What documents should you provide a Licensed Insolvency Practitioner before our initial discussion?

To have a meaningful discussion and put a plan in place, it helps to have the important information ahead of time. This allows us to give you a steer on your options and advise on what will likely get the best outcome for stakeholders.

So, what do we look for and why?

- Creditor List

To understand the level of company debt and the class of each creditor. If there are secured creditors, we’ll want to know what assets they may be entitled to under a General Security Agreement (GSA) or Purchase Money Security Interest (PMSI), and whether any assets need to be returned to suppliers with valid claims. If we look to trade the business on it is important to know which suppliers may be key relationships that are not easily substituted and will need their buy in for any ongoing trading prospect. - Account Application Folder

Beyond identifying creditors, reviewing account applications helps us spot any personal guarantees that may survive liquidation. These will need to be dealt with by the guarantor in their personal capacity. - Asset Register

What assets does the company own? This is key to understanding what we’ll be dealing with during the appointment and whether those assets are recoverable. If there are no recoverable assets, an upfront fee may be required to proceed with the insolvency appointment. Are any of these assets surplus to requirements that may be realized to free up some quick cash for the business and get it through a lumpy period. - Bad Debts List

Have any debtors been written off? If so, why? Are they recoverable? If the company accounts on an invoice basis for GST, there may be a refund due as a result of the write-off. - Debtors List

What debts are currently outstanding? Are they supported by sufficient documentation? Are they recoverable and is this overstated I the financial statements? What is the average debtor days, can this be brought down to get in some cash to help working capital fluxuations. - Employee Arrears

What wages, holiday pay, or other entitlements are owed to staff? If we’re considering trading on, we’ll need a plan to address arrears otherwise, staff may walk off on Day 1. - Lease Agreement

If the company leases premises, we’ll need to know how long is left on the lease, whether there’s a bank bond or personal guarantee, and which onsite assets are landlord owned chattels (as detailed in the lease). Is the landlord supportive of the business being traded on if their ongoing costs are met and will they consider a new owner coming in and entering into a new lease for the site. - Financial Statements

Do the documents above align with the financial statements? If not, why? Financial statements are typically prepared by the company’s accountant, while the other documents are often sourced directly by directors/shareholders with minimal oversight. - Latest Management Accounts

While financial statements reflect the last financial year, management accounts give us a current snapshot of the company’s position. - Company Constitution / Shareholder Agreements

Do these exist, or are we just working with what’s in the Companies Act 1993? A company constitution or shareholder agreement often includes clauses that change the voting thresholds for special resolutions or outline the process required to place the company into liquidation or take other formal steps. These documents help clarify who has decision-making authority and what procedures need to be followed, especially when stakeholders aren’t aligned.

This list isn’t exhaustive. Depending on the asset types and complexity of the situation, further documents will likely be required once the engagement begins.

What documents should you provide a Licensed Insolvency Practitioner before our initial discussion?

To have a meaningful discussion and put a plan in place, it helps to have the important information ahead of time. This allows us to give you a steer on your options and advise on what will likely get the best outcome for stakeholders.

So, what do we look for and why?

- Creditor List

To understand the level of company debt and the class of each creditor. If there are secured creditors, we’ll want to know what assets they may be entitled to under a General Security Agreement (GSA) or Purchase Money Security Interest (PMSI), and whether any assets need to be returned to suppliers with valid claims. If we look to trade the business on it is important to know which suppliers may be key relationships that are not easily substituted and will need their buy in for any ongoing trading prospect. - Account Application Folder

Beyond identifying creditors, reviewing account applications helps us spot any personal guarantees that may survive liquidation. These will need to be dealt with by the guarantor in their personal capacity. - Asset Register

What assets does the company own? This is key to understanding what we’ll be dealing with during the appointment and whether those assets are recoverable. If there are no recoverable assets, an upfront fee may be required to proceed with the insolvency appointment. Are any of these assets surplus to requirements that may be realized to free up some quick cash for the business and get it through a lumpy period. - Bad Debts List

Have any debtors been written off? If so, why? Are they recoverable? If the company accounts on an invoice basis for GST, there may be a refund due as a result of the write-off. - Debtors List

What debts are currently outstanding? Are they supported by sufficient documentation? Are they recoverable and is this overstated I the financial statements? What is the average debtor days, can this be brought down to get in some cash to help working capital fluxuations. - Employee Arrears

