Arrears with Inland Revenue and Insolvency

Many NZ companies are currently affected by cash flow issues and are facing insolvency. To be insolvent means one of two things:

- Debts can’t be paid when they’re due.

- Total debt is more than the value of all assets.

The Commissioner of Inland Revenue ("CIR") will take debt recovery action where debts are in arrears. The CIR is able to issue a statutory demand as a step necessary to advance a proceeding against a company.

Ignorance Isn't Bliss

It is recommended for any business struggling to meet tax arrears that negotiations are entered into promptly to avoid a potential winding up proceeding.

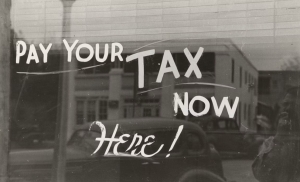

Taxpayers are required to pay their tax in full and on time. Failure to do so leads to late payment penalties and interest. These charges compensate the Commissioner for the loss of use of the money and act as a deterrent to encourage taxpayers to pay the correct amount of tax on time.

If your company receives an IRD formal demand, doing nothing really isn’t an option. Inaction will limit your options and virtually guarantees insolvency. You can also be held personally liable for failing to pay PAYE.

In certain situations the Commissioner may be able to provide assistance to taxpayers if they are not able to pay on time, or if the imposition of penalties and/or interest is not appropriate. Depending on the circumstances the Commissioner may also agree to write off or remit amounts owing (so they do not need to be paid), or agree that the taxpayer enters into an instalment arrangement (so the amount is paid over time rather than immediately).

The IRD seek open communication and are more willing to consider instalment arrangements when directors have been upfront from the start. Company directors that bury their heads in the sand and have no plans in place may face less leniency and liquidation proceedings.

The IRD can find directors liable for their company’s tax under general insolvency law. The law also says if a company agreement purposefully leaves it unable to pay a foreseeable tax liability, a director can be personally liable.

In the first instance the IRD will try for a settlement. This is your chance to negotiate terms and arrive at a compromise that allows you to stay in business while the IRD claims their tax. If you can reach a repayment agreement, the IRD won’t take the matter further.

If you’re unable to reach a compromise, the IRD will issue a formal demand, followed by a statutory demand and then issue an application for putting the company into liquidation (winding up proceeding) if you don’t settle the demand. If you do nothing the company will be placed into liquidation by the High Court.

The first step is to make contact, complete a 12 month forecast (IR591) recording what you can afford to pay and discuss the options.

Relief Options

The IRD offer relief options for companies with viable businesses.

Financial relief can be granted when a taxpayer cannot meet their payment obligations. The process to apply for financial relief or an instalment option is here.

The Commissioner is open to instalment arrangements towards tax arrears. Splitting up what you owe over weekly or fortnightly payments can make it easier to repay your tax debt.

The CIR may agree to collect the amounts owing over a period of time through an instalment arrangement, or to not collect the amount owing (that is, write off the amount), or a combination of the two options (that is, write off some of the debt and enter into an instalment arrangement for the remainder). An amount may be written off if collecting it would place the taxpayer in “serious hardship”.

Where an amount is considered irrecoverable, the Commissioner has the discretion to write it off. The Commissioner may write off amounts if collecting the amounts owing is considered to be an inefficient use of Inland Revenue’s resources.

Certain penalties may be remitted when an event or circumstance has occurred which is beyond the taxpayer’s control.

Interest or certain penalties may be remitted if to do so is consistent with the Commissioner’s duty to collect the highest net revenue over time.

Voluntary Liquidation

One possibility for meeting the IRD formal demand is voluntary liquidation. This gives the director and shareholders a small element of control over liquidation proceedings. If liquidation is inevitable then the opportunity to voluntarily appoint a liquidator is usually required within 10 working days of the winding up proceeding being served so acting promptly following the statutory demand (or earlier) is advised. Waiting until the service of the winding up proceeding is not a good idea and limits your options.

If you do nothing or you can’t reach a settlement, the IRD can apply for their preferred liquidator or Official Assignee and manage your affairs and liquidate your company. In this instance the Court will appoint the IRD’s liquidator. As company director you have less control over the process and must cooperate with the Court appointed liquidator or Official Assignee at all times.

Deciding between involuntary and voluntary liquidation may not seem like much of a choice. Appointing a licensed insolvency practitioner that you believe understands you, your business and your industry, and who can consider your interests while satisfying the IRD’s demands provides more certainty of the likely outcomes. For example, with the liquidators approval, you may be able to be involved to help achieve better outcomes for your creditors and in doing so, you may reduce your own personal exposure from personal guarantees. Your liquidator can apply specialist skills to remove some of the sting from this traumatic process. Acting cooperatively with the liquidator is good advice. If you would like more advice from experienced insolvency practitioners contact our team.

Statutory and formal IRD demands are outside threats to your business. There are just as many risks that can come from within, so how do you protect your business from those?

If your company is experiencing financial difficulty, download our free guide for NZ Companies to discover your different options.

WHAT SHOULD YOU BE CONSIDERING NOW?

- Consider the risks of trading insolvently and how directors can be held personally liable.

- Negotiate an instalment plan with IRD for historic arrears and have a plan in place. The Inland Revenue have pressure to maximise the recovery for the Commissioner under the Tax Administration Act. They are willing to work with companies that communicate early on and this can save further interest/penalties.

