Insolvency by the Numbers #60: NZ Insolvency Statistics November 2025

What has happened with the insolvency stats during November 2025 when compared with the last few years for personal and corporate insolvency ahead of the Christmas break.

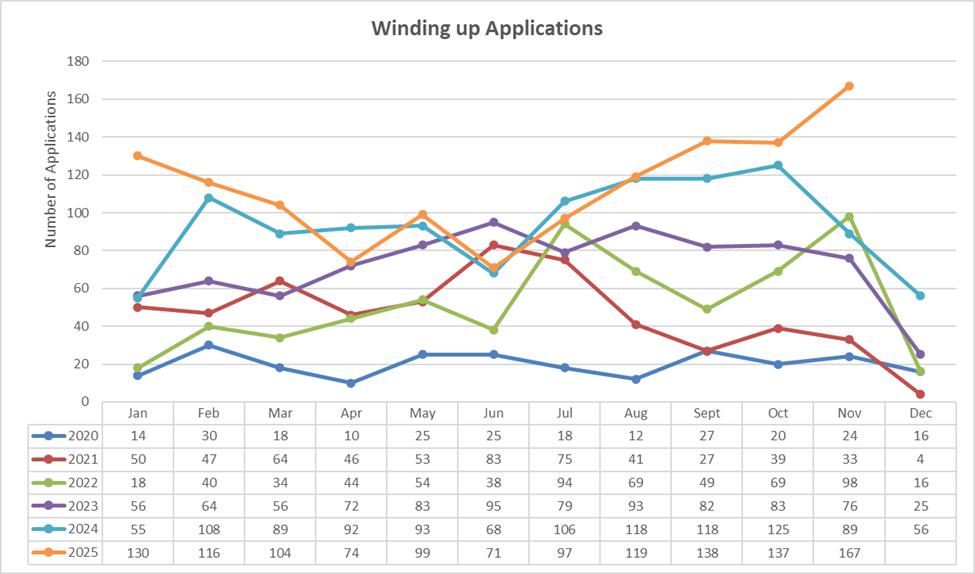

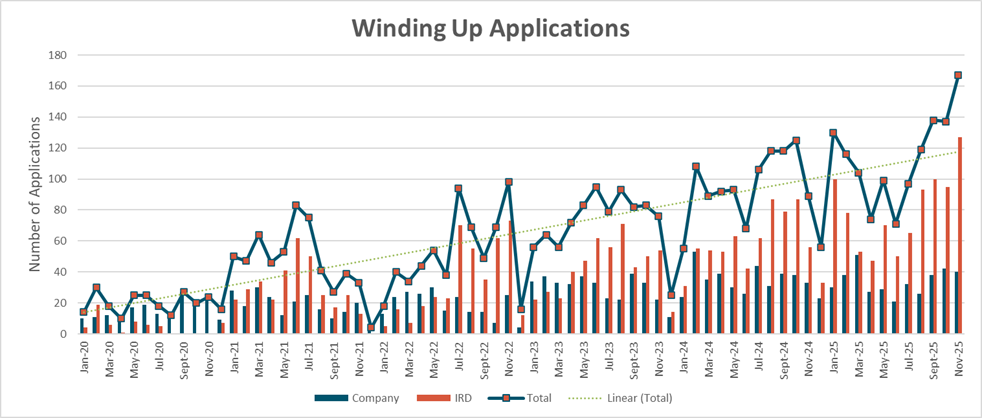

Winding Up Applications

Winding up applications for November 2025 took off like a shot on the back of IRD chasing a group of 45 sushi companies with common stakeholders. Even with the 45 group winding up applications removed the monthly total would remain well above previous November highs and only slightly down on the highs seen so far throughout 2025.

The monthly total was 167 applications the highest in the last 6 years , these applications are now starting to be advertised with February court dates reinforcing the courts will be pumping into the end of the year and will start off with a busy 2026 once they reopen for liquidation appointments.

