The Risks of Surrendering Business Assets to the Landlord Before Liquidation.

The Risks of Surrendering Business Assets to the Landlord Before Liquidation.

It’s becoming increasingly common for business owners when they get themselves into financial trouble to close the doors and walk away.

From the landlord’s perspective this can be ideal as they get left with a site that may be easier to lease due to existing fixtures and fittings for a similar type of business. They may have had to sacrifice some unpaid rent and a personal guarantee to gain control of the assets. From the director’s perspective they often see this as a solution where they can remove an ongoing obligation for the rest of the lease term and get out of a personal guarantee.

The issues arises when there are other creditors apart from the landlords unsecured creditors claim. For preferential creditors they would normally have an interest in any inventory or work in the progress of the company that is left behind. For secured creditors holding a general security when the assets of the business are “sold” to the landlord their remedy’s become limited. For unsecured creditors they will be left with little remedy against a company with no assets.

What we will often see next is that the company will be placed into liquidation by shareholder resolution or through the courts. When a company is insolvent, any transaction that allows one creditor to receive more than they would in a liquidation is potentially voidable. That includes surrendering assets to a landlord. If the company was unable to pay its debts at the time, and the landlord receives chattels, stock, or equipment that would otherwise have been available to all creditors, the liquidator will look to pursue the value or claw back the assets as an insolvent transaction or a transaction at undervalue.

One of the purposes of liquidation is to ensure that creditors receive their correct entitlement to the assets of the company based on their class of creditor. The assets are to be shared evenly as a percentage between the creditors in that class based on the quantum of their claim against the total creditor pool.

If there are three creditors with claims of $50, $150 and $300, the total creditor pool is $500. The assets of the company are valued at $250. Creditors should be receiving 50% of their claim back assuming that are all from the same class of creditors.

Claim % of total claims $250 available funds % claim

Creditor 1 $50 10% $25 50%

Creditor 2 $150 30% $75 50%

Creditor 3 $300 60% $150 50%

In situation where the landlord retains the assets of the company, they have effectively received an advantage over other creditors and as such the transaction can be looked at if within the 6 month and two-year periods prior to liquidation. That includes informal deals, verbal agreements, and even situations where the landlord simply refuses access and retains the assets.

Directors who enter these types of transactions may find themselves in breach of their director’s duties if the liquidator determines that the transaction was not in the best interests of creditors. If assets are surrendered for no consideration, or for less than market value, the liquidator may pursue recovery.

There’s also the issue for secured creditors. Many companies have a General Security Agreement (GSA) registered over their assets. That GSA gives the secured creditor priority over the assets not the landlord. Surrendering assets to a landlord can interfere with the rights of the GSA holder and may trigger legal action. Assets that the liquidators recover under their powers are often non included under the GSA so the recoveries under these powers are available for unsecured creditors.

It’s important to understand that a landlord’s rights under the Property Law Act do not override the rights of secured creditors or the statutory powers of a liquidator to recover the assets owned by the company. Landlords when presented with these options need to be mindful that by entering into these types of transactions can run the risk of having them reviewed by the liquidators and potentially losing the assets.

Once liquidation is imminent, directors must tread carefully. The best course of action is to seek advice before making any decisions about asset surrender. A formal liquidation process ensures that assets are dealt with properly, creditors are treated equitably, and directors avoid the risk of personal liability.

Insolvency by the Numbers #59: NZ Insolvency Statistics October 2025

Insolvency by the Numbers #59: NZ Insolvency Statistics October 2025

We take a look at what happened in the insolvency figures during October 2025 when compared with the last few years for personal and corporate insolvency.