- Assess the viability of the business and its future. Prepare a cashflow forecast.

- Where cashflow is an issue, consider compromises with creditors leading to some debt forgiveness and time payment arrangements or voluntary administration.

If the company has lost too much and the prospects are that the company has minimal ability to repay creditors nor has a financial source to fall back on to offer a better position than what liquidation holds, then liquidation sooner may be the better option. Continuing to trade with knowledge of insolvency is a risk for the directors.

WE ARE HERE TO HELP

Our team are happy to discuss the options available for struggling companies and how to manage personal guarantees and personal exposure. Contact This email address is being protected from spambots. You need JavaScript enabled to view it.

If your company needs some advice on the restructuring options or is likely facing the prospect of liquidation, we are happy to advise on the process and consequences.

Considerations When Accepting a Debt Repayment Arrangement

Accepting an informal instalment arrangement for a debt that is owing to you instead of being paid on trade terms is not obligatory, giving you the discretion to evaluate the situation before making a decision. However, it's crucial to assess both the potential advantages and the associated risks.

If a debt is owing and not being paid there are common courses of action such as negotiating an agreeable solution and instalment plan, issuing a statutory demand, enforcing a judgment, engaging a debt collection agent, mediation, caveats (where there is a caveatable interest), lodging a report with credit agencies etc.

There are benefits and risks to most options. We discuss the informal arrangements here.

Risks of Accepting an informal Instalment Arrangement:

1. Delayed Payment: Opting for an instalment plan may result in a prolonged period before you receive the full amount owed, potentially affecting your own financial commitments. However if presented under a Companies Compromise this may provide a greater return than otherwise available.

2. Default Risk and Clawback Concerns: There is a risk of the debtor defaulting on the instalment plan. Additionally, in cases of insolvency and subsequent liquidation, there could be a risk of voidable transactions and clawback of payments made, potentially leading to partial or complete loss of the debt repayment.

3. Risk of Insolvent Transactions and Clawback: In cases where an insolvent company enters into an informal repayment arrangement, there is a significant risk of such an arrangement being deemed an insolvent transaction unless there are clear defences. This could lead to a legal challenge and potential clawback of payments already made to you. In such instances, you may face the prospect of having to return these funds, leaving you with a reduced or nullified debt repayment.

4. Interest and Penalties: Depending on the agreed-upon terms, interest or penalties may be associated with late payments.

5. Potential Financial Struggles: If the debtor's financial situation deteriorates further, they may face difficulties in adhering to the agreed-upon payment schedule.

Mitigating the Risks:

1. Clear and Comprehensive Agreement: Ensure that the terms of the instalment plan are thoroughly detailed, covering the total amount owed, payment frequency, and any applicable interest or penalties.

2. Document Everything: Maintain meticulous records of all correspondence, agreements, and payments related to the instalment plan. This documentation will be crucial in case of any disputes.

3. Collateral or Security: Whenever possible, request collateral or some form of security to secure the debt. This provides an additional layer of protection in case of default or a potential clawback following insolvency.

4. Vigilant Payment Monitoring: Keep a close watch on the debtor's payments to verify that they are meeting their obligations as agreed.

5. Legal Counsel: Seek legal advice or the advice of a Licensed Insolvency Practitioner to review and assist in drafting the instalment agreement. Legal guidance can help safeguard your interests.

6. Contingency Plans: Consider the steps you would take if the debtor defaults on the instalment plan. This could involve legal action or exploring alternative collection methods.

Instalment Plan Binding Following Insolvency Proceedings:

If the debtor has undergone an approved voluntary administration or entered into a company compromise under the Companies Act 1993, the terms of any instalment plan may be legally binding. This is subject to the specific terms and conditions outlined in the approved arrangement.

A company compromise should be seriously considered when offered by a company facing the risk of insolvency where that business is viable. The compromise may provide some relief but it ensures continued trade, employment for staff and a better outcome than an immediate liquidation.

It's crucial to consult with a legal professional who specializes in insolvency matters or a Licensed Insolvency Practitioner to ensure that any instalment plan complies with the legal framework and is enforceable.

If you are convinced the company that is not paying is insolvent then consult our team for advice on how to advance proceedings for putting the company into liquidation.

Remember, every situation is unique, and professional advice tailored to your specific circumstances is essential for making informed decisions regarding debt repayment arrangements.

The risk of not paying your Taxes

The risk of not paying your company taxes to the Inland Revenue Department (IRD) in New Zealand can be significant and may include the following:

-

Penalties and interest: If you do not pay your taxes on time, you may be subject to penalties and interest charges. These charges can quickly add up and significantly increase the amount owed.

-

Legal action: The IRD has the power to take legal action to recover unpaid taxes. This can include issuing a statutory demand, taking court action, or placing a lien on your assets.

-

Business closure: If a business fails to pay its taxes, the IRD may take steps to wind up the business. This can result in the forced sale of assets and the closure of the business.

-

Personal liability: In some cases, company directors and officers may be held personally liable for unpaid company taxes (in particular unpaid PAYE which is Trust money). This can result in personal bankruptcy, legal action, and damage to personal credit ratings.

-

Reputational damage: Failing to pay taxes can damage a business's reputation and make it harder to secure financing, attract customers, or establish partnerships.