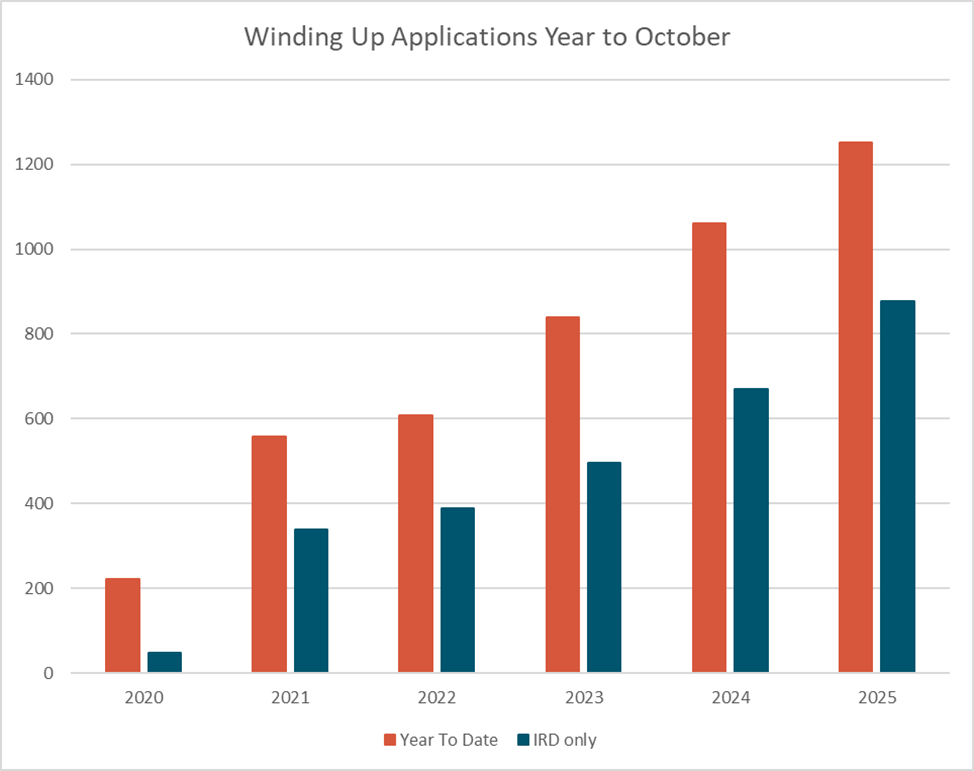

2025 continues to easily surpass 2024 in total numbers and has now exceeded 1,200 applications with December figures yet to come in.

The ongoing strong levels of winding up applications reinforces that the market remains under pressure regardless of talk of green shoots that has yet to flow through to all sectors, creditors continue to default on payments and are facing serious collection issues. IRD remains a constant for business owners chasing debts hard and taking a tougher line on payment proposals for businesses that get behind.