What wages, holiday pay, or other entitlements are owed to staff? If we’re considering trading on, we’ll need a plan to address arrears otherwise, staff may walk off on Day 1. - Lease Agreement

If the company leases premises, we’ll need to know how long is left on the lease, whether there’s a bank bond or personal guarantee, and which onsite assets are landlord owned chattels (as detailed in the lease). Is the landlord supportive of the business being traded on if their ongoing costs are met and will they consider a new owner coming in and entering into a new lease for the site. - Financial Statements

Do the documents above align with the financial statements? If not, why? Financial statements are typically prepared by the company’s accountant, while the other documents are often sourced directly by directors/shareholders with minimal oversight. - Latest Management Accounts

While financial statements reflect the last financial year, management accounts give us a current snapshot of the company’s position. - Company Constitution / Shareholder Agreements

Do these exist, or are we just working with what’s in the Companies Act 1993? A company constitution or shareholder agreement often includes clauses that change the voting thresholds for special resolutions or outline the process required to place the company into liquidation or take other formal steps. These documents help clarify who has decision-making authority and what procedures need to be followed, especially when stakeholders aren’t aligned.

This list isn’t exhaustive. Depending on the asset types and complexity of the situation, further documents will likely be required once the engagement begins.

Insolvency by the Numbers #57: NZ Insolvency Statistics August 2025

We take a look at what happened in the insolvency figures during August 2025 when compared with the last few years for personal and corporate insolvency.