In short, not paying company taxes can have serious consequences for both the business and its owners. It's always advisable to ensure that taxes are paid on time and in full to avoid these risks.

If you are in arrears with company taxes to the Inland Revenue Department, there are several options available to you. These include:

-

Payment arrangement: You can negotiate a payment arrangement with the IRD to pay your tax debt over time. This can help you manage your cash flow while also meeting your tax obligations.

-

Late payment penalty remission: The IRD may consider remitting late payment penalties in certain circumstances. This may be available if you have a good compliance history and can demonstrate that the late payment was due to circumstances beyond your control.

-

Debt compromise: In some cases, you may be able to negotiate a debt compromise with the IRD. This involves settling your tax debt for less than the full amount owed. However, debt compromise is not available in all circumstances and is subject to strict criteria.

-

Voluntary disclosure: If you have made a mistake on your tax return or have failed to disclose information to the IRD, you can make a voluntary disclosure. This involves informing the IRD of the error or omission and paying any additional tax owed. Voluntary disclosure may help reduce penalties and interest charges.

-

Insolvency procedures: If you are unable to pay your tax debt and have exhausted other options, you may need to consider insolvency procedures such as liquidation, voluntary administration, or receivership. These options involve winding up the business or placing it under the control of an external party to manage the debt.

It's important to note that the options available to you may depend on your specific circumstances and the amount of tax debt owed. It's always advisable to seek professional advice from an accountant, tax advisor, or licensed insolvency practitioner before taking any action. Send us your enquiry from here.

Resolving Disputed Debts

It’s important to address disputed debt as soon as possible. This will more likely lead to a positive outcome and enable you to rescue your business relationship.

You cannot recover a debt via a statutory demand if the debt is disputed. And, of course, you need cash to continue to operate, so it’s important to find a solution quickly.

Below, we outline the three steps to settling disputed debt:

FIRST: PREVENTING DEBT DISPUTES WITH STRONG IN-HOUSE CREDIT CONTROL AND TERMS OF TRADE

Of course, the best way to minimise disputed debt is to avoid the situation where disputes can arise in the first place. Many disputes can be avoided by good record keeping. Clear terms of trade and customer credit limits that are enforced will go a long way to ensuring you’re never put in a difficult situation again.

Terms of trade should be reviewed periodically (at least once a year) to ensure they’re still meeting your current needs. You may wish to amend your payment terms, default provisions and PPSR guidelines. You might also consider insisting on taking personal guarantees. The ability to register a security in your supplies provides you remedies in the event of failure of your customer.

SECOND: TRY TO REACH AN INFORMAL DEBT SETTLEMENT

Chasing disputed debt through the courts can be a costly process, sometimes far outweighing the benefits of retrieving your money. Dragging a customer through court will also irreparably harm your relationship with them. The best (and usually most cost-effective) solution may be to reach an informal debt settlement or compromise with your customer.

When offering a settlement, consider the customer’s grievance with the debt, as well as their ability to pay. What solution can you offer that ensures both parties come out satisfied?

You may wish to seek advice from a professional firm specialising in business debt settlement, such as McDonald Vague. We can help advise you on a settlement that will ensure the best possible outcome.

THIRD: LEGAL PROCEEDINGS

If you’re not able to reach an agreement about the dispute, your next recourse is to undertake legal proceedings against the debtor. Depending on the amount being contested, you have different options:

Disputes Tribunal: for disputes up to $30,000. Filing fees for the Tribunal are on the low side and both parties represent themselves, making this a cost-effective solution if legal proceedings are required. An order or agreed settlement made by the Tribunal referee is enforced against the debtor in the same way a District Court order would be.

District Court/High Court: The District Court will deal with claims up to $200,000, and any claim higher than this will go through the High Court. Applications for proceedings at these courts are similar, and both require more expert skills, time, and research than the proceedings for the Disputes Tribunal. We recommend you seek out legal advice before issuing proceedings in the District or High Court.

If you are struggling with disputed debts contact us now. This email address is being protected from spambots. You need JavaScript enabled to view it.

IRD Debt Collection – NZ Companies In Financial Distress

Debt collection actions are gaining momentum. Winding up proceedings are on the rise. There is a climb in IRD initiated winding up proceedings.

Many NZ companies have been impacted by Covid-19 and are facing insolvency. To be insolvent means one of two things:

- Debts can’t be paid when they’re due.

- Total debt is more than the value of all assets.

The Commissioner of Inland Revenue has increased debt recovery actions. The CIR is able to issue a statutory demand as a step necessary to advance a proceeding against a company.

Ignorance Isn't Bliss

It is recommended for any business struggling to meet tax arrears that negotiations are entered into promptly to avoid a potential winding up proceeding.

Taxpayers are required to pay their tax in full and on time. Failure to do so leads to late payment penalties and interest. These charges compensate the Commissioner for the loss of use of the money and act as a deterrent to encourage taxpayers to pay the correct amount of tax on time.

If your company receives an IRD formal demand, doing nothing really isn’t an option. Inaction will limit your options and virtually guarantees insolvency. You can also be held personally liable for failing to pay PAYE.

In certain situations the Commissioner may be able to provide assistance to taxpayers if they are not able to pay on time, or if the imposition of penalties and/or interest is not appropriate. Depending on the circumstances the Commissioner may also agree to write off or remit amounts owing (so they do not need to be paid), or agree that the taxpayer enters into an instalment arrangement (so the amount is paid over time rather than immediately).