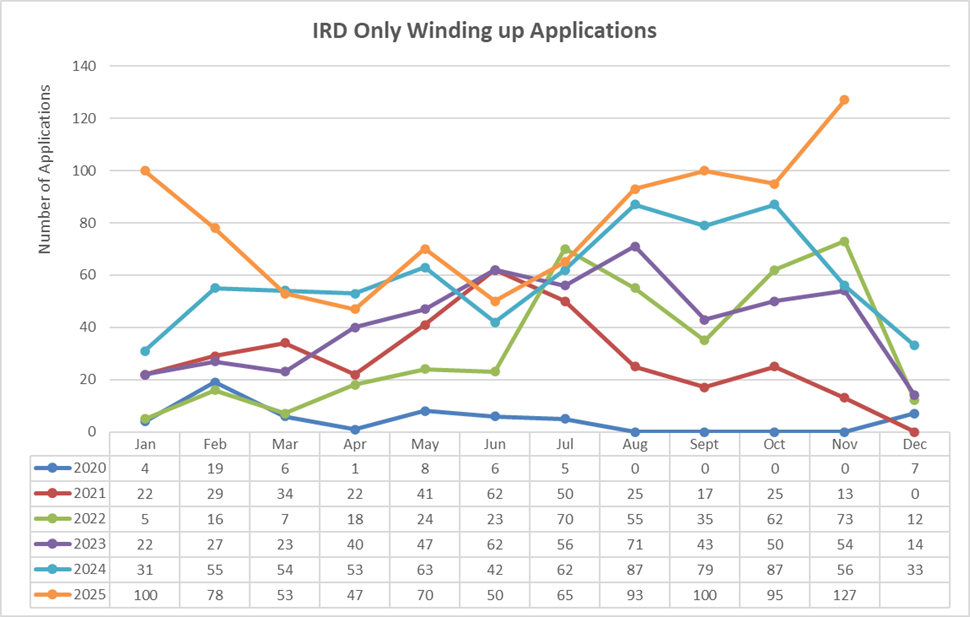

IRD made up 127 of the 167 monthly applications, all other creditor applications have floated around 40 per month since September 2025. This is well above IRD’s previous highs of 100 applications.

The IRD has continued their 32-month streak of having more applications than all other creditors combined. At this stage with 9 billion + in outstanding taxes to collect this is unlikely to change in the foreseeable future. How the election next year will affect their willingness to chase debtors is yet to be seen.

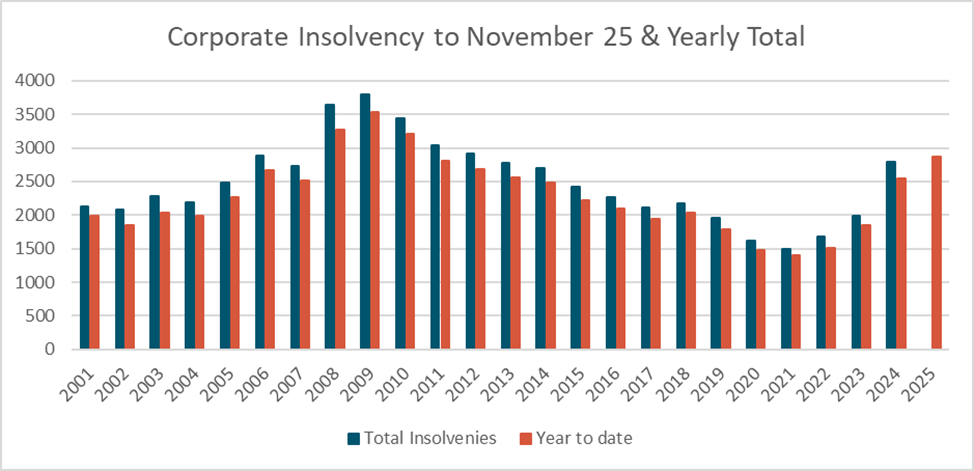

Company Insolvencies – Liquidations, Receiverships, and Voluntary Administrations

November 2025 was down on the October 2025 highs but like the winding up applications the month remains well ahead of past Novembers.

Year to date the appointment figures remain up, easily above 2024 and are now in line with the post GFC 2011 levels, at this stage it is unlikely they will reach 2010 levels and are still 700 appointments down on the same period in during the GFC in 2009. On this basis we estimate total appointments for the year have a strong likelihood of exceeding 3,000 appointments.