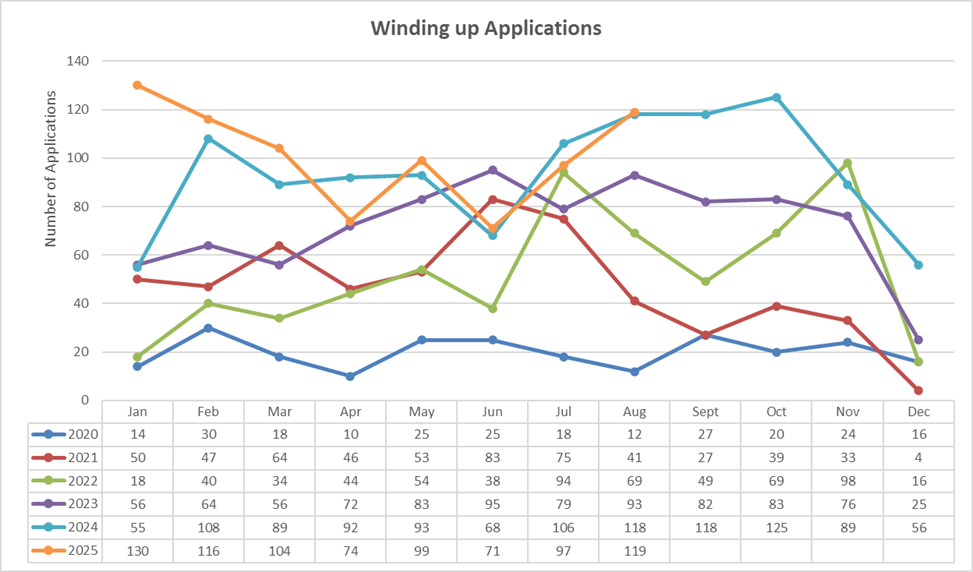

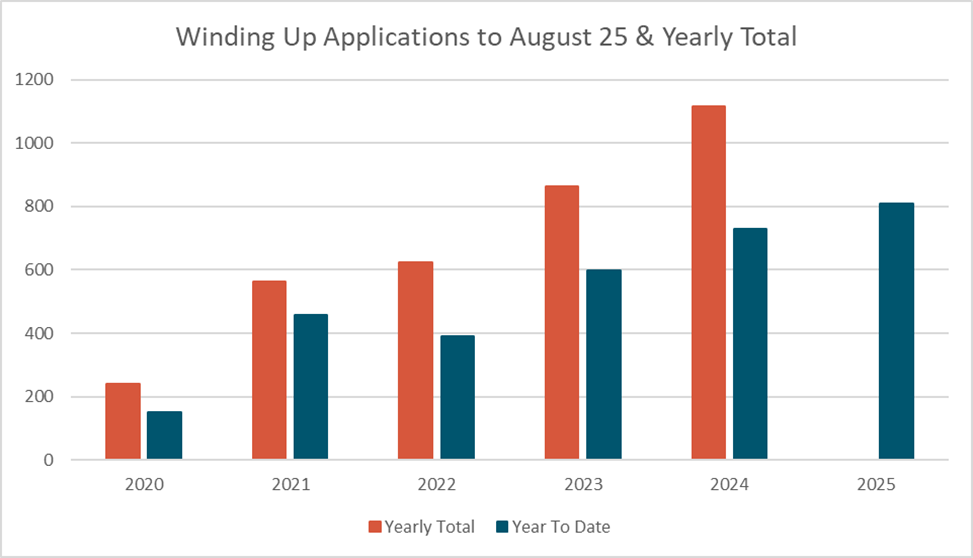

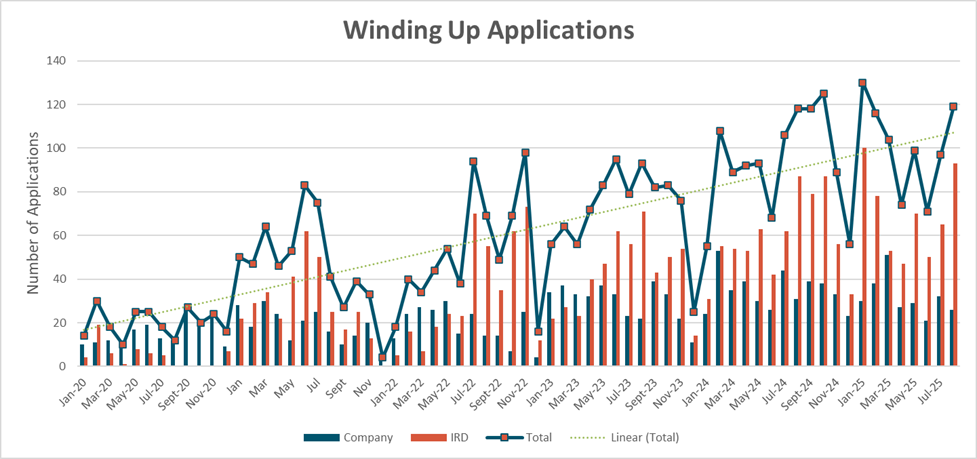

Winding Up Applications

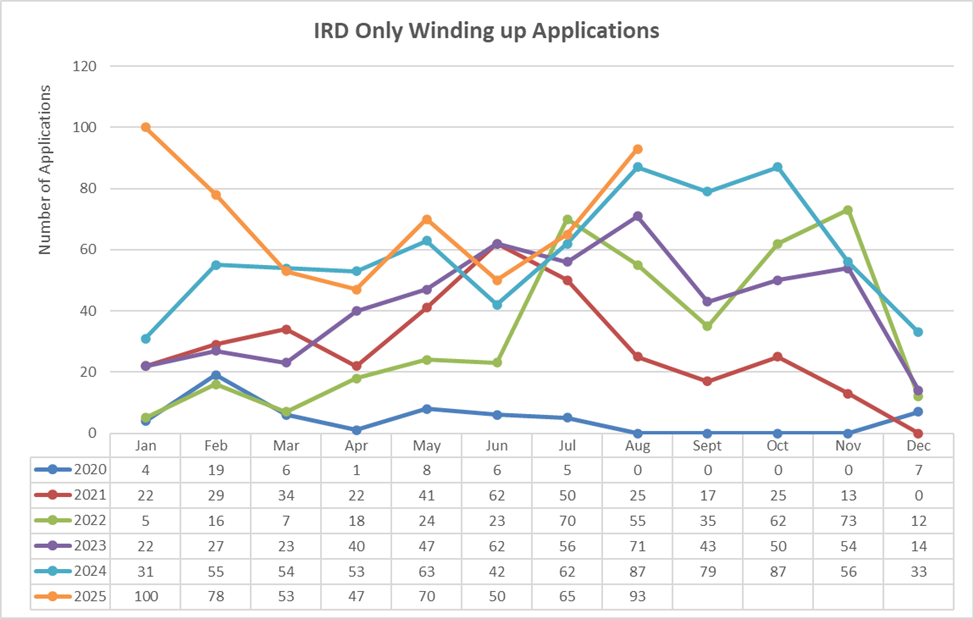

Winding up applications for August 2025 were slightly above last years August, with just one advertised winding up application more. Overall, 2025 continues to exceed 2024. Looking at this on a month by month bases we can see in the year to date that this excess was driven by the higher January, February and March we saw at the start of the year, traditionally these have been slower months.