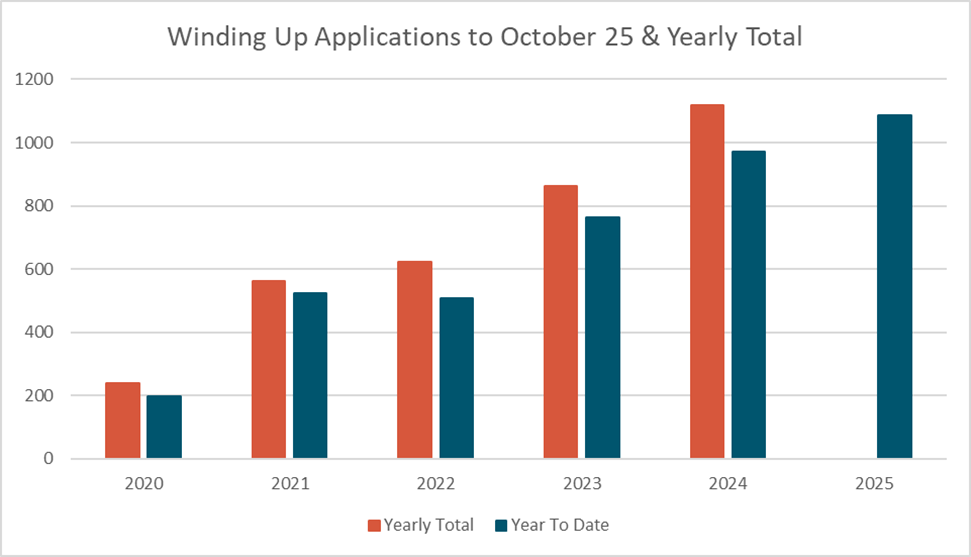

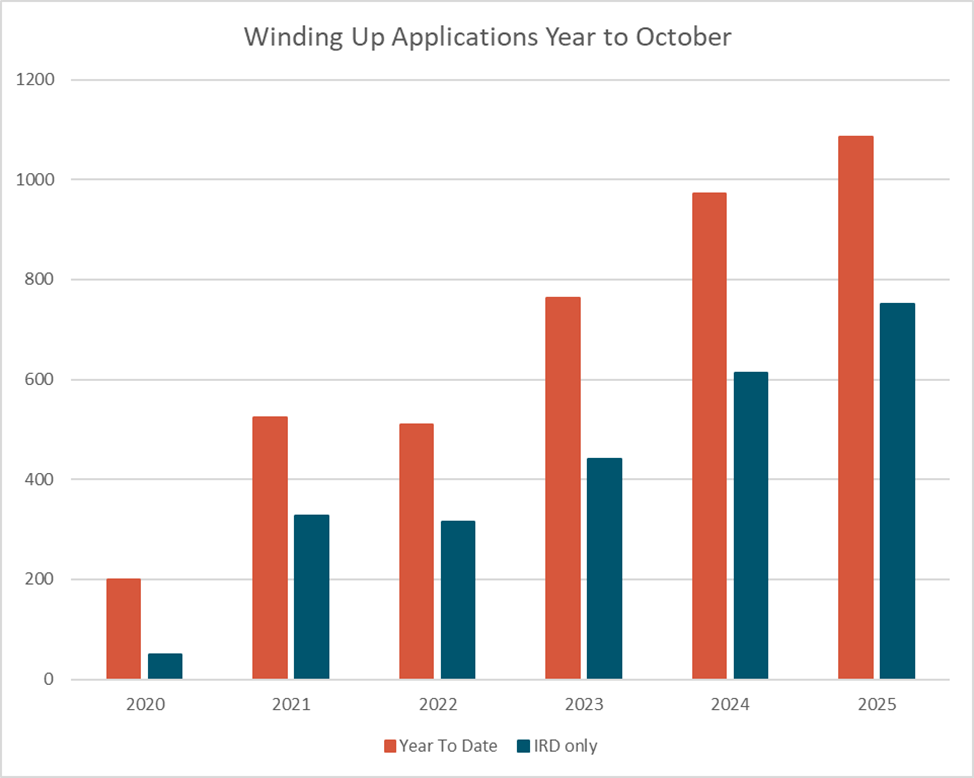

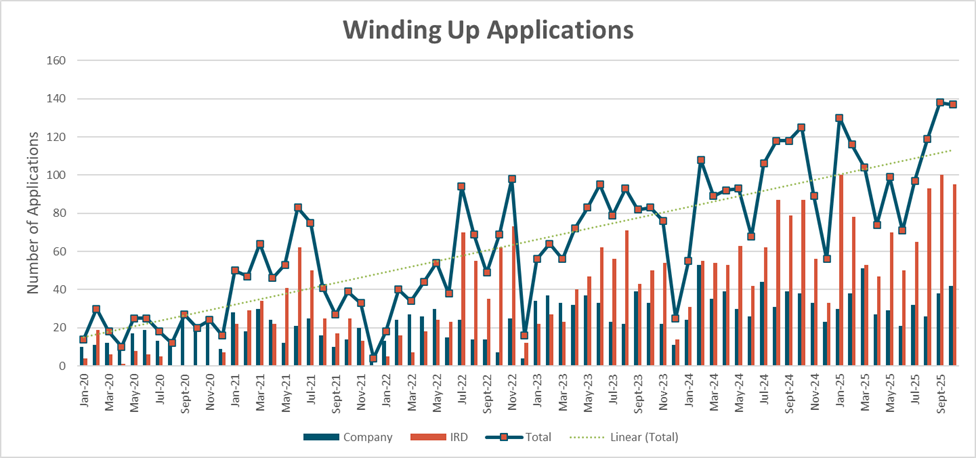

Winding Up Applications

Winding up applications for October 2025 took a slight drop of 1 application from last months highs to remain the 2nd highest they have been in the last 5 years, showing we will indeed be in for a big end to the year for creditor enforced liquidations and liquidations overall. 2025 continues to easily exceed 2024 in total numbers and looks on track to exceed 1,200 applications with 2 months left to run in the year.

The ongoing strong levels of winding up applications reinforces that the market remains under pressure despite the drop in OCR and 5% level of unemployment, creditors continue to default on payments and are facing serious collection issues.