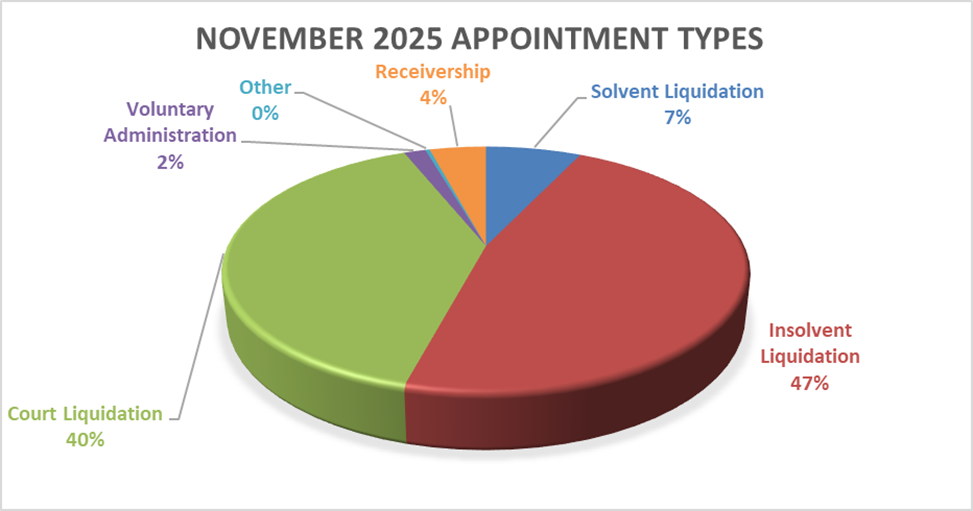

With the high levels of winding up application this month and last month the number of court appointed liquidations remains almost 3x the long-term average. Solvent liquidations continue to remain down on their average.

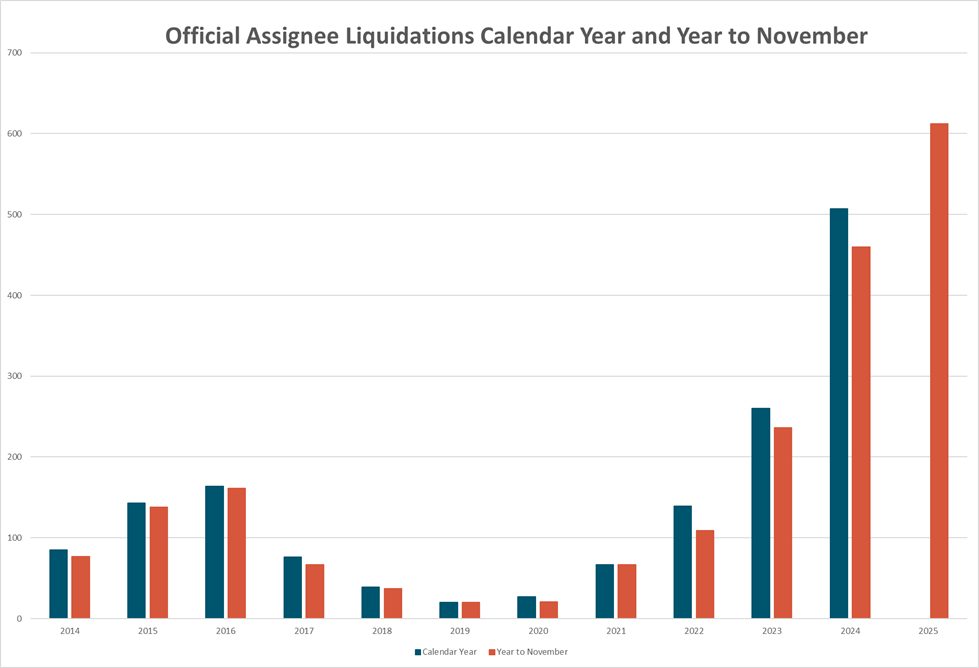

Like last month we have continued with the graph of liquidations taken by the Official Assignee since 2014. It shows the huge uplift in liquidation work they are experiencing over the last few years largely driven by IRD winding up applications. In November 2025 the Official Assignee took 104 of the 124 court appointed liquidations. This makes two months in a row where the Official Assignee has taken over 100 appointments, they could reasonably be one government department that could justify taking on more staff to deal with the workload they are facing.