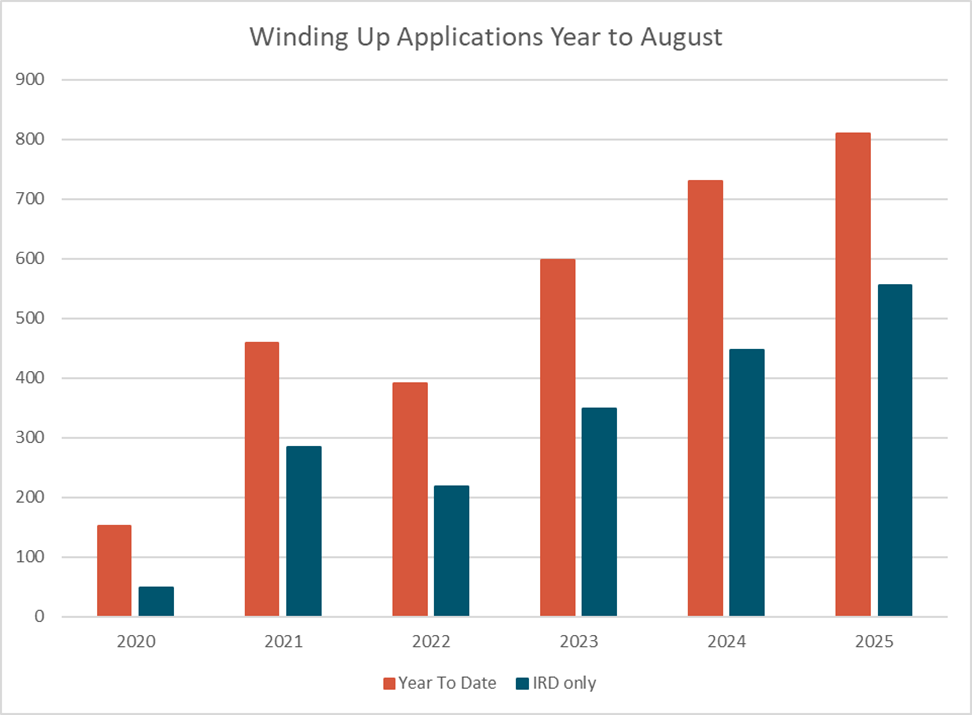

IRD smashed our 93 of the 119 applications for the month, that’s a huge 78.15%, well above the long term average of 52%. It’s not the case that non IRD applications are not happening it’s just that their levels have not risen while IRD has charged on with liquidation applications as they keep the pressure on derelict debtors. The question remains, how many of the billions of dollars that they are owed by businesses to the IRD is collectable and how much is going to end up as a claim in a liquidation. The billion-dollar question.

Taking a look as comparative Augusts back from 2020 onwards shows a sizable jump for IRD winding up applications:

2020 0

2021 25

2022 55

2023 71

2024 87

2025 93

The IRD has continued their 29-month streak of having more applications than all other creditors combined.

We are now heading into the busy time of the year for winding up applications as people push to get things rolling in the lead up to Christmas in an effort to not have the collections drag into 2026. Anecdotally the courts are already feeling the pump from the number of applications they are processing with notifications to liquidators of new appointments going out after 5pm on the day of the appointment in some instances. Prudent liquidators however know what consent to acts have been sent out and when they are due to be heard and are following up directly with the lawyer appearing to see if the appointment went ahead so they can act in a timely fashion. Locking down those bank account and attending onsite on the day of appointment can be the difference between assets being available and assets disappearing in some cases.