IRD made up 95 of the 137 monthly applications, a drop of 5 from last month but still 2x+ what all other creditors are advertising for the month.

The IRD has continued their 31-month streak of having more applications than all other creditors combined. At this stage with 9 billion + in outstanding taxes to collect this is unlikely to change in the foreseeable future.

Company Insolvencies – Liquidations, Receiverships, and Voluntary Administrations

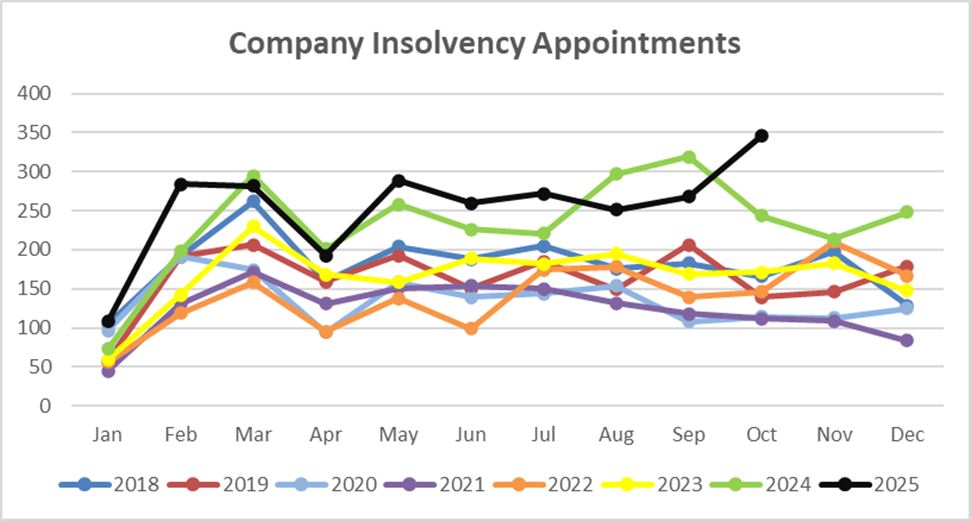

October 2025 took a jump in appointments to overtake the 2024 monthly comparison after 2 slow months in August and September.