The IRD seek open communication and are more willing to consider instalment arrangements when directors have been upfront from the start. Company directors that bury their heads in the sand and have no plans in place may face less leniency and liquidation proceedings.

The IRD can find directors liable for their company’s tax under general insolvency law. The law also says if a company agreement purposefully leaves it unable to pay a foreseeable tax liability, a director can be personally liable.

In the first instance the IRD will try for a settlement. This is your chance to negotiate terms and arrive at a compromise that allows you to stay in business while the IRD claims their tax. If you can reach a repayment agreement, the IRD won’t take the matter further.

If you’re unable to reach a compromise, the IRD will issue a formal demand, followed by a statutory demand and then issue an application for putting the company into liquidation (winding up proceeding) if you don’t settle the demand. If you do nothing the company will be placed into liquidation by the High Court.

Relief Options

The IRD offer relief options for companies with viable businesses and have been supportive of businesses that have shown clear impacts of Covid-19 on their business.

Financial relief can be granted when a taxpayer cannot meet their payment obligations. The process to apply for financial relief or an instalment option is here.

The Commissioner is open to instalment arrangements towards tax arrears. Splitting up what you owe over weekly or fortnightly payments can make it easier to repay your tax debt.

The CIR may agree to collect the amounts owing over a period of time through an instalment arrangement, or to not collect the amount owing (that is, write off the amount), or a combination of the two options (that is, write off some of the debt and enter into an instalment arrangement for the remainder). An amount may be written off if collecting it would place the taxpayer in “serious hardship”.

Where an amount is considered irrecoverable, the Commissioner has the discretion to write it off. The Commissioner may write off amounts if collecting the amounts owing is considered to be an inefficient use of Inland Revenue’s resources.

Certain penalties may be remitted when an event or circumstance has occurred which is beyond the taxpayer’s control.

Interest or certain penalties may be remitted if to do so is consistent with the Commissioner’s duty to collect the highest net revenue over time.

Voluntary Liquidation

One possibility for meeting the IRD formal demand is voluntary liquidation. This gives the director and shareholders a small element of control over liquidation proceedings. If liquidation is inevitable then the opportunity to voluntarily appoint a liquidator is usually required within 10 working days of the winding up proceeding being served so acting promptly following the statutory demand (or earlier) is advised.

If you do nothing or you can’t reach a settlement, the IRD can apply for their preferred liquidator or Official Assignee and manage your affairs and liquidate your company. In this instance the Court will appoint the IRD’s liquidator. As company director you have less control over the process and must cooperate with the Court appointed liquidator or Official Assignee at all times.

Deciding between involuntary and voluntary liquidation may not seem like much of a choice. Appointing a licensed insolvency practitioner that you believe understands you, your business and your industry, and who can consider your interests while satisfying the IRD’s demands provides more certainty of the likely outcomes. Your liquidator can apply specialist skills to remove some of the sting from this traumatic process.

Statutory and formal IRD demands are outside threats to your business. There are just as many risks that can come from within, so how do you protect your business from those?

If your company is experiencing financial difficulty, download our free guide for NZ Companies to discover your different options.

WHAT SHOULD YOU BE CONSIDERING NOW?

- Consider the risks of trading insolvently and how directors can be held personally liable.

- Negotiate an instalment plan with IRD for historic arrears and have a plan in place. The Inland Revenue have pressure to maximise the recovery for the Commissioner under the Tax Administration Act. They are willing to work with companies that communicate early on and this can save further interest/penalties.

- Assess the viability of the business and its future. Prepare a cashflow forecast.

- Where cashflow is an issue, consider compromises with creditors leading to some debt forgiveness and time payment arrangements or voluntary administration.

If the company has lost too much from the impact of Covid19 and the prospects are that the company has minimal ability to repay creditors nor has a financial source to fall back on to offer a better position than what liquidation holds, then liquidation sooner may be the better option. Continuing to trade with knowledge of insolvency is a risk for the directors.

WE ARE HERE TO HELP

Our team are happy to discuss the options available for struggling companies and how to manage personal guarantees and personal exposure. Contact This email address is being protected from spambots. You need JavaScript enabled to view it.

If your company needs some advice on the restructuring options or is likely facing the prospect of liquidation, we are happy to advise on the process and consequences.

Received A Statutory Demand ?

A statutory demand is a claim under Section 289 of the Companies Act 1993. Failing to comply with a statutory demand or applying to set it aside within the specified timeframes will result in your company being deemed to be insolvent and liquidation may follow.

A company is insolvent if it is unable to pay its debts when they fall due.

Non-compliance with a statutory demand served on your company allows the creditor that served the statutory demand to apply to the High Court to appoint a liquidator. The most common basis for a company in New Zealand to be placed into liquidation by the High Court is from failure to comply with a statutory demand.

If you receive a Statutory Demand you need to act quickly. You can either pay the specified sum, enter into some form of compromise to pay the debt, or offer up some form of security to the satisfaction of the creditor.

If the debt is disputed you must apply under Section 290 to have the debt set aside. You will need to engage a lawyer.

