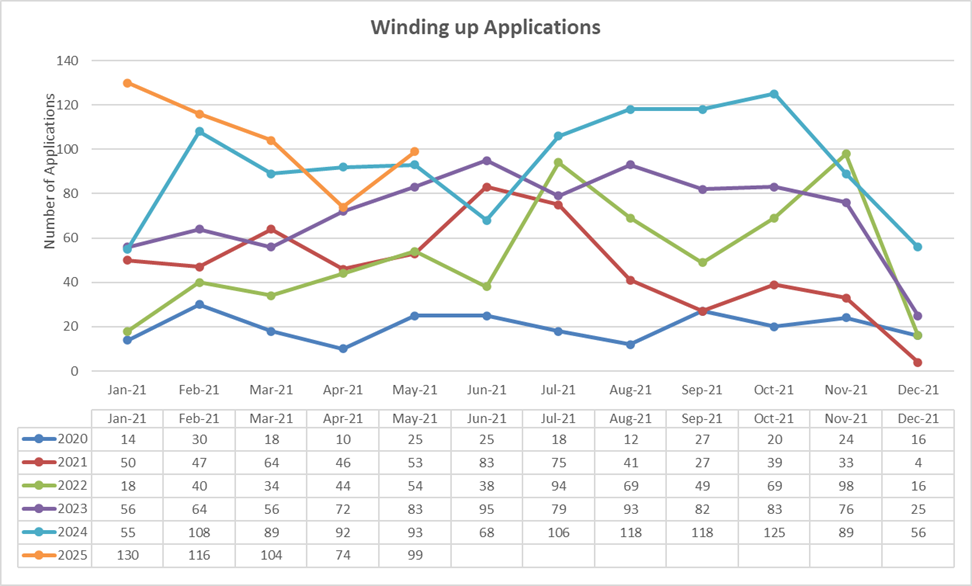

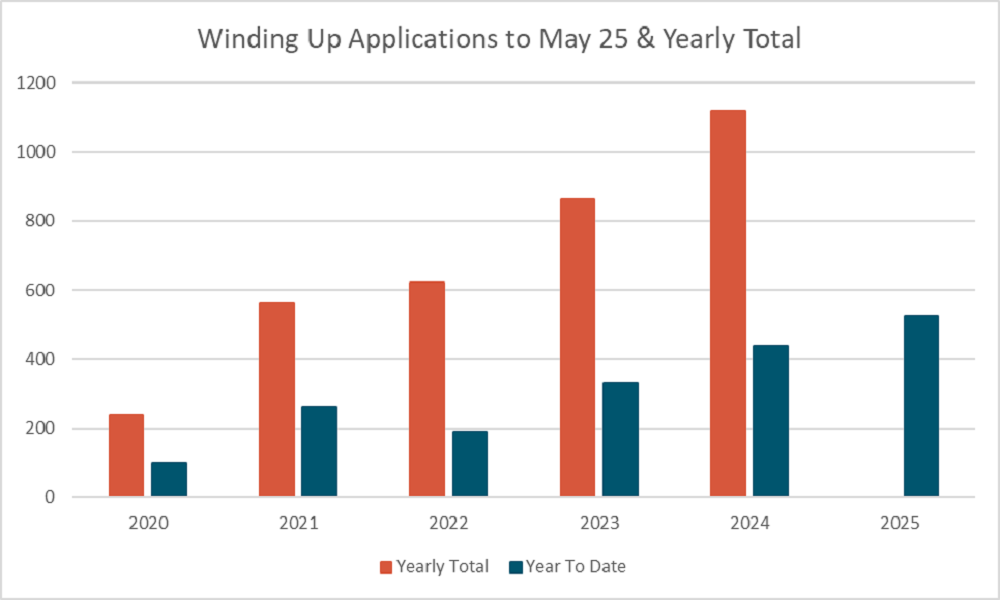

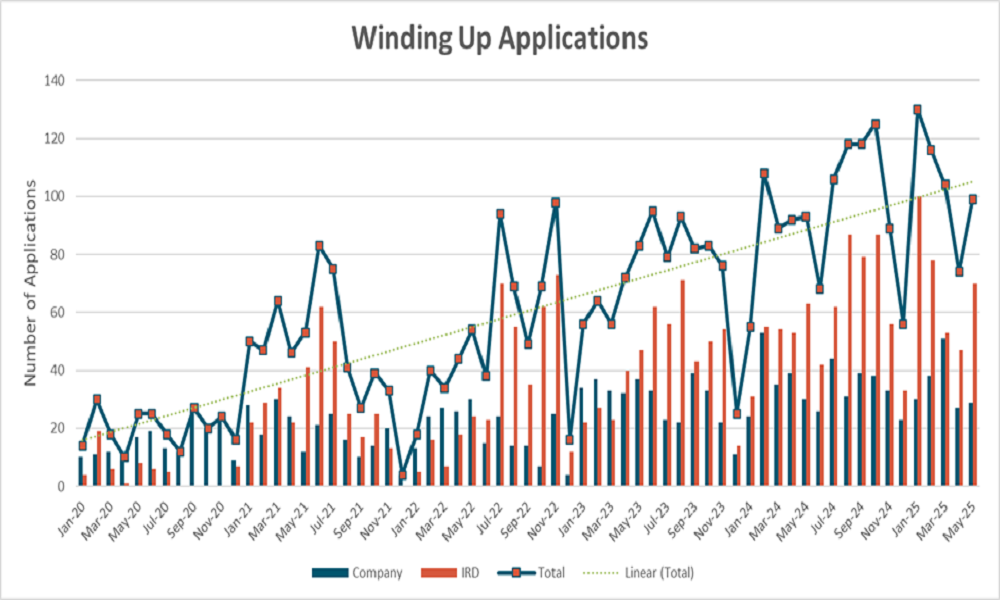

Winding Up Applications

The bounce back from last month’s public-holiday lows saw May just shy of the triple figures we had predicted.

The May winding up figures were above the level of the last 5 years, but still down from the highs experienced at the start of the year when IRD was catching up on its Christmas closure.

While not quite reaching triple figures creditors continue to apply pressure on debtors and their remains a squeeze on the economy with consumers not feeling they can return to their old spending habits. A combination of decreased discretionary spending and decreasing asset values from the highs seen a few years ago causing consumers to not feel as affluent as they once were (recall when vehicles went up in value after you purchased them and the property highs seen in 2021-2022)

Overall winding up applications for the year to date remain above prior years and look to continue increasing for the rest of the year. When compared to previous recessions this one has a winder feel across the whole economy and appears to be dragging out over a longer timeline rather than a short sharp peak.