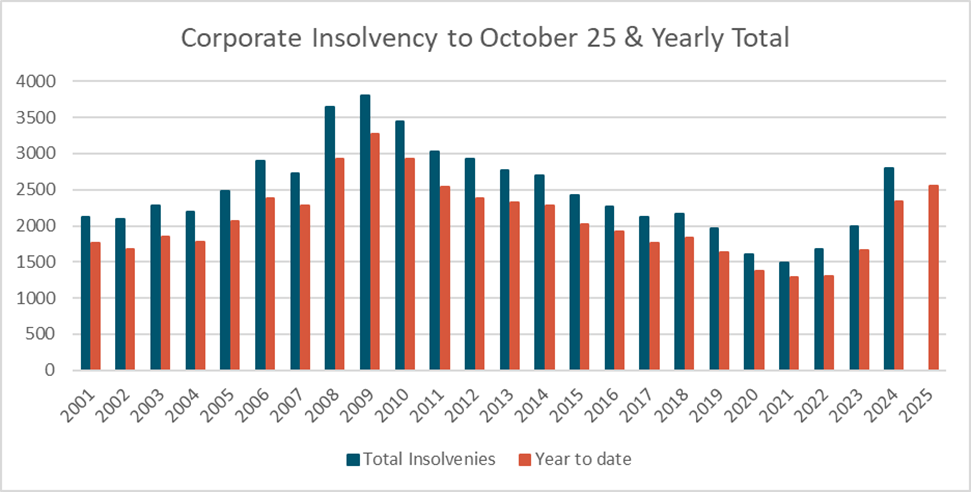

Year to date the appointment figures remain up, easily above 2024 and are now in line with post GFC 2011 levels rather than the 2012 levels we were at last month. On this basis we estimate total appointments for the year will be higher than 2024, with the likelihood of exceeding 3,000 appointments.

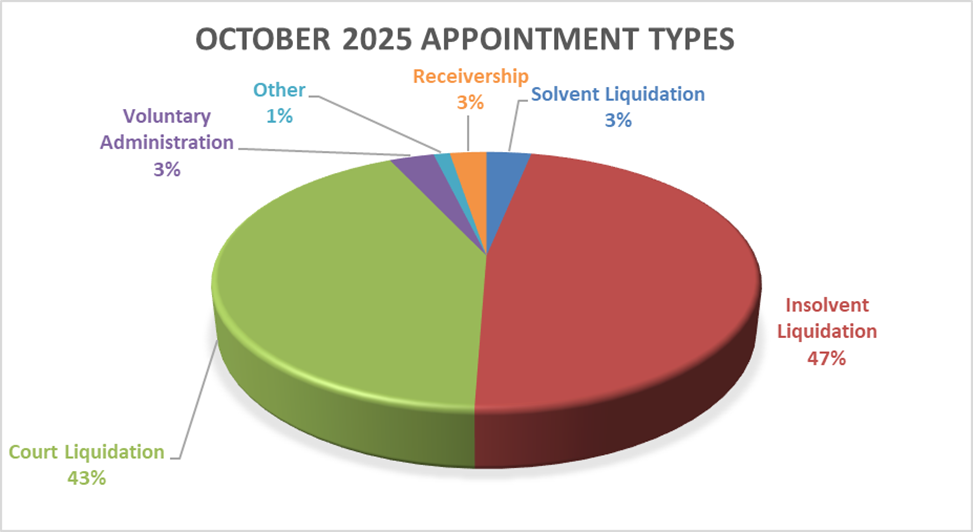

With the high levels of winding up application seen last month the number of court appointed liquidations was almost 3x the long-term average, while solvent liquidations had dropped off once again reinforcing cash flow shortages in the economy.

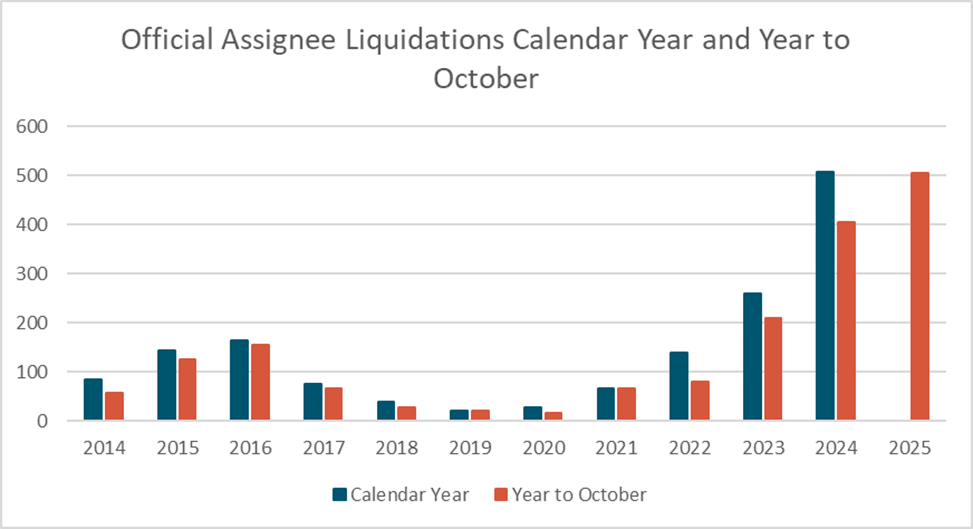

Leading on from the above comments on winding up applications I have included a graph of liquidations taken by the Official Assignee since 2014. It shows the huge uplift in liquidation work they are experiencing over the last few years largely driven by IRD winding up applications. In October 2025 the Official Assignee took 103 of the 147 court appointed liquidations. As a comparison the bulk of insolvency firms in 2024 did not take over 100 appointments in the entire year.