The court may grant an application to set aside a statutory demand if it is satisfied that

(a) there is a substantial dispute whether or not the debt is owing or is due; or

(b) the company appears to have a counterclaim, set-off, or cross-demand and the amount specified in the demand less the amount of the counterclaim, set-off, or cross-demand is less than the prescribed amount; or

(c) the demand ought to be set aside on other grounds.

If no action is taken, nor a liquidator appointed voluntarily (by the shareholders) before the service of the Winding Up Proceeding, the Winding Up Application hearing takes place and if the High Court is satisfied that the company should be wound up, an order for the Company to be wound up is made and the Court appoints a liquidator. A liquidator is nominated by the applicant creditor and provides a consent to act prior to the hearing.

If your company does not satisfy the solvency test and is risking trading insolvently then the shareholders of the company can voluntarily appoint a liquidator so long as the appointment occurs before the service of a winding up application (which often closely follows the expiry of the statutory demand).

Pending Winding Up Proceeding – options to consider

Your company may be closed by the liquidator or the business sold. You can save your company from facing Court liquidation proceedings with the following options:

• Voluntary liquidation (if liquidation is inevitable)

• Voluntary Administration

• Company Compromise – Part XIV Companies Act 1993

• Debt Restructuring and a workout

• Advice on your options early on

Liquidation may be inevitable and a way out of a downward spiral. Speak to an a Licensed Insolvency Practitioner. It may not mean losing your business. Some companies advance liquidation voluntarily in order to restructure.

Get Advice

For advice on statutory demands, liquidation, hive down, voluntary administration or compromise contact our team at McDonald Vague.

If you need a Licensed Insolvency Practitioner to consent to act as liquidator on an upcoming court liquidation or to manage a voluntary liquidation, Boris, Iain, Colin, Keaton or Peri are pleased to assist.

Other Links:

1. Statutory Demand Infographic

Business debt advice: how to resolve disputed debts

It’s important to address disputed debt as soon as possible. This will more likely lead to a positive outcome and enable you to rescue your business relationship.

You cannot recover a debt via a statutory demand if the debt is disputed. And, of course, you need cash to continue to operate, so it’s important to find a solution quickly.

Below, we outline the three steps to settling disputed debt:

First: Preventing debt disputes with strong in-house credit control and terms of trade

Of course, the best way to minimise disputed debt is to avoid the situation where disputes can arise in the first place. Many disputes can be avoided by good record keeping. Clear terms of trade and customer credit limits that are enforced will go a long way to ensuring you’re never put in a difficult situation again.

Terms of trade should be reviewed periodically (at least once a year) to ensure they’re still meeting your current needs. You may wish to amend your payment terms, default provisions and PPSR guidelines. You might also consider insisting on taking personal guarantees. The ability to register a security in your supplies provides you remedies in the event of failure of your customer.

Second: Try to reach an informal debt settlement

Chasing disputed debt through the courts can be a costly process, sometimes far outweighing the benefits of retrieving your money. Dragging a customer through court will also irreparably harm your relationship with them. The best (and usually most cost-effective) solution may be to reach an informal debt settlement or compromise with your customer.

When offering a settlement, consider the customer’s grievance with the debt, as well as their ability to pay. What solution can you offer that ensures both parties come out satisfied?

You may wish to seek advice from a professional firm specialising in business debt settlement, such as McDonald Vague. We can help advise you on a settlement that will ensure the best possible outcome.

Third: Legal proceedings

If you’re not able to reach an agreement about the dispute, your next recourse is to undertake legal proceedings against the debtor. Depending on the amount being contested, you have different options:

Disputes Tribunal: for disputes up to $15,000 (or $20,000 if both parties agree to extend the jurisdiction). Filing fees for the Tribunal are on the low side and both parties represent themselves, making this a cost-effective solution if legal proceedings are required. An order or agreed settlement made by the Tribunal referee is enforced against the debtor in the same way a District Court order would be.

District Court/High Court: The District Court will deal with claims up to $200,000, and any claim higher than this will go through the High Court. Applications for proceedings at these courts are similar, and both require more expert skills, time, and research than the proceedings for the Disputes Tribunal. We recommend you seek out legal advice before issuing proceedings in the District or High Court.

If you are struggling with disputed debts contact us now.

Small business debt management advice: how to collect outstanding debts

As a small business owner, pursuing outstanding debts can be a painful process. You don’t want to be seen as the “bad guy”, but at the same time, you rely on debtors paying on time in order to service your own cash flow, and if a debtor defaults, your business suffers.

Unfortunately, the creditor who protests the loudest is likely to be paid first. This means if you want to see your money soon, you’ll need to get vocal with your debtor. In this article, we have a look at the small business debt recovery process and suggest ways you can make the debt collection process a little easier for all parties involved.

If you have a debt owing, and your usual debt recovery process (email reminder, follow-up phone call, compounding, etc) hasn’t resulted in payment, legally you have three tools in your arsenal you can employ.

Debt recovery tool one: send a lawyer’s letter

For a fee, your lawyer will draft up a letter outlining your debtors legal obligations and the repercussions of not paying the debt within a certain timeframe. Often, simply receiving a letter on a lawyer’s letterhead will be enough to convince a debtor to move your debt to their top priority. This can be a good first step as it is cheaper than engaging a lawyer for legal action.