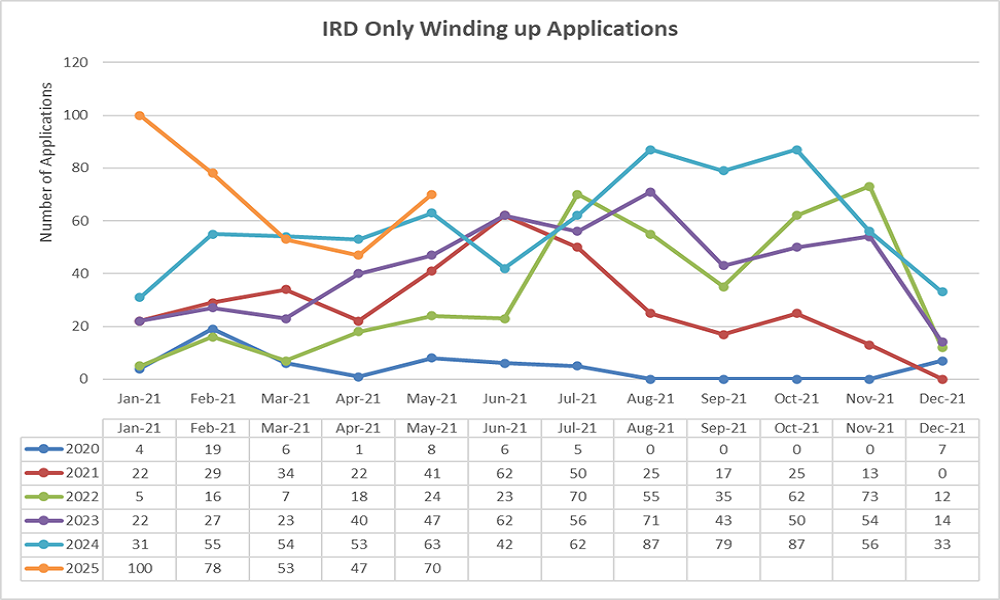

IRD made up 70 of the 99 applications for the month (70.71%), with non IRD applications still down on the figures seen in Jan, Feb and Mar. IRD continue to be well above the past 5 years average, so it is safe to assume they are continuing to apply pressure to derelict debtors, this is supported by the coms they are putting out on their increased compliance and recovery work in 2025 and the increased funding supplied by the government.

The IRD has continued their 26-month streak of having more applications than all other creditors combined.

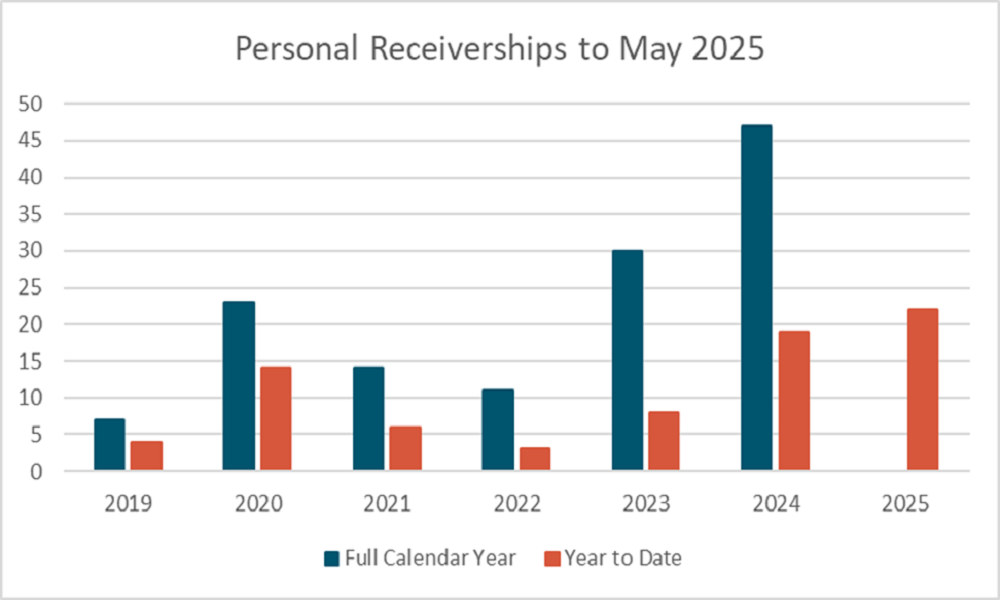

Personal Receiverships

May saw the number of personal receivership appointments continue to steadily rise ahead of the 2024 figures. As more companies continue to default on their lending personal security agreements are being called up, we believe this will continue to track upwards for the remainder of the year. There continue to be a number of tier 2 – tier 4 lenders who made some questionable lending over the least few years and are now having to take enforcement steps to try recover any value on their securities.