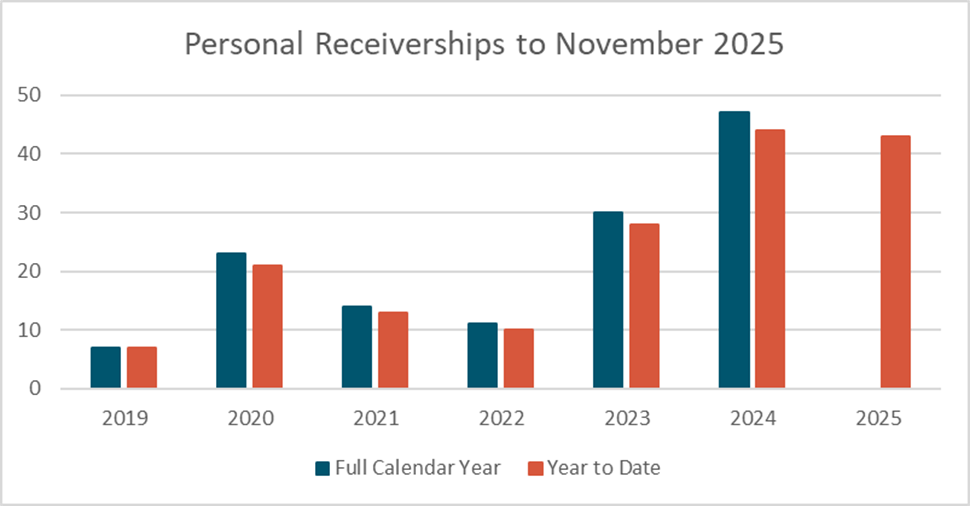

Personal Receiverships

Personal receiverships took a bit of a break in October with minimal appointments before picking back up in November, regardless they have not come back to the momentum seen at the start of the year and look likely to finish slightly down on 2024 or there abouts. A reversal from my earlier prediction of a new high for the year.

Personal Insolvencies – Bankruptcy, No Asset Procedure and Debt Repayment Orders.