Debt recovery tool two: use a debt-collection agency

You can assign small business debt collection to an agency. They will pursue the business on your behalf and attempt to recover your debt. This is a good option if communications between you and the debtor have broken down.

The agency will establish contact with your debtor via mail and telephone, and may also visit in person to collect on the debt. They will also register the default against your debtor, which will remain on their credit record for up to five years. Debt collection agencies settle the majority of claims without legal proceedings, but if required, can also act on your behalf to sue the debtor to recover money owing.

Debt recovery tool three: issue a statutory demand

If you suspect the company owing you money may be insolvent, and the debt is not in dispute, you can have your lawyer issue a statutory demand to recover your money. As we outline in our Statutory demands article, you may be able to recover the outstanding debt, interest owing on the debt, and legal costs associated with small business debt collection.

A statutory demand should ideally come from a lawyer you’ve hired, rather than from yourself or a debt collection agency. Once issued, the debtor has 15 days to pay the amount claimed. If they neglect to do this, you can apply to place their company into liquidation.

Seeking legal action for small business debt collection should not be taken lightly, and it’s important to ensure the debt is not in dispute before issuing a statutory demand.

If you are struggling to manage the debt in your company contact us now.

Top tips for better debt control

Dealing with non-payers can be like ‘pulling teeth’. Cash, however, is the lifeblood of business and most business owners cannot afford to sit back and not take action. We cover our top tips for taking control of your debtors...

The good news is that you can take steps (with Court proceedings often a last resort) to improve your cash flow and disincentivise your clients from treating you like a bank. We all know court can be an expensive and time consuming process and can spell the end of a business relationship. A formal demand can also damage your relationship with your customer and, if you suspect insolvency, potentially place you in a difficult position with the liquidator seeking to ‘claw back’ that payment down the track.

In this article we cover our top tips for taking control of your debtors: putting in place credit control processes, using your debt collection processes, resolving disputes through the relevant Court/Tribunal. We also set out the liquidation (companies) and bankruptcy (individuals) processes.

Tip 1: Have strong in-house credit control

When you are deciding whether to start a new business relationship, you should make an informed decision. If you are going to be supplying goods or services on credit, you should have the customer complete a credit application form and provide a copy of your terms of trade. You should also consider running a credit check and speaking to the customer’s credit references.

Once in a business relationship, you should set and enforce customer credit limits and have clear terms of trade in place that include (amongst other things) payment terms and default provisions in the event of non payment. If your terms include PPSR provisions entitling you to register a security interest on the PPSR then do it. Also consider obtaining personal guarantees.

Including a clause in your terms of trade allowing you to charge interest on overdue invoices (and adding interest to overdue invoices) will encourage customers to pay on time. It is also a good idea to include a term allowing you to pass on debt collection fees and/or legal costs you incur to your customer, in the event of non-payment.

Actively monitor your debtors and take steps when payments are missed. This makes it harder for your debtors to ignore you, which increases your chance of being paid.

It is important that you act in accordance with your terms of trade, rely on your credit policies (such as stop credit limits), and have a clear record of treating all customers in the same way. By having robust credit control processes, you help protect your business from exposure to bad debts. If you do not take any steps until you suspect that a customer is insolvent, if that customer company later faces liquidation/bankruptcy and your debt was paid in the period leading up to liquidation, there is a risk the liquidator/assignee may have the ability to claw back that payment.

Tip 2: Use lawyers letters and debt collection agencies

If your internal debt collection process has not resulted in payment, you should consider sending the debt to your lawyers or a debt collection agency. Because this increases the “seriousness” of the unpaid debt, referring the debt to an independent party for collection will be successful even though your internal processes have not resulted in payment.

Often, a letter of demand on your solicitors’ letterhead or a visit from a debt collection agent will prompt payment. If there is a dispute relating to the debt, contact from your lawyer or debt collection agent may elicit a response, even if the debtor has been ignoring you.

Once you have engaged your lawyers / a debt collection agent, you can leave them to deal with the communications and legal process (although some input from you will still be required). This means that you can spend your time adding value to your business instead of following up late payers.

There is a cost associated with engaging outside help to recover your debt. Lawyers generally charge for work undertaken whereas debt collectors generally charge a fee based on a percentage of the debt owing. Some debt collection agencies work on a success fee basis, that is, no fee if no reward. There are benefits and drawbacks to both approaches so you will need to decide which option is best for you in relation to the debt in question.

If you want to recover these outside legal / debt recovery costs, you need to ensure there is provision for passing on these costs included in your terms of trade.

Tip 3: Address disputed debt

Dealing with a disputed debt is not enjoyable. However, if your customer has a genuine concern / grievance, they are unlikely to pay you until the debt is resolved. In addition, the earlier the dispute is addressed, the more likely you are to save your business relationship.

The best “self help” remedy for a disputed debt is to reach a compromise or informal settlement. This is also generally the most cost effective option, in the long run.

If the dispute cannot be resolved, you will need to consider issuing legal proceedings. Which Court or Tribunal is the most appropriate will depend on the amount owing to you.

Disputes Tribunal – up to $30,000

If there is a dispute and the debt up to $30,000 then a claim can be filed in the Disputes Tribunal. The Disputes Tribunal only has jurisdiction to deal with disputed debts – it is not for obtaining judgment on undisputed debts. The filing fees in the Disputes Tribunal are low and solicitors cannot represent you at the hearing, which also keeps costs down. At the hearing, the referee will make an order or approve an agreed settlement. Once the order is made, it can be enforced against the debtor in the same way that a District Court judgment could.