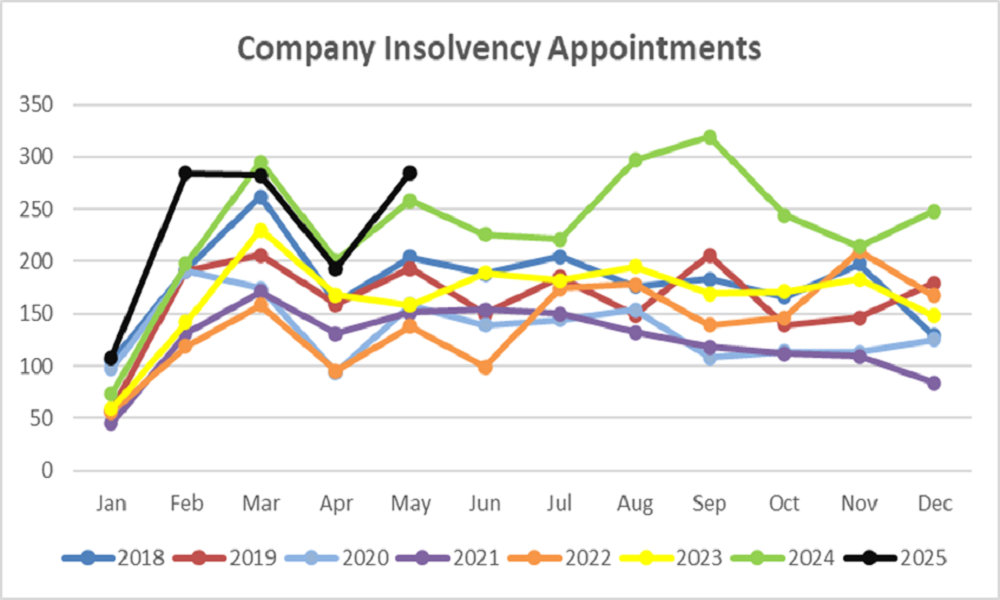

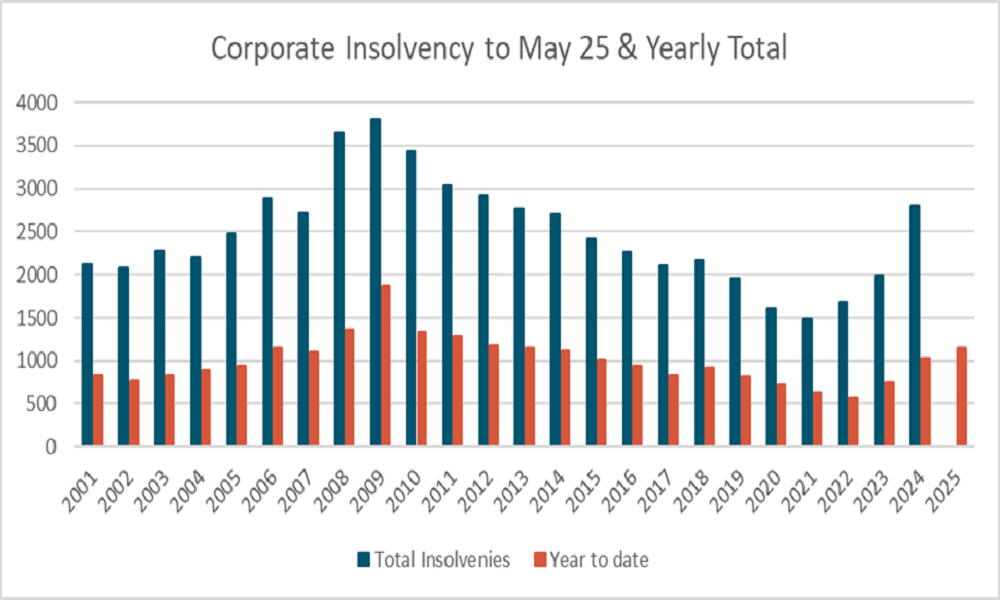

Company Insolvencies – Liquidations, Receiverships, and Voluntary Administrations

May 2025 was well above prior May’s and above the low appointments seen in April. This was a combination of the catchup in court liquidations with 112 for the month compared to April’s 28 court liquidations. The bulk of the balance of the appointments were the result of shareholder appointments. While the trend line is following previous years it looks likely to overshoot the monthly figures to date.