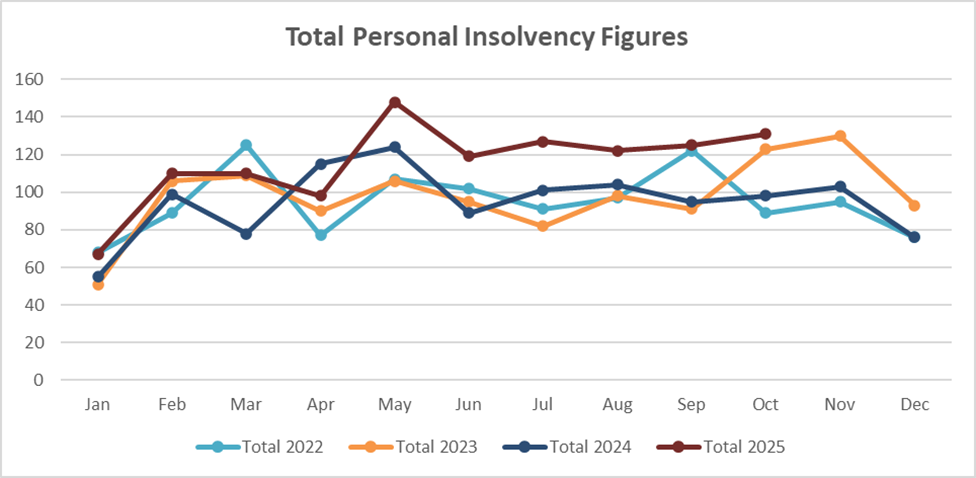

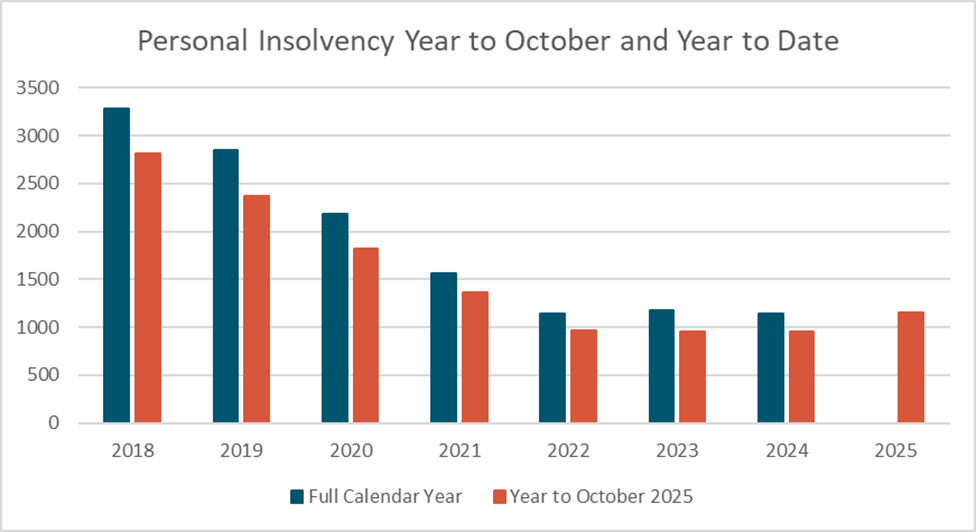

Personal insolvency figures have remained stable at slightly elevated levels and seen no further growth since the jump we noted in May. At this point we continue to expect more of the same for the rest of the year with a further uplift predicted in 2026 if the IRD pursuit of corporate tax debt flows through to personal tax debt.

Year on year the 2025 figures are now above the last 3 years, while on the increase they remain behind the 2021 figures. This period remains one of the lowest bases for personal insolvency figures.

Where to from here?

All insolvency types have continued at the increased levels seen across 2025. We continue to expect these figures to track up through to the end of the year and into 2026. Whether 2026 increases on 2025 is still to be determined, 2026 is an election year where we have in the past anecdotally noted a pullback in IRD pressure.

If you want to have a chat about any points raised or an issue you may have you can call on 0800 30 30 34 or email This email address is being protected from spambots. You need JavaScript enabled to view it..

Liquidation of Charities or Not for Profit’s

Liquidation of Charities or Not for Profit’s

Many Charities and NFP organisations are facing reduced income as a result of the current economic conditions and government changes to grants making fund raising more difficult. We thought it was timely to look at the steps to take when a charity is no longer able to meet its intended purpose and mission statement.

There are several critical steps and legal obligations a Charity must consider to wind up responsibly and protect its charitable status:

Legal and Governance Considerations

- Review the charity’s rules or trust deed: Most registered charities have a wind-up clause that outlines how assets should be distributed and what procedures must be followed.

- Comply with the Charities Act 2005: Officers must ensure the charity continues to meet its obligations under the Act, even during insolvency.

- Notify Charities Services: The charity must inform Charities Services of its intention to wind up so it can be deregistered from the Charities Register.

- Inform the Companies Office: If the charity is incorporated (e.g. as a Charitable Trust or Incorporated Society), it must also notify the Companies Office and follow the correct dissolution process.

Financial Responsibilities

- Settle all creditor claims and collect outstanding debtors: Before distributing any assets, the charity must pay off creditors and recover any money owed to it.

- Avoid premature asset distribution: Distributing assets before settling debts can lead to legal complications, including clawback actions and open the board to risk.

- Tax implications: Deregistration may trigger tax liabilities, including a one-off tax on accumulated assets unless they’re transferred to another registered charity within a specific timeframe.

Liquidation Process

- Voluntary liquidation: A charitable trust board can initiate liquidation via resolution, often requiring two general meetings to confirm the decision.

- Court-ordered liquidation: Creditors or other parties (including the Attorney-General) may apply to the High Court if it’s deemed “just and equitable” to liquidate the charity.

- Licensed liquidator: A Licensed Insolvency Practitioner must be appointed to oversee the process.

Liquidation in New Zealand varies depending on whether the charity is structured as a charitable trust, incorporated society, or company. Each has its own legal framework and procedural nuances. Here's a breakdown:

Charitable Trusts

- Legal basis: Governed by the Charitable Trusts Act 1957 and Companies Act 1993 (Parts 16 & 17).