District Court - up to $350,000 / High Court - $350,000 or more

If the debt is less than $350,000, the claim will fall within the jurisdiction of the District Court. If the debt is greater than $350,000, the claim falls within jurisdiction of the High Court. While there are some differences, the processes followed in the District Court and the High Court are similar.

The District Court and High Court can be used to resolve claims over disputed debts. This is done by issuing ordinary proceedings. These applications are more complex, costly, and time consuming than claims in the Disputes Tribunal. For this reason, we recommend that you obtain legal advice before issuing proceedings in the District Court or High Court.

Once judgment has been obtained, it can be enforced.

Tip 4: Get in early

If the debt is owed by a company and there is no dispute but payment is not forthcoming, you can issue a statutory demand demanding payment. If the customer takes no steps to compromise, or pay, or offer some form of security, then following the expiry of 15 working days after the service of that statutory demand, winding up proceedings can be advanced within the next 30 working days.

Unless the company is genuinely insolvent, service of a statutory demand or a bankruptcy notice will often lead to payment (or an arrangement for payment). For a company that is genuinely insolvent, it will inevitably lead to liquidation (company) either by a company creditor or by the company’s shareholders. In our experience, debts generally continue to mount while insolvent companies are left to their own devices. This means that, the longer the period of insolvency, the less creditors are likely to recover. During the liquidation process you will need to gain the consent of a Licensed Insolvency Practitioner at an insolvency/recovery specialist firm such as McDonald Vague Limited to consent to act as liquidators of the company. If you want to choose the company’s liquidators, the liquidators’ consent to act needs to be with the Court before the liquidation order is made.

The consent of an Licensed Insolvency Practitioner, who will have the requisite skills and experience necessary to carry out the liquidation and who has a governing body they report to, is now a requirement.

If the liquidator does not realise a recovery for creditors (i.e. there are no realisable assets before or after taking into account secured and preferential claims) or is only able to realise a partial recovery for creditors, the only recovery option still available may be to pursue a personal guarantee, if this was gained during the business relationship or as part of a compromise or settlement.

Claims for payment of undisputed debts against individuals (e.g. sole traders and guarantors) can be made by way of ordinary proceedings or summary judgment proceedings in the District Court or High Court. We recommend that you get legal advice before issuing proceedings against a guarantor.

Once judgment is obtained against an individual, a bankruptcy notice can be issued requiring the debtor to make payment within 10 working days of service. If the bankruptcy notice is not complied with, adjudication proceedings can be brought within 3 months of the bankruptcy notice expiring.

There are, of course, other enforcement options available. These options include financial assessment hearings, attachment orders, warrant to seize property, charging orders, garnishee orders, and

community work. Further information is available from your solicitors or from www.communitylaw.org.nz.

Summary

There are a range of steps you can take to minimise your unpaid debtors. If you take positive steps to manage your debtors and to deal with your disputed debts, you increase the likelihood of being paid. While implementing new policies and systems can seem daunting, we are here to help. At McDonald Vague Limited we provide advice and assistance to companies seeking to advance statutory demands and winding up proceedings. We are a firm of Licensed Insolvency Practitioners.

We also advise the recipient of a demand who is seeking to offer a settlement, enter into a compromise, or to advance liquidation by shareholder resolution. We also advise the insolvent individual who seeks to compromise with creditors (Part 5 Proposals) following a formal demand and who may be facing bankruptcy proceedings.We specialise in liquidations, company compromises, restructuring, turnaround (including hive down) and personal proposals. We provide positive solutions to businesses and have a wealth of experience in helping businesses to turn around.

Please contact Peri Finnigan on direct dial (09) 303 9519 or by email This email address is being protected from spambots. You need JavaScript enabled to view it. or Marisa Brugeyroux on (09) 303 0506 or by email This email address is being protected from spambots. You need JavaScript enabled to view it..

Statutory demands - minimising bad debts is critical for any business

Statutory demands - minimising bad debts is critical for any business

Debt collection is difficult for business owners. Pursuing bad debts early on improves any chance of receiving payment. A creditor that puts the most pressure on a debtor will most likely receive their money before others; however, they need to be conscious of the voidable transaction regime when they are dealing with an insolvent company.

If you are owed a debt and that debt is not in dispute and you suspect the company you have been trading with may be insolvent, you can issue a statutory demand against the company. Depending on your terms of trade, a statutory demand will require the debtor to pay you the outstanding debt, interest on the debt, and the legal costs for issuing the statutory demand. The purpose of a statutory demand is to determine whether the creditor can pay and not that they are liable to pay.

The statutory demand process provides a quick procedure for ensuring payment, or for at least achieving some knowledge on whether payment is possible. This process is intended to be a first step in making an application to put a company into liquidation when a company genuinely cannot pay.

It is important to get the process right and it is advisable to instruct a lawyer who has ethical obligations to ensure the correct steps are taken rather than issuing the demand yourself or a debt collection agency taking responsibility. It is however an abuse of process if the statutory demand option is taken when there is no prospect of the company being placed into liquidation.