Year to date insolvency figures are just behind the 2011 levels and look similar to those seen from 2012 – 2013, on this basis we estimate total appointments for the year will be higher than 2024, with the possibility to exceed 3,000 appointments for the year.

The drop seen in court appointed liquidations in April has reverted to the norm and played a little catchup. However there has been a drop in other corporate appointment options and solvent liquidations. Solvent liquidations dropping off in a recession is not surprising with a tighter economy, cashing out can become more difficult. The drop in receiverships and voluntary administrations is likely just a monthly anomaly that will even out across the year.

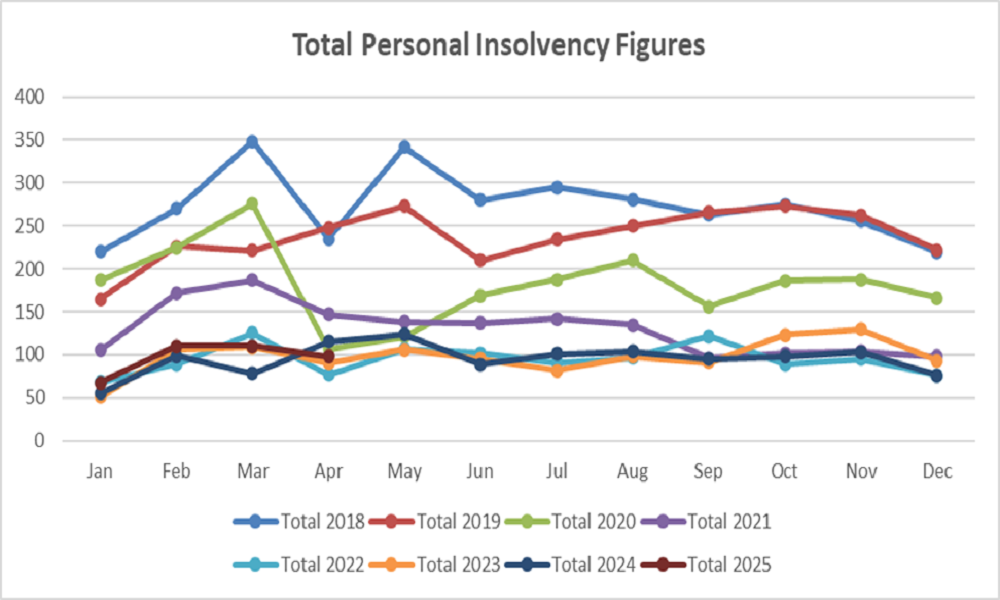

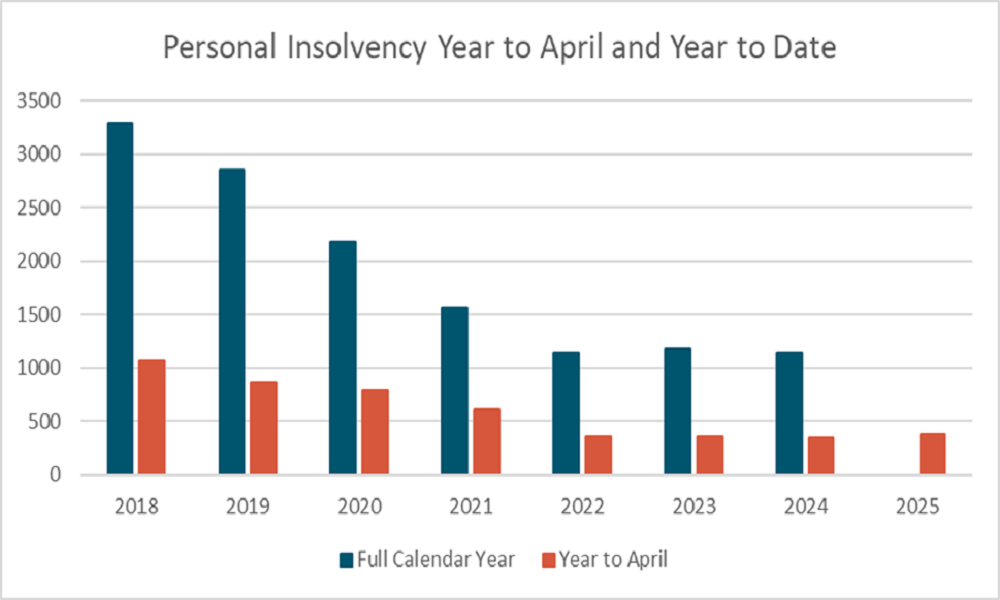

Personal Insolvencies – Bankruptcy, No Asset Procedure and Debt Repayment Orders.

Personal insolvency appointment figures have not yet moved. Minimal change to Bankruptcy, No Asset Procedure and Debt Repayment Order figures. This may pick up towards the 2nd half of the year as corporate appointments continue to lift and flow through.

Where to from here?

All insolvency types have seen a jump up in May. We expect these figures to track up into the 2nd half of the year as they historically have.

If you want to have a chat about any points raised or an issue you may have you can call on 0800 30 30 34 or email This email address is being protected from spambots. You need JavaScript enabled to view it..

Why Early Engagement with a Licensed Insolvency Practitioner Could Save Your Business

In today’s volatile economic climate, companies across industries are navigating increasing financial pressure. Rising interest rates, supply chain disruptions, and margin erosion are converging to place directors and business advisors under heightened scrutiny. Now, more than ever, proactive advice from a licensed insolvency practitioner (LIP) can be the difference between a successful turnaround and a forced wind-up.

Whether you’re a director, accountant, or legal advisor, understanding when and why to involve an insolvency professional is vital to protecting your client's (or your own) business, assets, and reputation.

The Power of Proactive Advice

Licensed insolvency practitioners are not just “last resort liquidators.” They are restructuring and risk management specialists trained to assess a business’s position, preserve value, and advise on compliant strategies to avoid insolvency.