Personal Insolvencies – Bankruptcy, No Asset Procedure and Debt Repayment Orders.

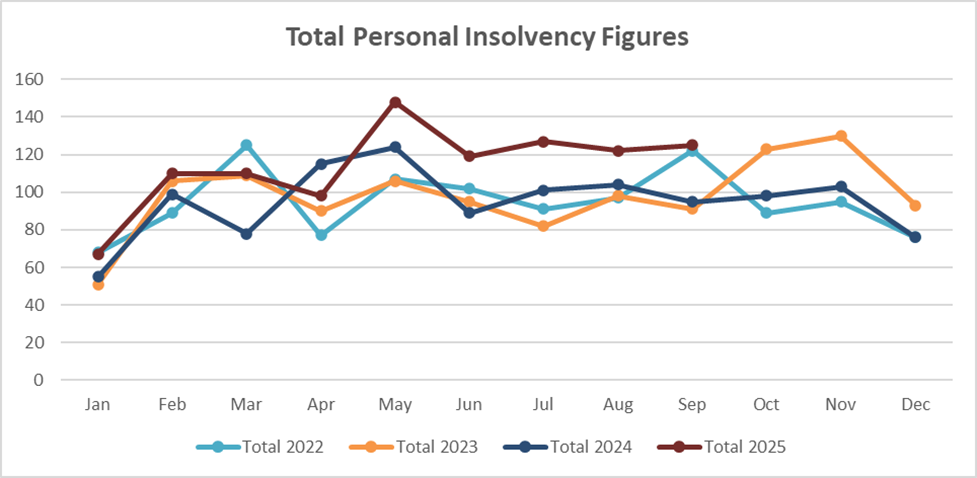

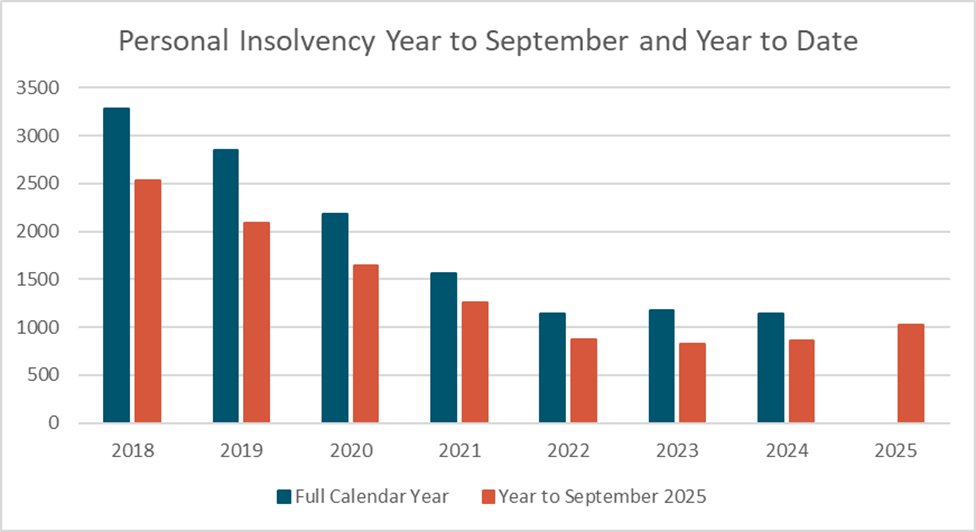

Personal insolvency figures have stabilised at slightly elevated levels and seen no further growth since the jump reported in May. At this point we continue to expect more of the same for the rest of the year with a further uplift predicted in 2026

Year on year the 2025 figures are now above the last 3 years, while on the increase they remain behind the 2021 figures. This period remains one of the lowest bases for personal insolvency figures.

Where to from here?

All insolvency types have continued at the increased levels seen across 2025. We continue to expect these figures to track up through the end of the year and into 2026.

If you want to have a chat about any points raised or an issue you may have you can call on 0800 30 30 34 or email This email address is being protected from spambots. You need JavaScript enabled to view it..