- Voluntary liquidation: Requires two general meetings to pass and confirm a resolution to liquidate.

- High Court liquidation: Can be initiated by trustees, creditors, the Registrar, or the Attorney-General if deemed “just and equitable”.

- Asset distribution: Surplus assets must go to another registered charity with similar purposes unless detailed otherwise in the deed.

- Officer liability: Trustees may be personally liable if proper records weren’t kept or duties were breached.

Incorporated Societies

- Legal basis: Governed by the Incorporated Societies Act 2022 and Companies Act 1993. Many Incorporated Societies are in the process of becoming compliant with the 2022 Act by 5 April 2026, so it is timely to have a clear view on what the organisation wants to occur on winding up.

- Voluntary liquidation: Members vote at a general meeting, then confirm at a second meeting. A licensed insolvency practitioner is appointed.

- Registrar dissolution: Registrar may strike off the society if it’s inactive or fails to file annual returns.

- High Court liquidation: Can be initiated by members, creditors, or the Registrar.

- Asset distribution: Must follow the society’s constitution.

Companies (with charitable status)

- Legal basis: Governed by the Companies Act 1993.

- Voluntary liquidation: Initiated by shareholders or directors.

- High Court liquidation: Can be triggered by creditors, shareholders, or the Registrar.

Each structure has its own quirks, especially when it comes to governance and asset handling. If you’re working with a specific type of Charity or Not For Profit we can assist with more specific advice.

For a more detailed breakdown of how it works see below:

- Determine the appropriate method for liquidation:

By members' resolution (for societies):

A society incorporated as a charitable trust board can be put into liquidation by a resolution of its members. This requires two general meetings to confirm the decision.

By application to the High Court:

Both societies and charitable trust boards can be liquidated by applying to the High Court. This can be done by the society itself, a member, a creditor, or the Registrar of Incorporated Societies.

By the Registrar of Incorporated Societies:

If a society fails to meet its obligations (e.g., annual financial statements), the Registrar can issue a notice striking it off the register.

- If liquidating by members' resolution (for societies):

First general meeting: Members must resolve to appoint a liquidator, following the society's rules.

Second general meeting: The resolution must be confirmed at a second meeting, held at least 30 days after the first.

Appointment of a liquidator: A licensed insolvency practitioner must be appointed as the liquidator.

- Once liquidation is commenced:

Notify Charities Register:

If the charity is incorporated, notify the Companies Office and Charities Register to begin formal dissolution.

The Inland Revenue should also be contacted to file a claim in the liquidation.

Notify creditors and realise assets:

Realise all assets and pay all creditors’ claims based on their priority.

Distribute assets:

Any surplus assets after payment of creditor claims must be distributed to other charitable organizations within New Zealand that have similar aims, in accordance with the charity's rules or trust deed unless advised otherwise in the rules or deed. This ensures compliance with the charity’s wind-up clause.

File Liquidation Documents

The liquidator must file a Notice of Appointment and subsequent reports with the applicable register similar to a company liquidation.

Once the liquidation is complete, the Liquidator will follow a prescribed process resulting in the charity being removed from the register and ceasing to exist as a legal entity.

- Potential implications of deregistration without liquidation:

Liability for income tax:

Deregistered charities may become liable for income tax unless they qualify for another tax exemption.

Potential tax on accumulated assets:

Depending on the circumstances, there might be a requirement to pay a one-off tax on the charity's accumulated assets at the time of deregistration.

- Considerations:

Winding-up clauses:

Ensure your charity's rules or trust deed include a winding-up clause that directs assets to charitable purposes.

Liquidation appointment process:

Follow the correct appointment process and timeframes so that the subsequent liquidation cannot be invalidated.

Consult with professionals:

It's advisable to seek legal and accounting advice from professionals experienced in charity law and insolvency to navigate the process effectively.