Key areas of early-stage support include:

- Restructuring & Turnaround Planning: Helping businesses assess viability and adjust structure, debt arrangements, or trading practices before creditors intervene.

- Security & Risk Review: Advice on protecting personal and company assets, including the appropriate use of the Personal Property Securities Register (PPSR) and other safeguards.

- Creditor Negotiations & Debt Collection: Guidance on engaging with secured and unsecured creditors, and recovering outstanding debts without escalating disputes.

- Governance & Director Conduct: Clarity on director duties during financial distress, helping reduce the risk of claims for reckless trading, voidable transactions, or breach of duties.

Recognising the Warning Signs

Accountants and legal advisors are often the first to spot financial red flags in a client’s business. These may include:

- Poor cash flow or consistently overdue creditors

- Inability to meet tax obligations (GST, PAYE, income tax)

- Increasing reliance on informal overdrafts or shareholder loans

- Loss of key customers or declining margins

- Poor internal reporting or forecasting

These indicators do not always mean the business is doomed—but they do call for professional triage.

Directors: What You Do Next Matters

One of the most common (and costly) mistakes directors make is waiting too long to seek help. In many cases, companies that could have been saved fall into formal insolvency because directors fail to act or take missteps trying to trade through.

Avoid these common missteps:

- Continuing to trade while insolvent

- Repaying related parties ahead of other creditors

- Selling assets below market value without proper advice

- Ignoring statutory demands or IRD notices

- Failing to record key decisions or seek professional guidance

A timely consultation with a LIP helps ensure that decisions are defensible and compliant, protecting directors from personal liability.

When Should You Call a Licensed Insolvency Practitioner?

If you're advising a business showing signs of distress, or you're a director facing growing uncertainty, don’t wait for a formal insolvency trigger. A confidential, no-obligation conversation with a LIP can offer clarity and practical options—often before formal appointments are needed.