The cost of issuing a statutory demand should not be taken lightly. If there is a substantial dispute and the creditor is successful in its challenge, Court costs will be awarded against the creditor. If a creditor gets this process wrong, not only are they out of pocket for additional costs but months may have passed and they are no closer to collecting the debt.

Sections 289 to 291 of the Companies Act 1993 deal with statutory demands.

The process

Before serving a statutory demand it is sensible to ensure that the debt is not in dispute. Sending a formal demand so any dispute can be raised will give you an opportunity to settle the debt without any further action being taken. If, however, the debt is disputed you can file proceedings at the District or High Court and seek judgement on the claim.

Step 1 - Serve a statutory demand for the debt

The demand must be in writing and should be served on the debtor company's registered office. The demand must require the company to pay the debt or to secure the debt or to settle it in some way. If the debtor does not pay the amount claimed within 15 working days, you can apply to put the company into liquidation. This is a powerful tool as it is quite likely the debtor will go to lengths to ensure that other creditors are not aware of liquidation proceedings pending or in progress. The company has 15 working days after being served to comply with the notice.

The statutory demand must specify exactly what amount is owed (and it must be over $1,000). The document specifies when the sum must be paid and provides the alternatives to full payment such as to enter into a compromise (Part XIV of the Companies Act 1993), or otherwise compound, or give a charge over property to secure payment of the debt to the reasonable satisfaction of the debtor, all within 15 working days of the date of service of the demand, or such longer period if the High Court order.

Once a statutory demand is served on the debtor company, the debtor has 10 working days to dispute the debt by filing an application to set aside the demand or pay the debt within 15 working days.

Step 2 - Applying to the Court to place the debtor into liquidation

In the event the debt is neither disputed nor paid, then, on the expiry of 15 working days the debtor is deemed to be insolvent and the creditor can apply to the Court to place the debtor into liquidation. The onus is then on the debtor to satisfy the Court that it is solvent. If the company is unable to pay then a liquidation with a Court appointed liquidator will follow, or, the shareholders within 10 working days of being served have an ability to appoint a liquidator by a shareholder resolution.

A liquidation application can only be issued by certain persons and the order for the appointment can only be made on grounds specified in section 241(4) of the Companies Act 1993. The decision on whether the company is placed into liquidation is at the Court's discretion. The Court may only put a company into liquidation by the appointment of a liquidator if the Court is satisfied that the company is unable to pay its debts, or the company, or the board of the company, has persistently or seriously failed to comply with the Companies Act 1993, or the company does not comply with section 10 (essential requirements), or it is just and equitable that the company be put into liquidation.

The alternatives to paying a statutory demand in full

Compounding means "coming to an agreement with a creditor". The most usual form of compounding is an acceptable offer of payment by instalments. It can also be an offer of a deferred payment or a request to defer filing of a winding up proceedings.

Company Compromise (Part XIV Companies Act 1993) is an agreement between the company and various classes of creditors that give the company an opportunity to survive by avoiding liquidation and trading out of financial difficulty. In order to reach a compromise a majority in number representing 75% in value of each class of creditor voting in favour of such a resolution is required (at a meeting of creditors). Once agreement is reached, all debts are frozen and no creditor can take action against the company during the term of the compromise. The outcome could be creditors are repaid either in full or in part and over time. It is specifically a good option if the business is solid and is in financial difficulty but customers and suppliers are prepared to provide support. Find out more about Company Compromises.

Another remedy upon receiving a statutory demand is to reach a full and final settlement. However, it is always important to bear in mind voidable transactions when dealing with an insolvent company. A payment from a third party or the director or a personal guarantee are wise.

How to serve a statutory demand

A statutory demand to qualify as being served on the company either must be delivered to a person named as a director on the New Zealand Companies register, to an employee of the company at the company's head office or principal place of business, be left at the company's registered office or address of service, and in accordance with directions as to service by the Court, or in accordance with any agreement made with the company. It is recommended that the document is served by a document server. The service of a statutory demand by facsimile cannot be relied upon.

Disputing a statutory demand

If a debtor can show that a defence or a counter claim or a set-off equal to the amount claimed in the demand exists, not only will a demand be set aside but the aggrieved creditor will be ordered to pay the debtor's costs and will be no closer to collecting the debt.

A Court may set aside a statutory demand if the application is made within 10 working days of the date of service of the demand and the application was served on the creditor within 10 working days of the date of service of the demand. The Court may grant an application to set aside the statutory demand if it is satisfied that there is a substantial dispute, whether or not the debt is owing or is due, or the company appears to have a counter claim, set-off, or cross demand and the amount specified in the demand, less the amount of the counter claim, set-off or cross demand is less than the prescribed amount or the demand not to be set aside on other grounds.

A demand will not be set aside by reason only of a defect or irregulatory unless the Court considers that substantial and injustice would be caused if it were not set aside. Under section 291 of the Companies Act 1993, if a Court is satisfied that there is a debt due by the company to the creditor that is not subject to a substantial dispute, or is not subject to a counter claim, or set off, or cross demand, the Court may order the company to pay the debt within a specified period and that in default of payment, the creditor may make an application to put the company into liquidation, or dismiss the application and make an order putting the company into liquidation on the grounds that the company is unable to pay its debts.

The service of a statutory demand process can give great leverage to get paid quickly, however if a debt is disputed or the company that owes the money is not in financial difficulty the process is used at your own peril.