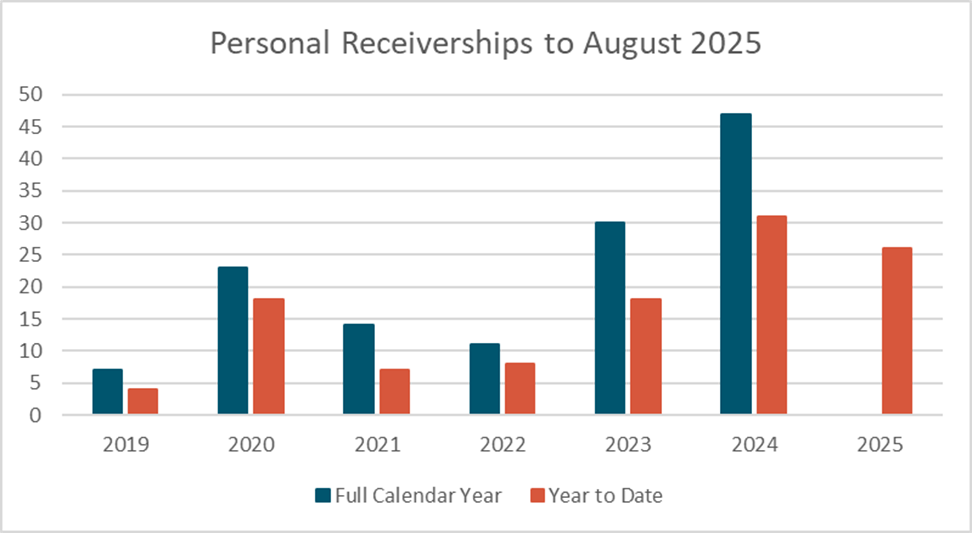

Personal Receiverships

August 2025 was a bit of a miss for personal insolvency with no new appointments for the month. Comparatively August 2024 was a busy month including all of the Duval entities. News on the Duval entites has been quiet in the last few months so it will be interesting what the latest round of reports have to say and if any real progress has been made for investors and creditors.

While currently behind 2024 Personal Receivership figures still look like they will be above or around 2024 with businesses and individuals still doing it tough and aiming to “survive 2025” in the hope 2026 will be better. There remains a lot of business lending on assets over the post covid years that is now underwater, due to defaults, penalty rates and asset values taking a bath in 2025 as buyers find themselves strapped for cash.