Even when a formal insolvency process becomes necessary, early involvement enables a more orderly, cost-effective resolution—whether that’s a voluntary administration, compromise with creditors, or liquidation.

Final Thought

Engaging a licensed insolvency practitioner isn’t a sign of failure. It’s a sign of leadership, responsibility, and good governance. Whether your client needs help with restructuring, securing their position, or understanding their duties, LIPs are trusted partners in preserving value and minimising risk.

We invite accountants, legal advisors, and directors to contact us for a confidential discussion. The right advice, at the right time, could protect your business or client—and even turn things around.

Licensed. Independent. Here to help.

The Hidden Risks in Director Loans and Related-Party Transactions

A guide for directors on what really happens in insolvency—and how to protect yourself.

In closely held or family-run businesses, it’s common for directors and shareholders to move money in and out of the company whether as loans, drawings, or transactions with related entities. These practices often feel routine, but in an insolvency scenario, they can become the focus of intense scrutiny and even personal liability.

Understanding how these transactions are treated when a business fails is essential for any company director. Here’s what you need to know.

- Director Loans: Not as Simple as They Seem

Directors often treat loan accounts as flexible cash flow tools drawing funds when needed, or injecting capital during tough periods. But unless documented properly and kept within clear legal boundaries, director loans can become a problem.

In insolvency, the liquidator or administrator will review any money taken out by directors. If there is an overdrawn shareholder current account (i.e., the director owes money back to the company), the liquidator is obligated to pursue repayment even from a director who has personally guaranteed company debts.

Key risk: Overdrawn loan accounts become recoverable debts. Directors can be personally pursued, even if they injected funds at other times.

- Related-Party Transactions: High Risk, High Scrutiny

Transactions with related parties such as family members, trusts, or other businesses owned by the same people face heightened scrutiny in insolvency proceedings. These include:

- Loans to or from related entities

- Asset transfers to trusts or family members

- Repayment of debts to directors or related parties ahead of others

- Intercompany charges or management fees

Liquidators examine whether these transactions were:

- At market value

- Genuinely necessary

- Preferential or insolvent at the time they occurred

Key risk: Related-party transactions can be set aside or clawed back if they were made when the company was insolvent or if they unfairly preferred insiders.

- Drawings vs. Salary: Understand the Difference

Many small business owners draw money from the company without a formal salary. However, in liquidation, informal drawings that aren’t backed by payroll records or tax deductions may be reclassified as loans, not wages.

This matters because:

- Salaries are subject to PAYE, which takes priority in insolvency

- Loans must be repaid in full

- Directors may lose any priority claims they thought they had

Key risk: Drawings treated as loans mean the director becomes a debtor to the company, not a creditor.

- How Liquidators Investigate

Licensed insolvency practitioners are required to act in the interests of all creditors. That means:

- Examining bank statements, accounting records, and emails

- Identifying transactions with “associated persons” under the Companies Act

- Assessing whether funds or assets can be recovered for the benefit of creditors

Even well-meaning actions like repaying a director loan to help keep the business going can be reversed if they were made in breach of insolvency law.

- How to Protect Yourself

To reduce risk and exposure as a director:

✅ Document all loans and repayments with clear terms, interest rates, and repayment schedules

✅ Avoid informal drawings use a proper payroll system or clearly document shareholder loans

✅ Don’t repay insiders ahead of trade creditors when cash is tight

✅ Get legal and financial advice before transferring assets or intercompany funds

✅ Engage with a licensed insolvency practitioner early if financial pressure is mounting

Final Thought: Intent Doesn’t Override the Law

Many directors fall into trouble not through fraud, but through informality. Good intentions, poor documentation, and a desire to “keep the business afloat” can all come back to bite in an insolvency.

If your company is facing financial strain, or your books involve related-party transactions or director loans, now is the time to seek professional advice.

Talk to Us Before Trouble Starts

We work with directors to help them understand the legal and financial implications of their actions before or during insolvency. A confidential, no-obligation conversation with one of our licensed insolvency practitioners could be the best decision you make to protect your position.