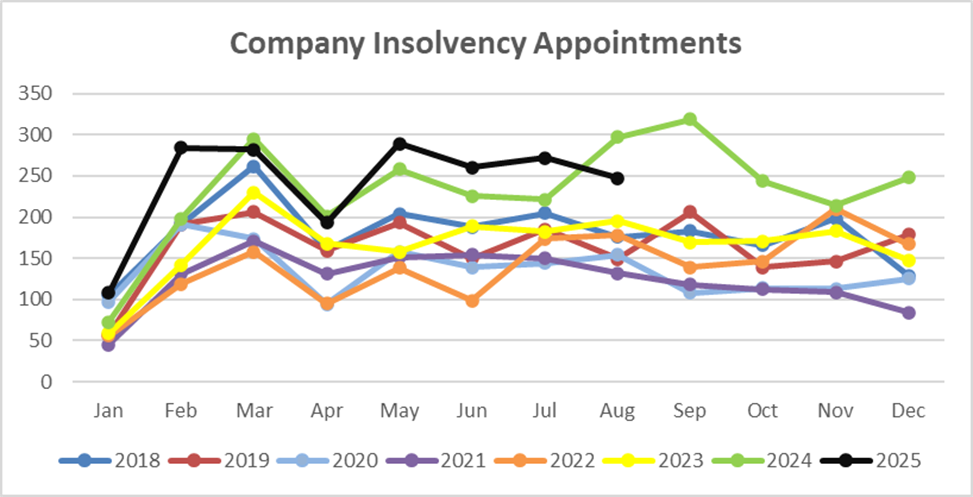

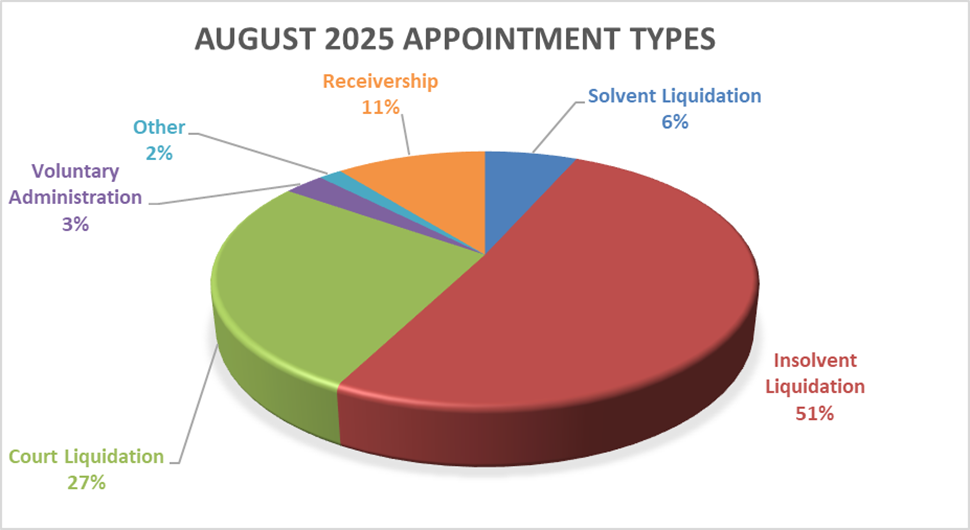

Company Insolvencies – Liquidations, Receiverships, and Voluntary Administrations

You may be looking at August and thinking whoa that’s a bit of a drop compared to 2024, regular readers will know I have been predicting things in 2025 will likely get worse before they get better so what’s going on??? Is everything ok now and it’s all going to turn around into 2026?

I’m afraid not, 2023 saw 195 insolvency appointments, in 2024 we saw a huge jump to 297 this jump was driven largely by the government placing the Du Val group into statutory management. 60+ entities that spiked the appointments last year. If we remove those appointments the numbers look like the below:

2023 195

2024 233

2025 247

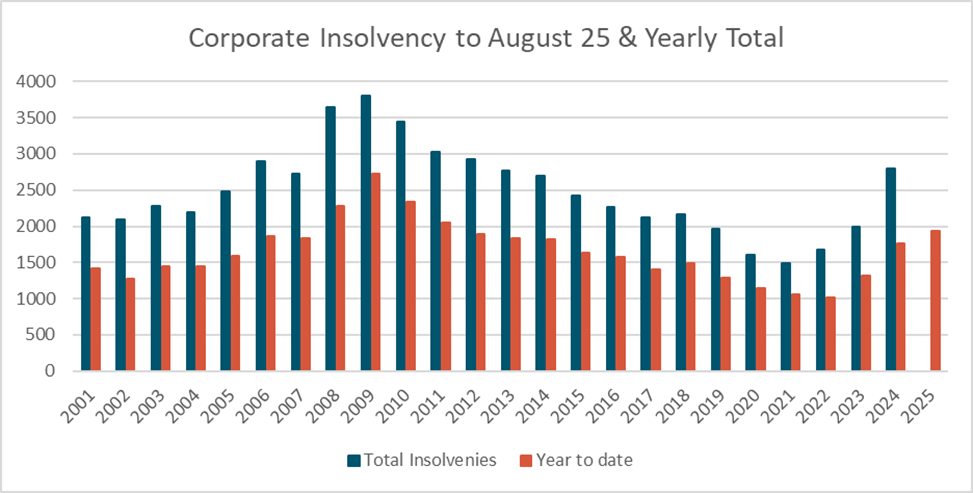

Year to date insolvency figures remain around the 2012 levels, on this basis we estimate total appointments for the year will be higher than 2024, with the possibility to exceed 3,000 appointments.

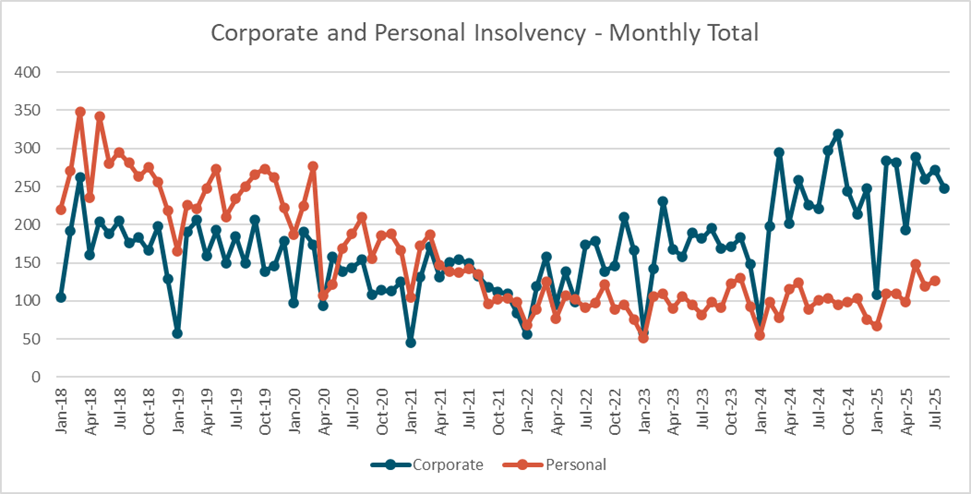

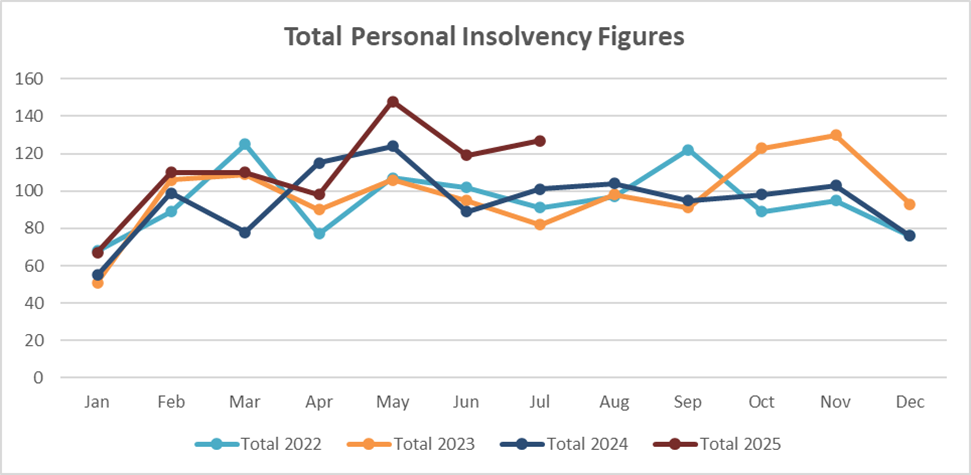

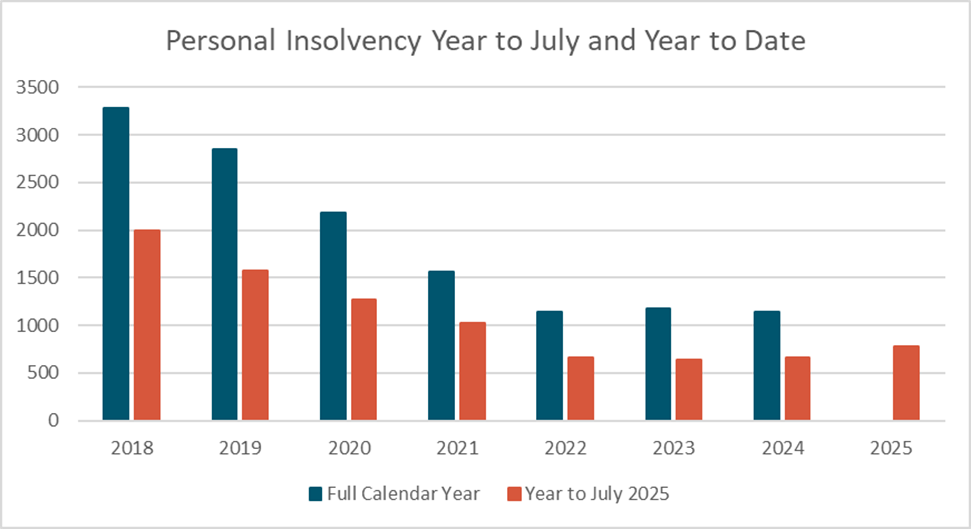

Personal Insolvencies – Bankruptcy, No Asset Procedure and Debt Repayment Orders.

That makes three months in a row where personal insolvency figures have been up on past years , while there has been a lift it certainly hasn’t taken off just yet.

Year on year the 2025 figures are now noticeably above the last 3 years, while on the increase they remain behind the 2021 figures. This period remains one of the lowest bases for personal insolvency figures.

Where to from here?

All insolvency types have continued at the increased levels seen across 2025. We continue to expect these figures to track up through the 2nd half of the year and into 2026. Survive to 2025 has now become Survive 2025.

If you want to have a chat about any points raised or an issue you may have you can call on 0800 30 30 34 or email This email address is being protected from spambots. You need JavaScript enabled to view it..